2024 Looks Promising for Eldorado Gold

Eldorado Gold Corp. (NYSE:EGO) announced preliminary gold production for fourth-quarter and full-year 2023 on Jan. 15. The company's presentation can be accessed here.

Company profile

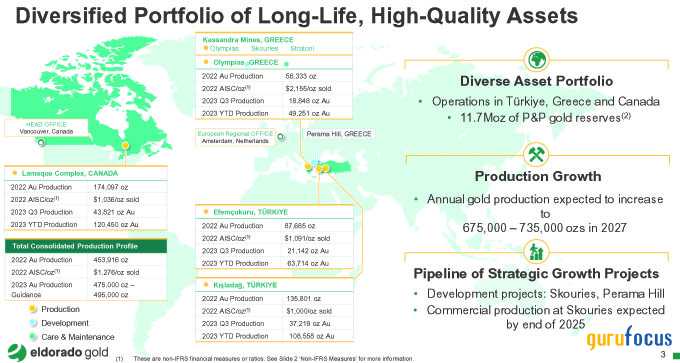

Eldorado Gold owns four active gold mines in Canada, Turkey and Greece. Additionally, the miner has received approval for the Skouries and Perama Hill projects in Greece, with Skouries expected to commence production by the end of 2025.

The company stated gold production is expected to increase roughly 45% in 2027, reaching 675,000 to 735,000 gold equivalent ounces, compared to the production rate in 2023.

Source: Eldorado Gold Presentation

During the third quarter, the Skouries gold and copper project in Northern Greece progressed smoothly, reaching 34% completion and aiming for 48% by year-end. The company still needs to provide an update on the progress made in the fourth quarter, but it should have exceeded 50% by now.

On April 5, 2023, Eldorado successfully secured financing of 680,400 euros ($741,391.06) for the development of the Skouries project, which will be sufficient.

The Skouries mine is expected to produce 67 million pounds of copper and 140,000 ounces of gold a year, with an anticipated $217 million in free cash flow over the first five years of operation. Gold and copper production is expected in the second half of 2025. Below are a few data points from the Skouries feasibility study:

Source: Eldorado Gold Presentation

Production snapshot

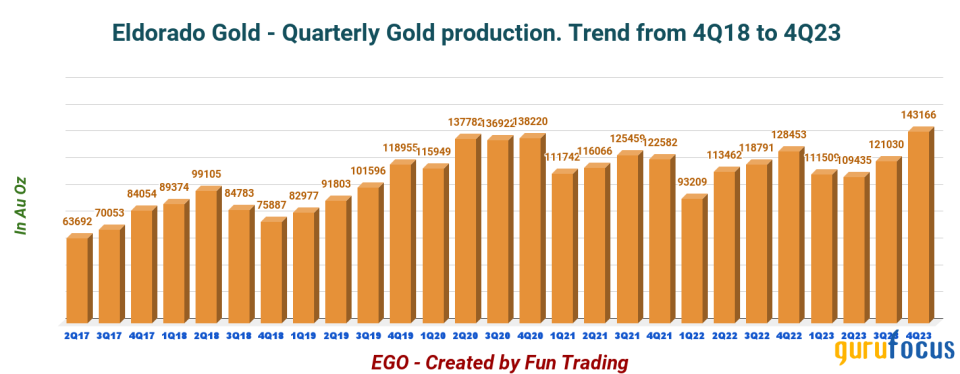

Eldorado Gold announced it produced 143,166 ounces of gold equivalent in the fourth quarter of 2023, a significant increase from the 128,453 ounces produced in the prior-year quarter and 121,030 ounces in the third quarter of 2023.

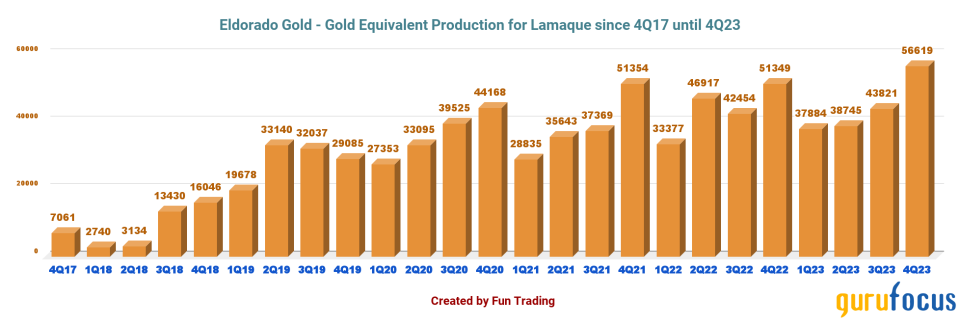

The company performed well, particularly at the Lamaque Mine, where production reached new highs. The chart below shows a multiyear record for quarterly production.

As I said earlier, Lamaque's production increased significantly. In addition, Kisladag and Efemcukuru performed above expectations, while Olympias registered a slightly lower production. The overall output was impressive.

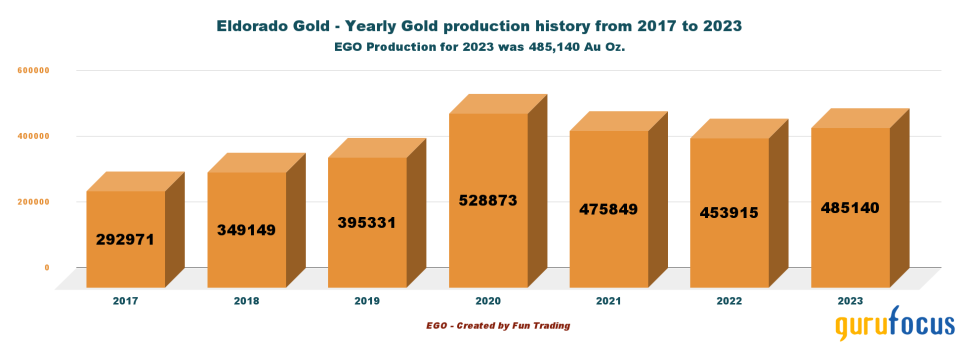

For the full year, total gold equivalent production was 485,140 ounces, up 6.90% year over year. Preliminary production met the revised guidance of 475,000 to 495,000 ounces.

Eldorado Gold's primary metal is gold, which accounts for almost 91% of third-quarter total revenue. Its official revenue results for the quarter will be available in February, however. Copper production from the Skouries mine is expected to begin by the end of 2025.

Commentary per mine

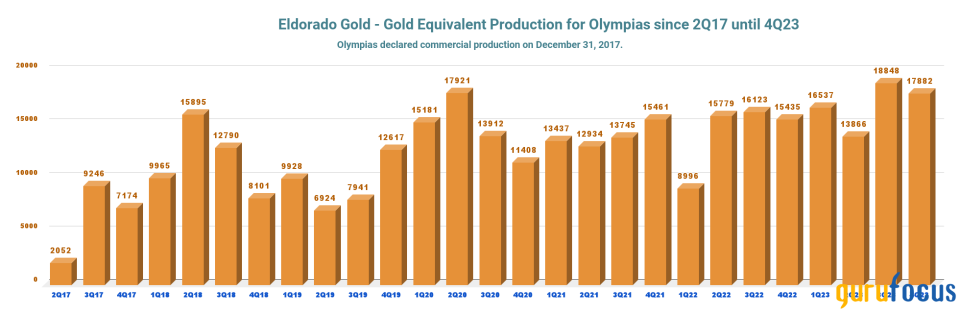

For the Olympias Mine, production was 17,882 ounces, compared to 15,435 ounces produced in the fourth quarter of 2022 and 18,848 ounces in the third qurater of 2023. The fourth quarter was slightly down sequentially, but production in 2023 saw record mill throughput.

Production at Lamaque increased to 56,619 ounces from 43,821 ounces in the third quarter and 51,349 ounces in the fourth quarter of 2022, reaching a record due to higher grades and mill throughput.

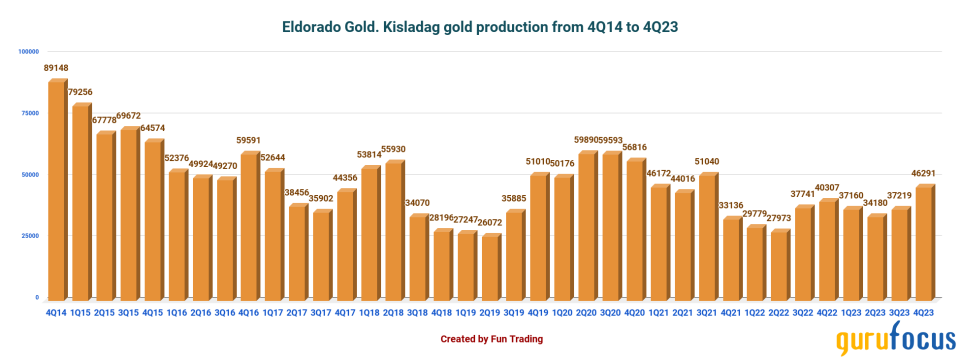

Gold production at the Kisladag Mine rose 24% quarter over quarter to 46,291 ounces due to improved technical components after the successful commissioning of the North Heap Leach.

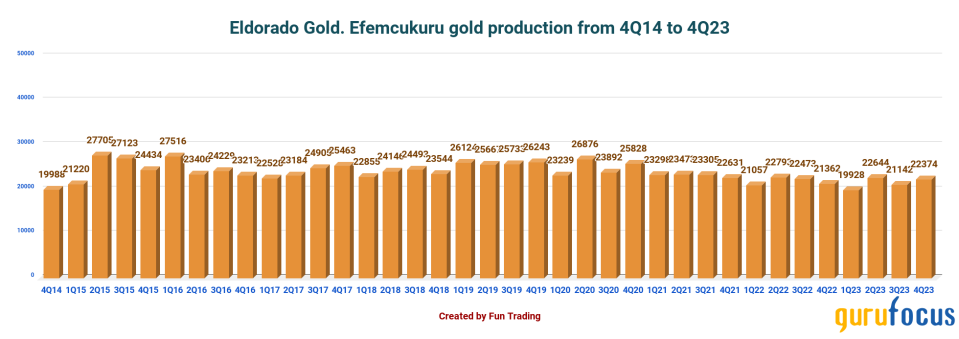

Gold production, throughput and average gold grade at the Efemcukuru Mine were on target for the fourth quarter with 22,374 ounces produced.

Fourth-quarter analysis

The price of gold closed at $2,029.2 on Friday, Jan. 24, up nearly 6% year over year. In contrast, silver and copper did not perform well.

According to Reuters, gold investors anticipate record-high prices by 2024 due to a dovish view of U.S. interest rates, geopolitical risks worldwide and central bank purchases. It said:

"On Dec. 4, gold hit a record high of $2,135.40 on bets of U.S. monetary policy easing in early 2024 after a perceived dovish tilt from Federal Reserve Chair Jerome Powell, surpassing the previous record scaled in 2020."

JPMorgan predicts a potential rise in gold prices to $2,300 by mid-2024 due to an expected "breakout rally." This projection is based on the assumption that the Federal Reserve may begin rate cuts later in 2024, as it previously indicated in December that three rate cuts could occur in 2024 and another four cuts in 2025.

In this probable scenario, gold miners such as Eldorado Gold are well-positioned to benefit from the bullish gold market.

What to expect for the upcoming quarterly results

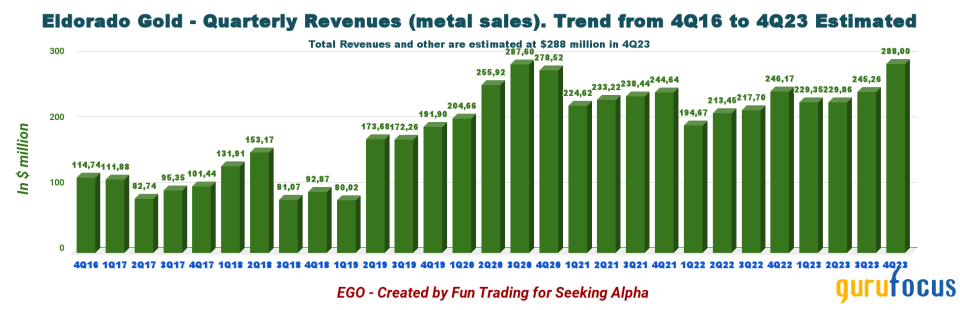

With strong production in the fourth quarter, Eldorado Gold is expected to announce record revenue of an estimated $288 million from metal sales, with an average gold price of $1,990 per ounce. However, the average price may be lower due to extra costs at Olympias.

As production increases, the all-in-sustaining costs are expected to decrease and could drop below $1,125 per ounce.

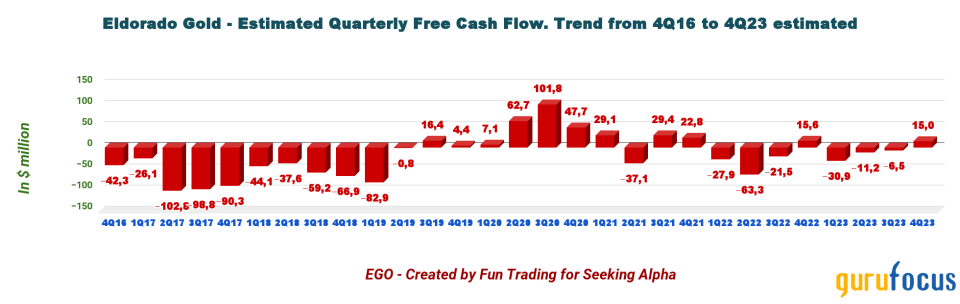

However, due to the high capital expenditure needed to develop Skouries, the free cash flow might not be as positive as originally anticipated. The free cash flow in the fourth quarter of 2023 is predicted to be approximately $15 million.

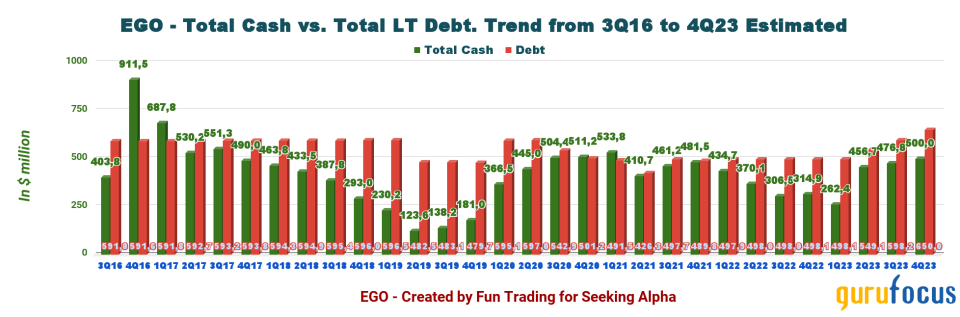

Further, as of the third quarter, the company's cash and cash equivalents and marketable securities summed up to $476.75 million. This amount is expected to increase to approximately $500 million for the most recent quarter. However, the company's total debt is anticipated to rise from $598.16 million in the third quarter to $650 million. With gold trading above $2,000 in 2024, the company will have no problem.

Summing up

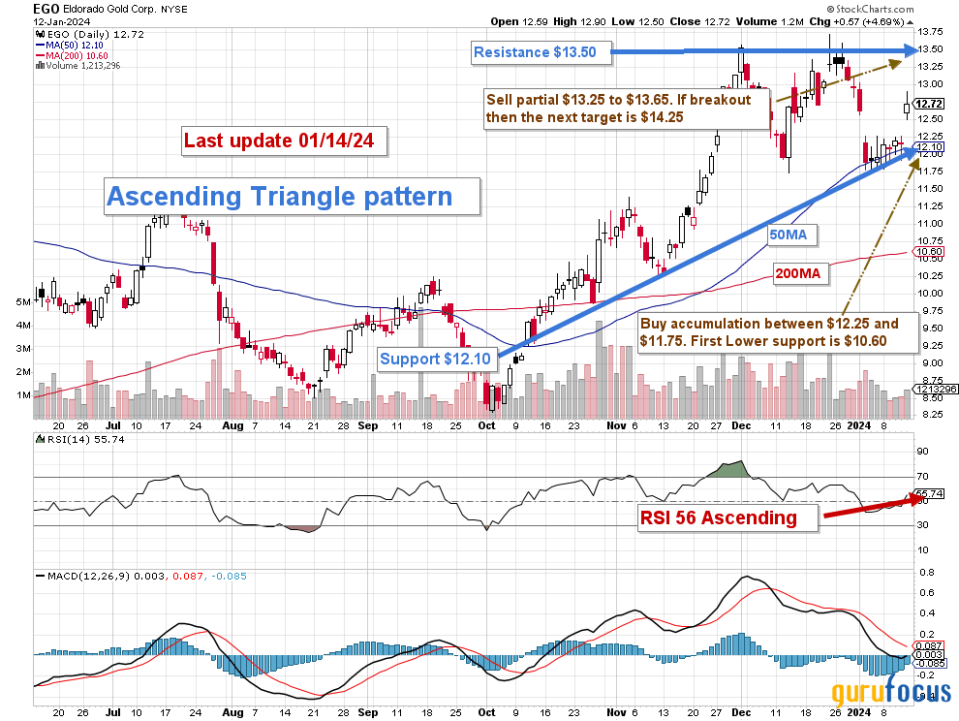

Eldorado Gold is expected to perform well in 2024 due to the likelihood of gold reaching a record-high level. As previously announced, this expectation assumes the Federal Reserve will begin cutting interest rates. However, the company is currently in a consolidation phase, specifically in a triangle pattern, until the end of February.

During this period, it is important to accumulate the stock and trade short-term LIFO for about 50% of your position. It is also recommended to wait for clear indicators of an imminent breakout before moving further.

Technical analysis and commentary

Eldorado Gold is forming an ascending triangle pattern, with resistance at $13.50 and support at $12.10.

This pattern is considered bullish, indicating the stock's value may increase soon. The resistance level of $13.50 is expected to be reached again more quickly. If the resistance level is crossed, we may see a breakout to $14.25 before the stock returns to $13.50, which will become the new support level. However, the gold price outlook may not be favorable in the short term, with significant fluctuations expected.

It may be a good idea to sell approximately 50% of the shares at a trading range of $13.25 to $13.65 (using the LIFO method) and anticipate potential higher resistance at $14.25 in the medium term. In contrast, if the gold price continues to decline, it may be wise to accumulate shares between $12.25 and $11.75, with potential support at $10.60 for a profitable outcome.

As always, watch the gold price like a hawk.

This article first appeared on GuruFocus.