$23 Billion of Warren Buffett-led Berkshire Hathaway's Portfolio Is in This Stock. Is It a Buy in 2024?

Famed investor Warren Buffett has spent his lifetime building Berkshire Hathaway into one of the world's largest companies. Inside Berkshire is a massive stock portfolio of some of Buffett's best investments over his lifetime.

Among them is Coca-Cola (NYSE: KO), Berkshire's fourth-largest position, worth more than $23 billion. The dividends alone are funneling $736 million into the company's coffers.

Should investors follow suit and build their own Coca-Cola dividend machines? Unfortunately, it's not that simple. Here is what you need to know.

Years and years of dividends

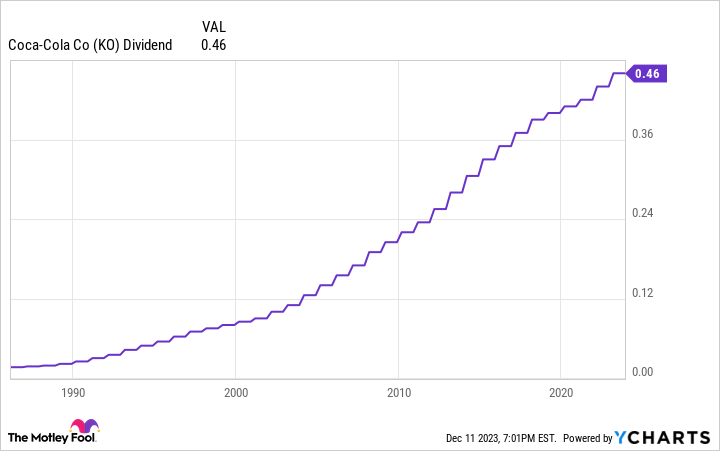

Buffett's Coca-Cola investment wasn't always this big. He originally invested $1 billion in 1988, and it's grown for decades. Dividends have been a big part of that. Coca-Cola has paid shareholders a little more each year for decades -- 61 consecutive years of raises, to be exact.

You can see below how that can snowball over time. Warren Buffett's $736 million in annual dividends from Coca-Cola today is almost like getting his initial investment back each year.

How does Coca-Cola do it? It's the world's largest non-alcoholic beverage company, with hundreds of products and brands many people worldwide know -- including Coca-Cola, Sprite, and almost two dozen others -- that generate over a billion dollars in annual sales.

Just think about the world's population as a market with eight billion customers. Everyone gets thirsty. Competitors lack the size and leverage to get their products on store shelves like Coca-Cola. The company can manufacture growth organically as the population grows; by acquiring and developing new products and brands; or by raising prices.

Coca-Cola may not be a growth stock, but it's consistently growing. The global beverage market is so big that Coca-Cola's winning recipe for steady growth should continue for the foreseeable future. Analysts believe the company's earnings will grow by an average of six percent annually over the long term.

Combine that with a healthy 76% dividend payout ratio, and Coca-Cola's dividend should keep growing. Invest, wait, collect your growing dividend, and prosper.

Buffett seized a rare opportunity

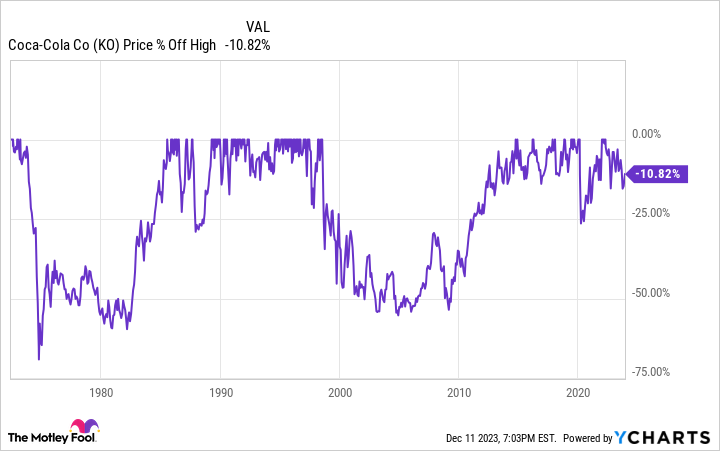

However, there is a significant hurdle investors must watch for in the stock's valuation. See, Coca-Cola isn't growing fast enough that you can buy at any price and make a lot of money. Buffett bought shares in 1988 after the famous 1987 stock market crash dragged the stock 30% off its highs.

Virtually everyone has heard of Coca-Cola and admires the company's admirable dividend growth streak. Stocks in high esteem don't often come cheap.

You can see above that Coca-Cola is susceptible to the occasional stock market crash, but isn't that volatile otherwise. The stock's beta is 0.58, meaning it's less volatile than the broader stock market.

The stock is trading at a hefty price tag

It's great that the S&P 500 is near all-time highs today, but that also means that Coca-Cola is carrying its usual price tag. Shares trade at a price-to-earnings ratio (P/E) of 22 against its estimated 2023 profits. At a six percent long-term growth rate, that's a PEG ratio of nearly four.

Go ahead if you want to prioritize building up that dividend income, but Coca-Cola's total returns could languish some until the company's earnings catch up to its share price. Ideally, one could buy shares at a P/E of around 15 to 17, but Coca-Cola rarely goes that low. Keep the stock on your watchlist and wait for the opportunity to strike.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Coca-Cola wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 11, 2023

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends the following options: long January 2024 $47.50 calls on Coca-Cola. The Motley Fool has a disclosure policy.

$23 Billion of Warren Buffett-led Berkshire Hathaway's Portfolio Is in This Stock. Is It a Buy in 2024? was originally published by The Motley Fool