25 Stocks to Ditch Before the Fed Meeting

The Fed will hold its two-day policy meeting next week, with the central bank's interest rate decision due at 2 p.m. ET on Wednesday, June 19. While CME Group's FedWatch tool pegs the odds of a June rate cut at less than 25%, traders will undoubtedly dissect a post-meeting presser with Fed Chair Jerome Powell for more hints of a July rate cut, the odds of which currently sit at 86.9%. And while we've already established that Fed week tends to be bearish for the broader stock market, below we've outlined some individual stocks to avoid, if past is prologue, including chip concern Western Digital Corp (NASDAQ:WDC).

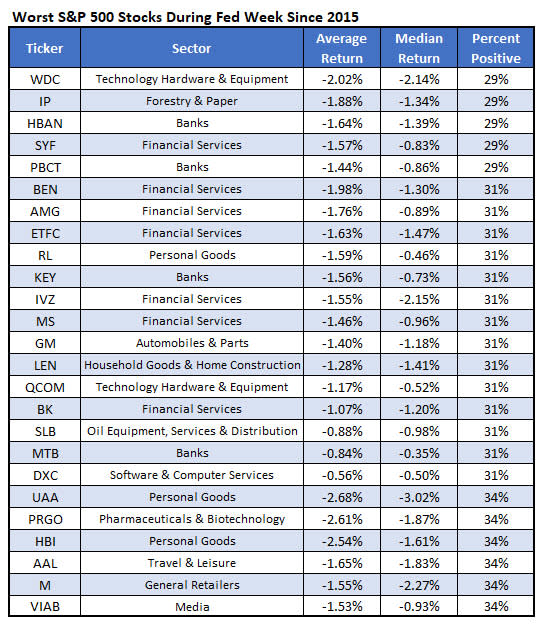

Below are the 25 worst stocks to own the week of Fed policy meetings, looking at data since 2015, which encompasses 35 meetings. Equities needed at least 25 returns to be considered, with the list cultivated by Schaeffer's Senior Quantitative Analyst Rocky White. At the top of the list was semiconductor issue WDC, which has averaged a loss of 2.02%, and has ended the week higher just 29% of the time.

Western Digital shares are down 3.2% to trade at $36.16 today, as chip stocks sink on ugly Broadcom (AVGO) guidance. After losing more than 50% in 2018, WDC shares started 2019 on a high note, but upside momentum ultimately stalled around $55 -- where the stock was trading before a November bear gap -- back in April. The security has subsequently surrendered all of its 2019 gains, and is on pace for a whopping eighth straight weekly loss -- its longest weekly losing streak since September.

Should the stock once again struggle during Fed week, extending that losing streak -- and possibly hitting new lows -- then negative analyst attention could follow. Despite WDC's problems on the charts, and the fundamental questions surrounding chip stocks amid the U.S.-China trade war, seven of 20 analysts maintain "buy" or better opinions of the equity. Plus, the average 12-month price target of $53.43 represents a steep 48% premium to current prices, leaving WDC vulnerable to price-target cuts.

Investors looking to speculate on the stock's short-term trajectory with options should note that WDC sports a Schaeffer's Volatility Scorecard (SVS) of 92 out of a possible 100. This indicates the chip stock has handily exceeded options traders' volatility expectations in the past year -- a boon to would-be premium buyers.

Meanwhile, for traders seeking bullish short-term positions, fellow chip stock Advanced Micro Devices (AMD) tends to do well on Fed policy days. In addition, medical device maker Align Technology (ALGN) has been among the best stocks to own during Fed meeting weeks.