2seventy bio Inc (TSVT) Reports Mixed Financial Results Amid Strategic Shift and Competitive ...

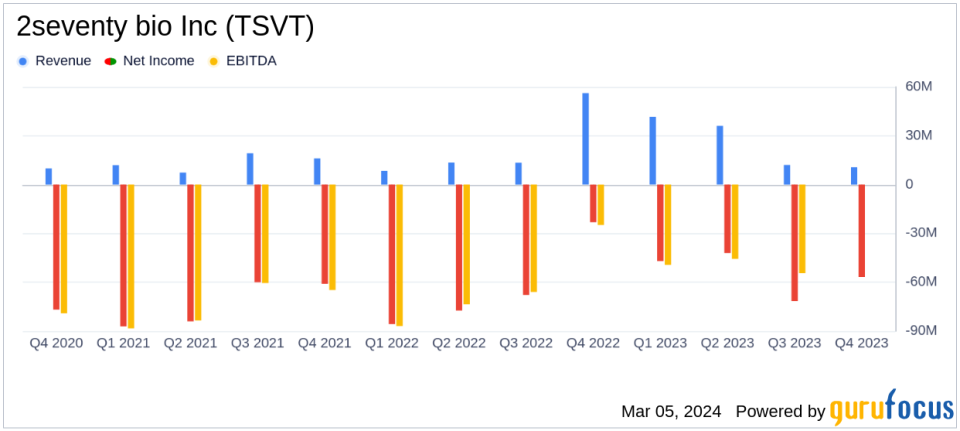

Revenue: Q4 U.S. commercial revenue for Abecma was $56 million, contributing to a full year total of $358 million, shared with Bristol Myers Squibb.

Net Loss: Reported a net loss of $56.8 million in Q4 and $217.6 million for the full year, showing an improvement from the previous year's losses.

Research and Development: R&D expenses decreased to $51.2 million in Q4, down from $60.1 million in the same period last year.

Cash Position: Ended the quarter with $221.8 million in cash and equivalents, with a cash runway extended beyond 2027.

Strategic Realignment: Announced a focus on Abecma and an asset sale to Regeneron, expected to close in the first half of 2024, potentially saving $150 million annually.

On March 5, 2024, 2seventy bio Inc (NASDAQ:TSVT) released its 8-K filing, detailing the fourth quarter and full year financial results for the period ending December 31, 2023. The company, a cell and gene therapy entity dedicated to cancer treatments, has recently undergone a strategic pivot to focus on its flagship product, Abecma, in collaboration with Bristol Myers Squibb.

Despite competitive challenges, Abecma generated significant revenue, although the fourth quarter saw a decline due to competition from other BCMA-targeted therapies. The company and its partner are working towards expanding Abecma's label to the third-line setting, which could potentially restore growth.

2seventy bio Inc (NASDAQ:TSVT) reported a net loss that was smaller compared to the previous year, indicating some improvement in financial health. The company's strategic realignment and the anticipated asset sale to Regeneron are expected to yield substantial cost savings and extend the cash runway, providing stability and focus for the company's future endeavors.

Financial Performance and Strategic Developments

The company's total revenues for the fourth quarter were $10.7 million, a decrease from $56.2 million in the same quarter of the previous year. However, full year revenues increased to $100.4 million from $91.5 million in the prior year. This growth is a positive sign for the company's revenue-generating capabilities, particularly in light of the strategic shift to focus on Abecma.

Research and development expenses saw a reduction, indicating a tighter control on costs. Selling, general, and administrative expenses also decreased, contributing to the company's efforts to streamline operations and focus on its core product.

2seventy bio Inc (NASDAQ:TSVT) emphasized the importance of the upcoming FDA Oncologic Drugs Advisory Committee meeting, which will review data supporting the supplemental Biologics License Application for Abecma. The outcome of this meeting is critical for the company's strategy to expand Abecma's label and reach.

"In the past weeks and months, 2seventy has made significant changes to our business and cost structure designed to optimize our ability to unlock value for Abecma," said Chip Baird, incoming CEO. "Given the strength of the KarMMa-3 data... we have confidence in the outcome of the ODAC meeting and potential for approval in the third line setting."

The company's balance sheet reflects a solid cash position, with $221.8 million in cash, cash equivalents, and marketable securities. This financial stability is crucial as the company navigates the competitive landscape and invests in the commercial success of Abecma.

Looking Ahead

2seventy bio Inc (NASDAQ:TSVT) is at a pivotal point, with the potential expansion of Abecma's label and the strategic asset sale to Regeneron. The company's focus on operational efficiency and cost savings is expected to position it favorably for future growth and profitability.

Investors and stakeholders will be closely monitoring the FDA's decision on the sBLA for Abecma, as well as the completion of the asset sale, both of which are anticipated milestones that could significantly impact the company's trajectory.

For more detailed information and to stay updated on 2seventy bio Inc (NASDAQ:TSVT)'s progress, investors and interested parties are encouraged to join the conference call and live webcast scheduled for today at 8:00 AM ET.

Value investors seeking opportunities in the biotechnology sector may find 2seventy bio Inc (NASDAQ:TSVT)'s strategic focus and potential for label expansion an interesting case to follow. GuruFocus.com will continue to provide timely and insightful analysis of the company's financial developments and operational progress.

Explore the complete 8-K earnings release (here) from 2seventy bio Inc for further details.

This article first appeared on GuruFocus.