2U (NASDAQ:TWOU) Misses Q4 Revenue Estimates, Stock Drops 19.5%

Online education platform, 2U (NASDAQ:TWOU) missed analysts' expectations in Q4 FY2023, with revenue up 8.3% year on year to $255.7 million. Next quarter's revenue guidance of $196.5 million also underwhelmed, coming in 5.7% below analysts' estimates. It made a non-GAAP profit of $0.48 per share, improving from its profit of $0.23 per share in the same quarter last year.

Is now the time to buy 2U? Find out by accessing our full research report, it's free.

2U (TWOU) Q4 FY2023 Highlights:

Revenue: $255.7 million vs analyst estimates of $281.4 million (9.2% miss)

EPS (non-GAAP): $0.48 vs analyst expectations of $0.64 (24.7% miss)

Revenue Guidance for Q1 2024 is $196.5 million at the midpoint, below analyst estimates of $208.4 million

Management's revenue guidance for the upcoming financial year 2024 is $810 million at the midpoint, missing analyst estimates by 7% and implying -14.4% growth (vs -1.7% in FY2023)

Free Cash Flow of $12.4 million is up from -$30.35 million in the previous quarter

Gross Margin (GAAP): 77.6%, up from 71.2% in the same quarter last year

Market Capitalization: $65.2 million

"I am proud to lead 2U through the next chapter of its journey," said Paul Lalljie, Chief Executive Officer of 2U.

Originally named 2tor after the founder's dog Tor, 2U (NASDAQ:TWOU) provides software for universities and colleges to deliver online degree programs and courses.

Education Software

The overwhelming trend of moving work, life and consumption of content online is starting to catch up with the education sector that has until recently stuck to providing courses and degrees in the same way as they did decades ago - in person. The COVID pandemic massively accelerated adoption of online education and has forced institutions to invest in creating digital courses, which drives demand for the software that enables it.

Sales Growth

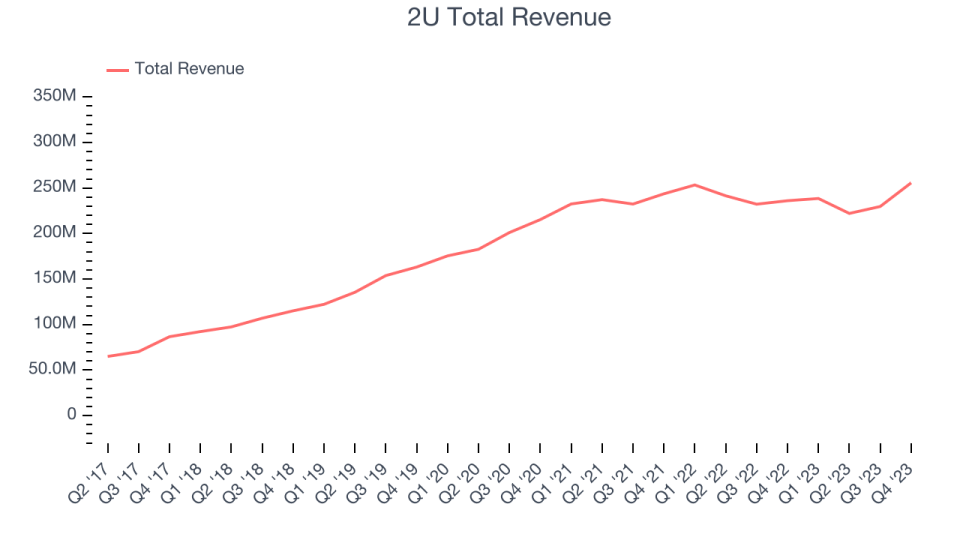

As you can see below, 2U's revenue growth has been unimpressive over the last two years, growing from $243.6 million in Q4 FY2021 to $255.7 million this quarter.

2U's quarterly revenue was only up 8.3% year on year, which might disappoint some shareholders. However, we can see that the company's revenue grew by $25.96 million quarter on quarter, re-accelerating from $7.61 million in Q3 2023.

Next quarter, 2U is guiding for a 17.6% year-on-year revenue decline to $196.5 million, a further deceleration from the 5.9% year-on-year decrease it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $810 million at the midpoint, declining 14.4% year on year compared to 1.8% drop in FY2023.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Cash Is King

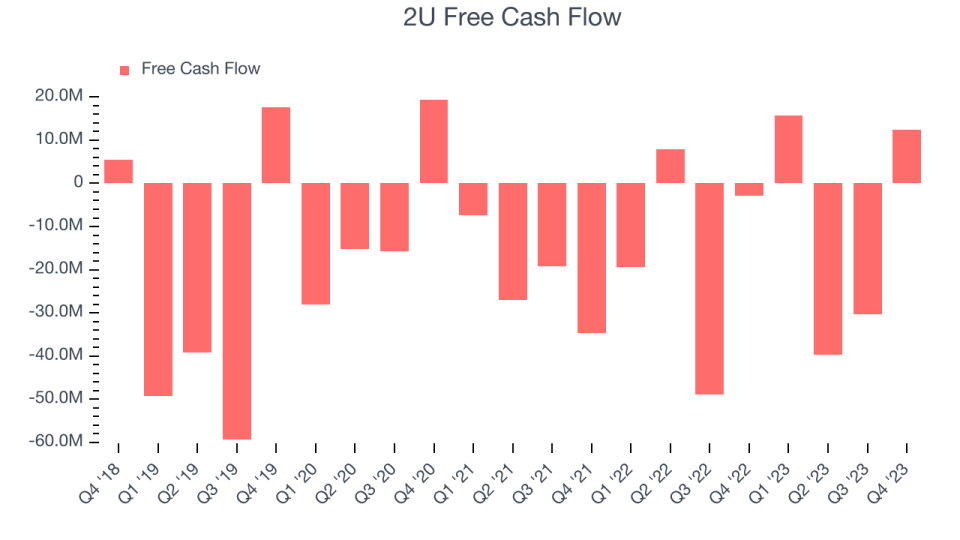

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. 2U's free cash flow came in at $12.4 million in Q4, turning positive over the last year.

2U has burned through $41.89 million of cash over the last 12 months, resulting in a negative 4.9% free cash flow margin. This low FCF margin stems from 2U's poor unit economics or a constant need to reinvest in its business to stay competitive.

Key Takeaways from 2U's Q4 Results

We were impressed by 2U's strong gross margin improvement this quarter. That stood out as a positive in these results. On the other hand, its revenue missed analysts' expectations, driven by poor performance in its Degree Program and Alternative Credentials segments. Furthermore, its full-year 2024 revenue and EBITDA guidance were below expectations, suggesting a slowdown in demand. Lastly, on January 3rd, Andrew Hermalyn was appointed President of the Degree Program segment and Aaron McCullough was appointed President of the Alternative Credential segment. Overall, this was a mediocre quarter for 2U. The company is down 19.5% on the results and currently trades at $0.74 per share.

2U may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.