2U's (TWOU) edX Collaborates With University of Cape Town

2U, Inc.’s TWOU renowned online learning platform, edX, declared that the University of Cape Town (“UCT”), Africa's leading university, has become the latest addition to the global edX partner network.

This collaboration allows UCT to join numerous universities and institutions in providing greater accessibility to high-quality education worldwide. Moreover, UCT will work together with edX to develop 15 new courses and five professional certificate programs, with additional content set to be introduced throughout 2023.

Over the past 15 years, UCT has been a pioneer in online education and has enjoyed a close collaboration with 2U since 2007. Together, UCT and 2U have developed more than 80 online executive education courses, which have been successfully completed by more than 120,000 students.

UCT, in collaboration with 2U, has developed an extensive collection of online programs covering diverse fields, such as finance, investment, technology, business leadership, marketing, project management and engineering the built environment. This comprehensive portfolio offers a wide range of educational opportunities for students interested in various disciplines.

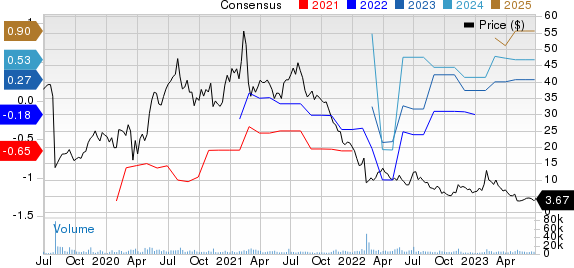

2U, Inc. Price and Consensus

2U, Inc. price-consensus-chart | 2U, Inc. Quote

2U’s Recent Partnerships to Aid Top Line

In recent months, 2U has formed strategic collaborations with notable companies. These partnerships are anticipated to contribute to revenue growth in the upcoming quarters, providing a positive impact on the company's financial performance.

The Raspberry Pi Foundation, a worldwide education charity that empowers young individuals to effectively and creatively utilize digital technologies, has become the new addition to the global edX partner network. Raspberry Pi Foundation has introduced a collection of 20 online courses as part of this announcement.

Tel Aviv University (“TAU”) recently became the member of the global edX partner network, joining a distinguished group of institutions committed to providing quality education worldwide. TAU has unveiled its first offering on the edX platform, a Professional Certificate program called Viruses and How to Beat Them: From Cells to Pandemics.

Intuit, a worldwide financial technology platform known for its products like TurboTax, Credit Karma, QuickBooks and Mailchimp, has collaborated with edX. Together, these platforms are introducing the QuickBooks Certified User Professional Certificate program on the edX.org platform.

The company expects total revenues between $985 million and $995 million for 2023. Adjusted EBITDA is expected in the range of $157 million to $163 million, indicating growth of 28% at the midpoint.

The Zacks Consensus Estimate for TWOU’s second-quarter 2023 loss per share is pegged at 3 cents. The Zacks Consensus Estimate for revenues is pegged at $233.67 billion, indicating a year-over-year decline of 3.23%.

Zacks Rank & Key Picks

Currently, 2U carries a Zacks Rank #3 (Hold).

Shares of TWOU have declined 41.5% year to date against the Zacks Computer and Technology sector’s rise of 34.8%.

Some better-ranked stocks from the broader sector, which investors can consider, are Salesforce CRM, NVIDIA NVDA and BlackLine BL, sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Salesforce have gained 56.3% year to date. The Zacks Consensus Estimate for CRM’s second-quarter 2023 revenues is pegged at $8.52 billion, indicating a year-over-year decline of 10.41%. The consensus mark for earnings is pegged at $1.90 per share, which has increased by 21 cents over the past 30 days.

Shares of NVIDIA have gained 178% year to date. The Zacks Consensus Estimate for NVDA’s second-quarter 2023 revenues is pegged at $11.01 billion, indicating year-over-year growth of 64.19%. The consensus mark for earnings is pegged at $2.04 per share, which has increased by 54 cents over the past 30 days.

Shares of BlackLine have declined 19% year to date. The Zacks Consensus Estimate for BL’s second-quarter 2023 revenues is pegged at $143.9 million, indicating year-over-year growth of 12%. The consensus mark for earnings is pegged at 28 cents per share, which has remained unchanged over the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

2U, Inc. (TWOU) : Free Stock Analysis Report

BlackLine (BL) : Free Stock Analysis Report