3 New Additions to the Zacks Rank Investors Cannot Miss

The stock market is on fire this year, and with so many stocks taking flight it can be hard to decide which ones are the best buys. Fortunately, the Zacks Rank can provide investors with a proven quantitative approach to picking stocks.

The Zacks #1 Rank list highlights companies that are experiencing upward trending earnings revisions, which significantly boosts the stocks near-term performance.

Because of the robust economic environment, slowing inflation, and normalizing interest rate policy, there is a strong likelihood that this bull market is just getting started. And while some investors think now is the time to book the gains on their recent wins, it may in fact be time to press on the accelerator.

Three fresh additions to the Zacks #1 Ranks list that look extremely compelling are Astec Industries ASTE, Griffon GFF, and Netflix NFLX. Each of these stocks boasts strong earnings revisions and some solid buying momentum pushing them higher this year.

Image Source: Zacks Investment Research

Astec Industries

Astec Industries a leading manufacturer and marketer of road building equipment. The company sells equipment used in each phase of road building, from quarrying and crushing the aggregate to applying the asphalt.

Astec Industries also manufactures equipment and components unrelated to road construction, including equipment for the mining, quarrying, construction and demolition industries and port and rail yard operators among many other industries.

Astec holds a dominant position in attractive niche markets in industries benefiting from long-term secular trends including population growth, urbanization, and aging infrastructure. It also boasts an industry-leading reputation for innovation, high-quality products, and superior customer service.

ASTE has seen analysts revise earnings estimates nicely higher over the last couple of months. Current quarter earnings estimates have been upgraded by 4.4% and are projected to climb 71.4% YoY to $0.48 per share. FY23 earnings estimates have been revised higher by 4.1% over the last two months and are expected to grow 128% YoY to $2.81 per share.

Image Source: Zacks Investment Research

Astec Industries has clearly begun to draw investors’ attention demonstrated by the stage one breakout. ASTE carved out a nearly 18-month base from which it broke out of and moved emphatically higher just last months. Now the stock looks to be forming a bull flag continuation pattern, where investors can trade the next move higher.

Although it looks like it may need a few more days of sideways action, once ASTE trades above the $53.75 level it should initiate its next leg higher. Alternatively, if the price can’t hold above the $51.40 level, the setup is invalid, and investors may want to wait for another opportunity.

Image Source: TradingView

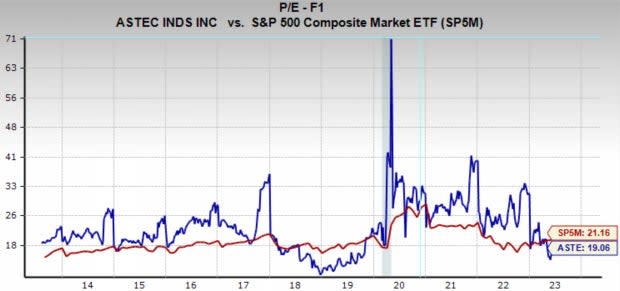

Astec Industries is trading at a one year forward earnings multiple of 19.1x, which is below the market average of 21.2x, and below its 10-year median of 21.2x. ASTE also offers a dividend yield of 1% and has raised the payment by 3.7% annually over the last five years.

Image Source: Zacks Investment Research

Griffon

Griffon is a diversified management and holding company conducting business through wholly owned subsidiaries. Griffon oversees the operations of its subsidiaries, allocates resources among them, and manages their capital structures.

GFF focuses on acquiring, owning, and operating businesses in a variety of industries, and intends to continue the growth of its existing segments and diversify further through investments and acquisitions.

Griffon’s primary businesses are the AMES company, which is a manufacturer of non-powered lawn and garden tools founded in 1876. ClosetMaid, a North American manufacturer and distributor of wood and wire home storage and organization products. And Clopay Building Products, a manufacturer of residential and commercial sectional doors and is North America's largest manufacturer of residential garage doors.

Although next quarter earnings estimates have seen some slight revisions lower, all the other timeframes have experienced upgrades. Current quarter earnings estimates have been revised higher by 8.5%, and FY23 earnings estimates have been boosted by 4.8% over the last two months.

Image Source: Zacks Investment Research

In the last two years GFF has made it a priority to return huge amounts of cash to shareholders through dividends. The dividend payment has exploded higher from $0.32 per share in 2021 to $4.42 per share today.

The dividend payment jumped so high because GFF management announced a $2 special dividend payment in late June 2023. After completing the sale of Telephonics, it was decided that the capital would be immediately returned to shareholders.

Image Source: Zacks Investment Research

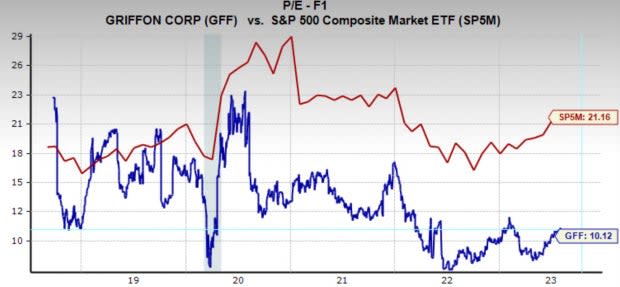

Griffon is trading at a one year forward earnings multiple of 10.1x, which is below the market average of 21.2x, and below its 10-year median valuation of 13.3x.

Image Source: Zacks Investment Research

Netflix

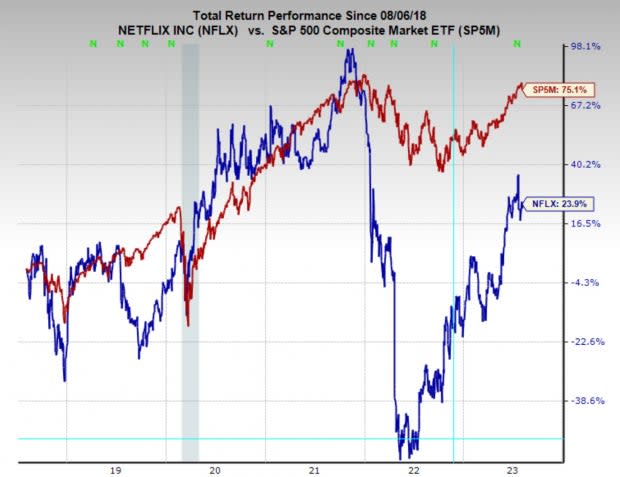

Netflix has gone through an extremely painful couple of years but has managed to come roaring back in 2023. During the bear market of 2022, NFLX stock drew down -77%, yet has managed to make back a majority of those loses so far this year.

Image Source: Zacks Investment Research

Like the stock price, earnings estimates have been moving considerably higher. Current quarter earnings estimates have been upgraded by nearly 11% and are projected to grow 12.3% YoY to $3.48 per share. FY23 earnings estimates have been revised higher by nearly 7% and are expected to climb 19.9% YoY to $11.93 per share.

Image Source: Zacks Investment Research

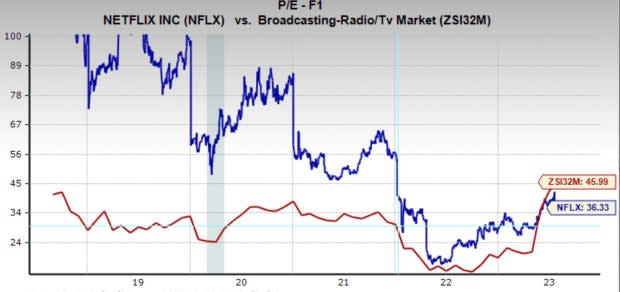

Netflix is trading at a one year forward earnings multiple of 36.3x, which is below the industry average of 46x, and well below its five-year median of 60x. Although it is debatable based on more granular data, NFLX in my opinion is the king of streaming services. It boasts the largest userbase and has a path to 1 billion paying subscribers.

It is hard to believe that in the depths of 2022, NFLX was trading at just 15x forward earnings, however even at this current valuation it remains rather appealing.

Image Source: Zacks Investment Research

Bottom Line

Looking for winning stocks? Checking the Zacks #1 Rank is always a fantastic place to begin your research process. Now that we can confidently say that the bull market is back, it is time for investors to hone their investing knowledge and identify stocks to carry their portfolios higher.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Astec Industries, Inc. (ASTE): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

Griffon Corporation (GFF): Free Stock Analysis Report