3 Auto Retailers to Watch Despite Subdued Industry Prospects

The Zacks Auto Retail and Whole Sales industry’s prospects look muted amid concerns related to the slowing growth rate of new vehicle sales. Also, while auto loan rates are declining, they are still quite high, causing potential buyers to defer purchases. Although enticing incentives are providing some relief to consumers, they are eroding retailers’ profits. Amid these complex industry dynamics, auto retailers like Lithia Motors LAD, AutoNation AN and Group 1 Automotive GPI seem better equipped to navigate the challenges.

Industry Overview

The automotive sector’s performance depends on its retail and wholesale network. Through dealership and retail chains, companies in the Zacks Auto Retail and Whole Sales industry carry out several tasks. These include the sale of new and used vehicles, light trucks as well as auto parts, execution of repair and maintenance services along with the arrangement of vehicle financing. The industry, being consumer cyclical, is dependent on business cycles and economic conditions. Consumers and businesses spend more on big-ticket items when they have higher disposable income. On the contrary, when income is tight, discretionary expenses are the first to be slashed. Importantly, the coronavirus pandemic has brought considerable changes in the operating environment, with the industry laying more emphasis on e-commerce retailing, and the trend is here to stay.

Key Trends Defining the Industry's Prospects

New Vehicle Sales Growth Slows Down: In November, auto sales volume witnessed a modest uptick compared to October. However, the growth was subdued, failing to surpass the sales pace observed in September and October. This signals a slowdown in the growth of new vehicle sales. Although vehicle prices are declining and auto loan rates have retreated from recent peaks, they continue to present a hurdle, deterring some potential buyers from purchasing these big-ticket items. These factors indicate a complex landscape for the auto retail sector, where despite improvements, such as the normalization of inventory levels, the slowing growth rate of new vehicle sales and financing constraints pose challenges to industry players.

High Incentives Squeezing Retailers’ Margins: In November 2023, the U.S. new vehicle average transaction price experienced marginal growth month over month but declined 1.5% year over year, reaching $48,247, according to Kelley Blue Book. This marks the third consecutive month of year-over-year declines in transaction prices. Notably, new vehicle sales incentives surpassed 5% of the average transaction price for the first time since September 2021, climbing 136% year over year. This surge in incentives reflects a shift toward a buyer's market, placing increased pressure on retailers. While consumers may benefit from lower vehicle prices, dealers are grappling with squeezed profit margins. As inventory levels normalize and incentives rise to stimulate sales, dealers are experiencing the financial impact of heightened downward price pressure in the competitive auto retail landscape.

Digitization Ramp-Up is Here to Stay: Since the pandemic, digitization has been in high gear. Online traffic is on the rise, with auto retailers ramping up digital capabilities to make deals with customers and arrange for home deliveries of vehicles. Initiatives like ship-to-home next day, curbside pick-up option, and buy online, pick-up in stores options are picking pace, driving additional traffic to companies’ online sites. Enhanced digital solutions are providing shoppers with a truly comprehensive and personal experience. With digitization gathering steam, auto retail companies are poised to reach new heights. But achieving that requires a delicate balance between digital innovation, cost management, operational optimization and an unwavering focus on enhancing the customer experience.

Zacks Industry Rank Indicates Dim Outlook

The Zacks Auto Retail & Whole Sales industry is within the broader Zacks Auto-Tires-Trucks sector. The industry currently carries a Zacks Industry Rank #214, which places it in the bottom 15% of around 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bleak near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are losing confidence in this group’s earnings growth potential. Since Dec 31, 2022, the Zacks Consensus Estimate for the industry’s 2023 earnings has declined 18.7%.

Despite the gloomy industry outlook, there are a few stocks worth watching. But before we present those stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock market performance and valuation picture.

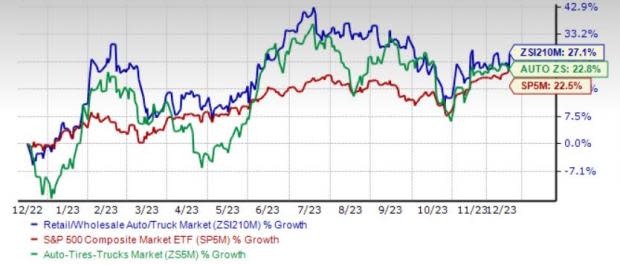

Industry Tops Sector and S&P 500

The Zacks Auto Retail & Whole Sales industry has outperformed the Zacks S&P 500 composite as well as the Auto, Tires and Truck sector over the past year. The industry has gained 27.1% over this period compared with the sector and S&P 500’s growth of 22.8% and 22.5%, respectively.

One-Year Price Performance

Industry's Current Valuation

Since automotive companies are debt-laden, it makes sense to value them based on the enterprise value/earnings before interest tax depreciation and amortization (EV/EBITDA) ratio.

On the basis of the trailing 12-month EV/EBITDA, the industry is currently trading at 6.84X compared with the S&P 500’s 13.61X and the sector’s trailing 12-month EV/EBITDA of 14X.

Over the past five years, the industry has traded as high as 10.71X, as low as 4.35X and at a median of 6.77X, as the chart below shows.

EV/EBITDA Ratio (Past 5 Years)

3 Auto Retailers to Keep a Tab on

Lithia: Its diversified product mix and multiple streams of income reduce its risk profile and position it for long-term top- and bottom-line growth. Enhanced digital solutions — including the Driveway e-commerce program — are helping LAD to further boost profitability and market presence. Strategic buyouts are helping the auto retailer increase its market share and solidify its portfolio. Since launching its five-year plan in mid-2020, Lithia has acquired roughly $17.5 billion in annualized revenues, representing 87.5% of the total $20 billion originally targeted by 2025. Robust cash flows and investor-friendly moves of the firm are driving shareholders’ confidence.

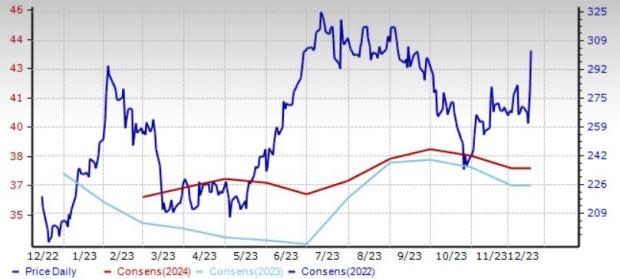

Lithia carries a Zacks Rank #3 (Hold) and has a Value Score of B. The Zacks Consensus Estimate for LAD’s 2024 sales and earnings implies growth of 9.5% and 2.3%, respectively.

Price & Consensus: LAD

AutoNation:It is one of the largest automotive retailers in the United States. Its diversified product mix and multiple streams of income reduce risk profile and augur well for sales growth. Strong footprint, large dealer network and aggressive store expansion efforts along with brand extension strategy and alliances are praiseworthy. With the launch of its digital platform AutoNation Express, the company has stepped up its digitization game. Increased focus on cost discipline is anticipated to aid margins. The firm is committed to shareholder value maximization, with a robust buyback program in place.

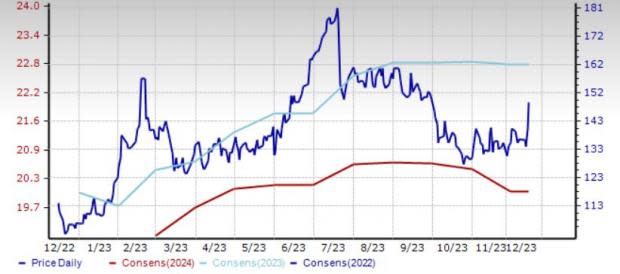

AutoNation currently carries a Zacks Rank #3 and has a Value Score of A. The Zacks Consensus Estimate for its 2024 EPS has moved north by 14 cents over the past 30 days. AutoNation managed to pull off an earnings beat in the last four quarters, with the average surprise being 6.6%.

Price & Consensus: AN

Group 1: It is one of the leading automotive retailers in the world, with operations primarily located in the United States and the UK. Group 1’s acquisitions of dealerships and franchises to expand and optimize its portfolio are fueling growth. The company has acquired revenues of more than $1 billion this year. GPI’s diversified product mix and omnichannel efforts bode well. The AcceleRide platform, its online retailing initiative, active at most of the firm’s U.S. dealerships, allows the company to enjoy higher productivity. Group 1’s investor-friendly moves instill optimism.

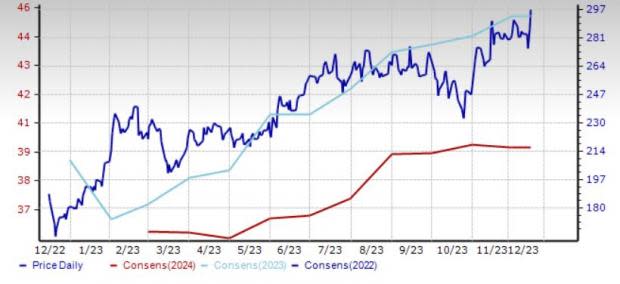

Group 1 carries a Zacks Rank #3 and has a Value Score of A. The Zacks Consensus Estimate for GPI’s 2023 sales implies growth of 9.5%. The consensus mark for 2023 and 2024 EPS has moved north by 23 cents and 3 cents, respectively, in the past 30 days. The company surpassed earnings estimates in the last four quarters, the average being 7.3%.

Price & Consensus: GPI

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

AutoNation, Inc. (AN) : Free Stock Analysis Report

Group 1 Automotive, Inc. (GPI) : Free Stock Analysis Report