3 Auto Stocks Set to Outpace Estimates This Earnings Season

The Auto-Tires-Trucks sector is almost halfway through the Q2 earnings season. The picture thus far is one of continued resilience and strength. So far, eight S&P 500 sector components — Tesla, Ford, General Motors, PACCAR, O’Reilly Automotive, Genuine Parts, BorgWarner and LKQ Corp — have reported quarterly numbers. All these companies managed to pull off earnings beat.

Per the Earnings Trend report dated Jul 26, the auto sector’s earnings for the second quarter are expected to grow 14.6% on a year-over-year basis. As for revenues, they are estimated to rise 19.9% year over year.

With a host of companies still left to release second-quarter 2023 results, we have identified —with the help of the Zacks Stock Screener — a few auto players, which are positioned to outshine the Zacks Consensus Estimate in second-quarter earnings. These include CarGurus CARG, Rivian Automotive RIVN and Honda HMC. Before we discuss the companies, let’s take a look at the factors shaping the quarterly performance of automotive companies.

Factors at Play

Most automakers experienced year-over-year sales growth in the second quarter of 2023, thanks to improving inventory levels. The demand for automobiles remained strong, indicating that the rise in interest rates did not significantly affect purchasing decisions. At the outset of 2023, industry experts anticipated a potential deceleration in the U.S. car market amid inflationary pressure and increased borrowing expenses. However, consumer demand demonstrated greater resilience than anticipated. Quoting Cox Automotive's chief economist Jonathan Smoke, "Consumers have found a way to buy new wheels."

The seasonally adjusted annualized sales rate for June 2023 was 15.7-15.8 million vehicles, up from 15.1 million vehicles in May 2023 and 12.9 million units in June 2022. Per Cox Automotive, new vehicle sales in the second quarter of 2023 topped 4 million units, up 15% year over year and 13% sequentially.

Supply constraints have been considerably alleviated. Limited new vehicle inventory over the past two years that had handcuffed sales is no longer a pressing concern. According to Cox Automotive, new vehicle inventory levels in the United States saw a significant increase of more than 70% in June compared to the same period last year.

The rising popularity of new energy vehicles (including all-electric, hybrids and fuel-cell) is also expected to have fueled the revenues of automakers. Despite concerns over high borrowing costs, Americans' unwavering love for cars and pent-up demand are likely to have aided auto sales in the second quarter of 2023.

Picking Potential Winners

While it is not possible to be sure about which companies are well positioned to beat earnings estimates, our proprietary methodology — Earnings ESP — makes it relatively simple. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Earnings ESP shows the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Our research shows that for stocks with the abovementioned combination, the chances of an earnings beat are as high as 70%.

Our Choices

CarGurus: The company is an online automotive marketplace connecting buyers and sellers of new and used cars. CarGurus is the #1 listing platform, with the largest selection of vehicles in the United States. The acquisition of the CarOffer platform added wholesale vehicle acquisition and selling capabilities to CarGurus’ portfolio of dealer offerings. The acquisition allows the firm to offer Instant Max Cash Offer to customers who wish to sell their car while purchasing a new one. This is likely to have benefited the firm.

During the quarter to be reported, CarGurus enhanced automotive search and shopping by introducing the ChatGPT plugin, utilizing generative AI to provide shoppers with greater personalization and ease in exploring vehicle options without being restricted by specific search fields.

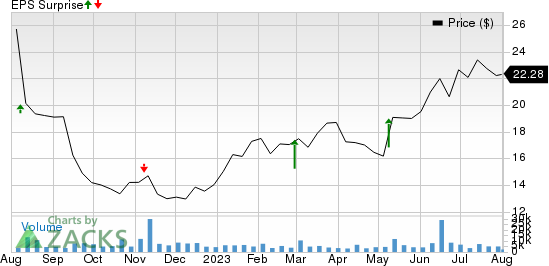

CarGurus has an Earnings ESP of +7.14% and a Zacks Rank #1. The company is scheduled to release second-quarter results tomorrow. The Zacks Consensus Estimate for CarGurus’ to-be-reported quarter’s earnings and revenues is pegged at 23 cents per share and $230 million, respectively. CARG surpassed earnings estimates in three of the trailing four quarters and missed in the other, with the average surprise being 49.5%.

CarGurus, Inc. Price and EPS Surprise

CarGurus, Inc. price-eps-surprise | CarGurus, Inc. Quote

Rivian: The company delivered 12,640 vehicles in the second quarter of 2023. It produced 13,992 vehicles at its manufacturing facility in Normal, IL, during the three months, ended Jun 30, 2023. The production and delivery numbers witnessed an uptick from the second-quarter 2022 level. In the second quarter of 2022, the company had produced 4,401 vehicles and delivered 4,467 vehicles. Higher deliveries are likely to have boosted revenues in the quarter under review. Increasing cost efficiency is also likely to have aided its performance and narrowed loss from the year-ago levels.

Rivian has an Earnings ESP of +0.75% and a Zacks Rank #2. The electric vehicle startup is scheduled to release second-quarter results on Aug 8. The Zacks Consensus Estimate for Rivian’s to-be-reported quarter’s bottom line is pegged at a loss of $1.41 a share, indicating an improvement of 25.4% year over year. The consensus mark for revenues is pegged at $979 million. RIVN surpassed earnings estimates in three of the trailing four quarters and missed in one, with the average surprise being 6.08%.

Rivian Automotive, Inc. Price and EPS Surprise

Rivian Automotive, Inc. price-eps-surprise | Rivian Automotive, Inc. Quote

Honda: Higher year-over-year deliveries in America during the April-June period are likely to boost Honda’s to-be-reported quarter results. In the second quarter of the year, Honda achieved remarkable sales growth in the American market. In June alone, the company experienced a substantial 56.9% year-over-year increase in U.S. sales, reaching a total of 111,498 units sold. Throughout the entire quarter, Honda continued to thrive, with a notable 44.7% year-over-year growth, culminating in the sale of 347,025 units. Honda brand sales in the second quarter surged 42.6% year over year to 306,848 units, while Acura brand sales soared 63.2% to 40,177 units. One of the driving forces behind Honda's success was the surge in electrified vehicle sales.

Honda has an Earnings ESP of +9.65% and a Zacks Rank #3. Japan’s auto giant is scheduled to release fiscal first quarter 2024 results on Aug 9. The Zacks Consensus Estimate for Honda’s to-be-reported quarter’s earnings and revenues is pegged at 99 cents per share and $33.6 billion, respectively. HMC missed earnings estimates in three of the trailing four quarters and beat in one, with the average negative surprise being 9.08%.

Honda Motor Co., Ltd. Price and EPS Surprise

Honda Motor Co., Ltd. price-eps-surprise | Honda Motor Co., Ltd. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

CarGurus, Inc. (CARG) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report