3 Beaten-Down IT Services Stocks to Buy for a Turnaround in 2024

In 2023, major tech firms saw improved results due to cost reduction, with more favorable comparisons to 2022. The emphasis on artificial intelligence (AI) boosted cloud and ad markets, demanding substantial investments. Softer hardware demand persisted as users retained pandemic-purchased products.

The surge in global digitization is creating prospects in 5G, blockchain and AI, particularly in the United States, where smart tech adoption and security investments drive growth. Companies incorporate AI, ML, blockchain and data science for a competitive edge. Despite data security worries, businesses adopt the cloud for efficiency. These dynamics are poised to positively impact the Technology Services sector.

Per Statista's projections, the IT Services market is anticipated to achieve a value of $1,204 billion in 2023, and the market volume is expected to attain $1,570 billion. This indicates a CAGR of 6.86% from 2023 to 2027.

How Technology Services Are Expected to Unfold in 2024

The ongoing global trend toward digitization is generating opportunities across various sectors, such as 5G, blockchain and AI. The United States, a key player in the IT industry, is poised for expansion due to the widespread adoption of smart technologies and increased investments in security.

Businesses are progressively integrating AI, machine learning (ML), blockchain and data science into their operations to attain a competitive edge. AI and ML are gaining significant traction in the technology sector. According to Statista, the global artificial intelligence market reached a value of $142.3 billion in 2022 and is expected to climb to $207.9 billion in 2023.

The global artificial intelligence market is projected to reach an impressive $1.85 trillion by 2030, indicating a substantial CAGR of 41.75% from 2022 to 2030. ML, as a subset of AI and a crucial element of the AI ecosystem, is poised for substantial growth, forecasted to rise from $140 billion to $2 trillion by 2030.

Per a research report by Grand View Research in 2022, the global cloud computing market reached a valuation of $483.98 billion, and it is anticipated to exhibit a CAGR of 14.1% from 2023 to 2030. This upward trajectory is fueled by various factors, including the capacity of cloud technology to augment business performance, a rising preference for hybrid and Omni-cloud solutions, the prevalence of pay-as-you-go models and its increasing popularity in developing nations. Government initiatives aimed at securing data and the aftermath of the pandemic are additional contributors to this growth.

Despite the positive outlook, concerns regarding data security act as a limiting factor. Nevertheless, significant enterprises are embracing cloud solutions to streamline data management and reduce costs, particularly with the adoption of pay-as-you-go models. The rapid uptake of cloud services by large businesses can be attributed to the on-demand accessibility that these platforms offer.

The swift uptake of technology services has led to certain adverse effects, as evidenced by a 300% increase in cybersecurity cases reported by the FBI. Despite these challenges, the industry is capitalizing on the rising need for solutions addressing data security and privacy protection. The escalating frequency of cyberattacks and related security threats is projected to uphold the industry's expansion. Per Statista, anticipated revenues indicate a robust annual growth rate (CAGR 2023-2028) of 10.48%, culminating in a market volume of $273.60 billion by 2028.

3 Technology Stocks to Add to Your Portfolio

Let’s find out some stocks that uphold a promising future in 2024 and are currently available at an inexpensive price. Using the Zacks Stock Screener, we've identified three stocks, each carrying a Zacks Rank #1 (Strong Buy) or #2 (Buy), with a market capitalization of $500 million or higher. Additionally, these stocks have experienced a year-to-date decline of more than 10%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Jamf Holding Corp. JAMF is a leading enterprise software company specializing in Apple ecosystem management. This provides solutions for IT professionals to manage and secure Apple devices, ensuring streamlined operations and a seamless user experience within organizations.

With a market cap of $2.38 billion and a Zacks Rank #2, Jamf excels with its focus on managing and securing Apple devices, capitalizing on the growing demand in enterprises. Its specialized expertise, cloud-based solutions, strong customer base, global presence and strategic partnerships contribute to its success. Innovation, security emphasis and commitment to user experience further strengthen Jamf's position in the market.

The company’s revenues are expected to grow 16.6% in 2023 and 15.1% in 2024. Earnings are expected to record an 81.3% increase in 2023 and a 25.3% rise in 2024. The Zacks Consensus mark for 2023 earnings has been revised northward 7.4% in the past 60 days. JAMF has declined 11.4% year to date.

Jamf Holding Corp. Price, Consensus and EPS Surprise

Jamf Holding Corp. price-consensus-eps-surprise-chart | Jamf Holding Corp. Quote

Vivid Seats Inc. SEAT, formerly known as Horizon Acquisition Corporation, is a prominent online ticket marketplace connecting buyers and sellers for live event tickets. Offering a wide range of sports, concerts and theater tickets, Vivid Seats provides a user-friendly platform with competitive pricing, ensuring access to diverse entertainment experiences.

Vivid Seats currently holds a Zacks Rank #2 and has a market cap of $1.5 billion and excels with a diverse ticket selection. Transparent fees, reliable transactions and customer reviews enhance trust. Mobile accessibility, dedicated support and promotions contribute to a positive experience. The resale marketplace expands options, making Vivid Seats a top choice for event ticket purchases.

The company’s revenues are expected to grow 16.7% in 2023 and 18% in 2024. Earnings are expected to record a 16.7% increase in 2023 and a 3.1% rise in 2024. The consensus mark for 2023 earnings has been revised northward by 5% in the past 60 days. SEAT has decreased 10.6% year to date.

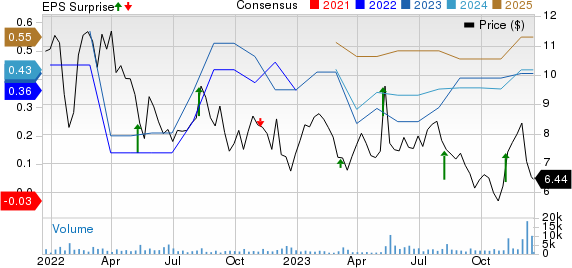

Vivid Seats Inc. Price, Consensus and EPS Surprise

Vivid Seats Inc. price-consensus-eps-surprise-chart | Vivid Seats Inc. Quote

Full Truck Alliance Co. Ltd. YMM is a Chinese digital freight platform connecting shippers and truckers. Founded in 2017, FTA utilizes technology to optimize freight matching, providing efficient and cost-effective logistics solutions in the rapidly growing trucking industry.

YMM outshines China's digital freight sector with market leadership, advanced tech, a large user base, strategic partnerships and diversified services. Its adaptability, operational efficiency and investor confidence contribute to its prominent position.

YMM currently carries a Zacks Rank #2 and has a market cap of $7.75 billion. The company’s revenues are expected to grow 15.9% in 2023 and 23% in 2024. Earnings are expected to record an 89.5% increase in 2023 and a 23.6% surge in 2024. The Zacks Consensus Estimate for 2023 earnings has been revised northward 16.1% in the past 60 days. YMM has declined 12.4% year to date.

Full Truck Alliance Co. Ltd. Sponsored ADR Price, Consensus and EPS Surprise

Full Truck Alliance Co. Ltd. Sponsored ADR price-consensus-eps-surprise-chart | Full Truck Alliance Co. Ltd. Sponsored ADR Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jamf Holding Corp. (JAMF) : Free Stock Analysis Report

Full Truck Alliance Co. Ltd. Sponsored ADR (YMM) : Free Stock Analysis Report

Vivid Seats Inc. (SEAT) : Free Stock Analysis Report