The 3 Best Flying Car Stocks to Buy in November 2023

Flying cars may soon become a reality. In the past few years, dozens of flying car stocks have emerged with one mission, the creation of the world’s first and fully functional flying car. Significant potential exists from this possibility. The flying car industry was valued at around $220 million in 2022. Over the next two decades, experts forecast that the industry will surpass more than $1.5 trillion, representing a compound annual growth rate (CAGR) of over 55%.

Flying cars are more environmentally friendly, while they also reduce travel time and increase productivity. They can revolutionize transportation as we know it. Though there is still much needed for their creation, here are the three best flying car stocks to look out for.

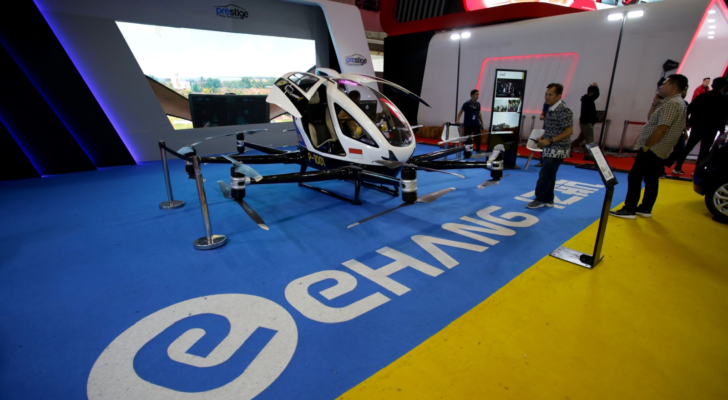

Ehang Holdings Ltd. (EH)

Source: Toto Santiko Budi / Shutterstock.com

Ehang Holdings Ltd. (NASDAQ:EH) emerges as a leading force in the autonomous aerial vehicle (AAV) sector, pioneering cutting-edge solutions in urban air mobility. Through their innovative approach, Ehang has established a robust presence across diverse domains including passenger transportation, logistics, smart city management and aerial media services. This forward-thinking company not only revolutionizes urban transit but also garners substantial interest from investors, thanks to its compelling fundamentals and encouraging technical signals.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

From a technical perspective, Ehang’s stock demonstrates a compelling uptrend. Over the past year, EH has delivered an outstanding return of 284%, reflecting the market’s confidence in the company’s future prospects. Crucially, key technical indicators, including the 50-day and 200-day moving averages, underscore a bullish momentum. The 50-day moving average, surpassing the 200-day moving average, points to a strong short-to-long-term outlook, signaling potential for sustained growth.

Furthermore, Ehang’s relative strength index (RSI) underscores its favorable position. With the RSI maintaining equilibrium between buying and selling pressure, investors can interpret this stability as a sign of market confidence. Additionally, the consistent and substantial trading volume indicates active market participation, reinforcing Ehang’s appeal among traders seeking opportunities in the dynamic realm of autonomous aerial vehicles.

Joby Aviation (JOBY)

Source: T. Schneider / Shutterstock.com

Joby Aviation (NYSE:JOBY) is another currently undervalued investment opportunity with robust growth potential. The company’s recent developments indicate a strong trajectory. Joby’s choice of Dayton, Ohio, as the location for its inaugural eVTOL factory, in collaboration with the manufacturing expertise of Toyota, underscores its commitment to mass production and expanding its market presence. This move not only enhances its production capabilities but also paves the way for scaling up the manufacturing of up to 500 electric vertical takeoff and landing vehicles (eVTOLs) annually, which could translate to substantial revenue growth. The company’s recruitment plans for the new factory further emphasize the momentum behind its expansion strategy.

Joby Aviation is also at the forefront of the eVTOL industry, positioning itself as a pioneer in urban air mobility. Its stock performance has demonstrated remarkable growth, surging nearly 80% year-to-date, indicating growing investor confidence in the eVTOL sector and Joby’s pivotal role in it. The company’s dedication to launching an emissions-free air taxi service by 2025 aligns with the global trend towards sustainable transportation solutions, making it an attractive prospect for environmentally-conscious investors.

Moreover, Joby’s strategic partnerships with major players like the U.S. Air Force and NASA through the AFWERX program are instrumental in advancing research and integration of eVTOLs into national airspace, potentially benefiting the entire air taxi industry. The recent $131 million contract with the U.S. Air Force for early delivery of their eVTOL aircraft exemplifies the market’s faith in Joby’s capabilities. These factors, combined with enabling legislation like SB 800 in California, highlight Joby’s position as a leader in the eVTOL market, making it a lucrative investment opportunity.

XPENG Inc. (XPEV)

Source: THINK A / Shutterstock.com

XPENG Inc. (NYSE:XPEV) is a pioneering force in the realm of flying cars, leading the charge towards the future of 3D transportation. Fueled by innovation and a commitment to revolutionizing travel, the company designs cutting-edge eVTOL flying cars that promise to transform the way we experience mobility. Their modular flying car concept, featuring seamlessly interchangeable air and ground modules, exemplifies their vision for versatile and efficient transportation solutions.

Xpeng Inc. presents a promising investment opportunity driven by robust fundamentals and compelling technical indicators. Examining the fundamentals, the company boasts a healthy price-to-earnings ratio, indicating an undervalued stock in comparison to its earnings per share. Additionally, a strong return on equity showcases efficient capital utilization, underlining the company’s financial strength. Furthermore, Xpeng Inc.’s low debt-to-equity ratio signifies prudent financial management, reducing the risk for potential investors.

On the technical front, the stock exhibits a clear upward trend with consistently higher highs and higher lows. The moving average convergence divergence chart illustrates a bullish momentum, suggesting an uptrend in the stock price. Moreover, the RSI stands comfortably within the optimal range, indicating a balanced market sentiment without being overly bought or sold. Analyzing trading volumes, the stock demonstrates increased investor interest, affirming the market’s confidence in the company’s growth potential.

Considering these metrics, Xpeng Inc. emerges as a compelling investment choice. Its undervalued status, coupled with strong financial health and positive technical indicators, positions the company as one of the best flying car stocks for investors looking to capitalize on the electric vehicle industry.

On the date of publication, Tomas Levani did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Tomas is a self-taught investor with a passion for ESG investing. He has managed the portfolio of a small investment fund, interned at a Fortune 500 investment company, and started his own research firm. Through his freelance writing, he now aims to find favorable investments in companies with a mission of bettering the world.

More From InvestorPlace

The #1 AI Investment Might Be This Company You’ve Never Heard Of

Musk’s “Project Omega” May Be Set to Mint New Millionaires. Here’s How to Get In.

The Rich Use This Income Secret (NOT Dividends) Far More Than Regular Investors

The post The 3 Best Flying Car Stocks to Buy in November 2023 appeared first on InvestorPlace.