3 Best Homebuilder Stocks for 2023

Here are 3 companies under heavy accumulation this year.

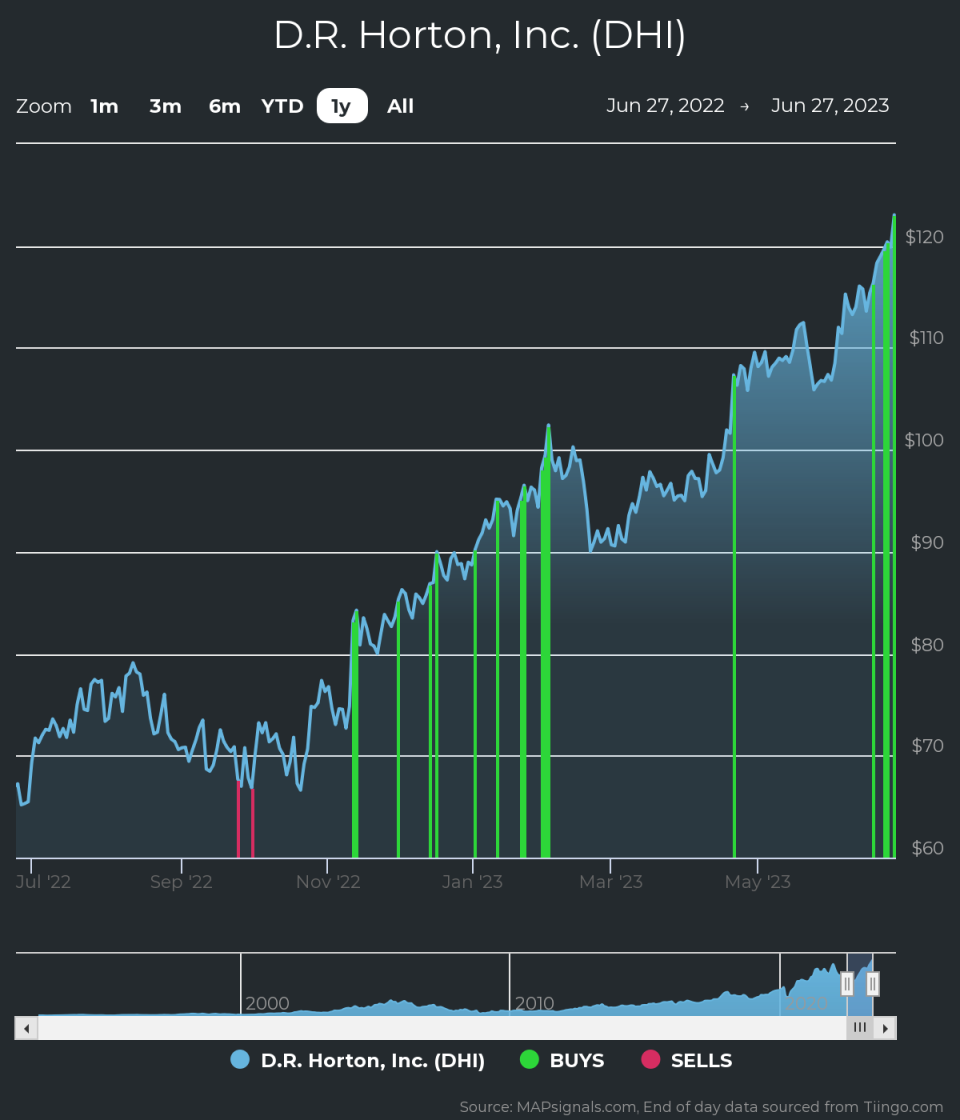

D.R. Horton Inc. (DHI) Analysis

First is D.R. Horton (DHI) which is one of the largest homebuilders in the US. The stock is up 38% in 2023. If you’re thinking the stock is a newcomer to the rally, think again.

Healthy institutional accumulation has helped vault the shares all year, which you can see below. Since last year the shares have seen relentless unusually large volume inflows (green bars):

Don’t fight the Big Money. The constant demand for the shares could keep the uptrend intact near-term.

MAPsignals software helps identify sector leaders with healthy fundamentals. D.R. Horton sports 1-year sales growth of +20.5% and 1-year EPS growth of 44%.

Now let’s look at another Homebuilder in demand.

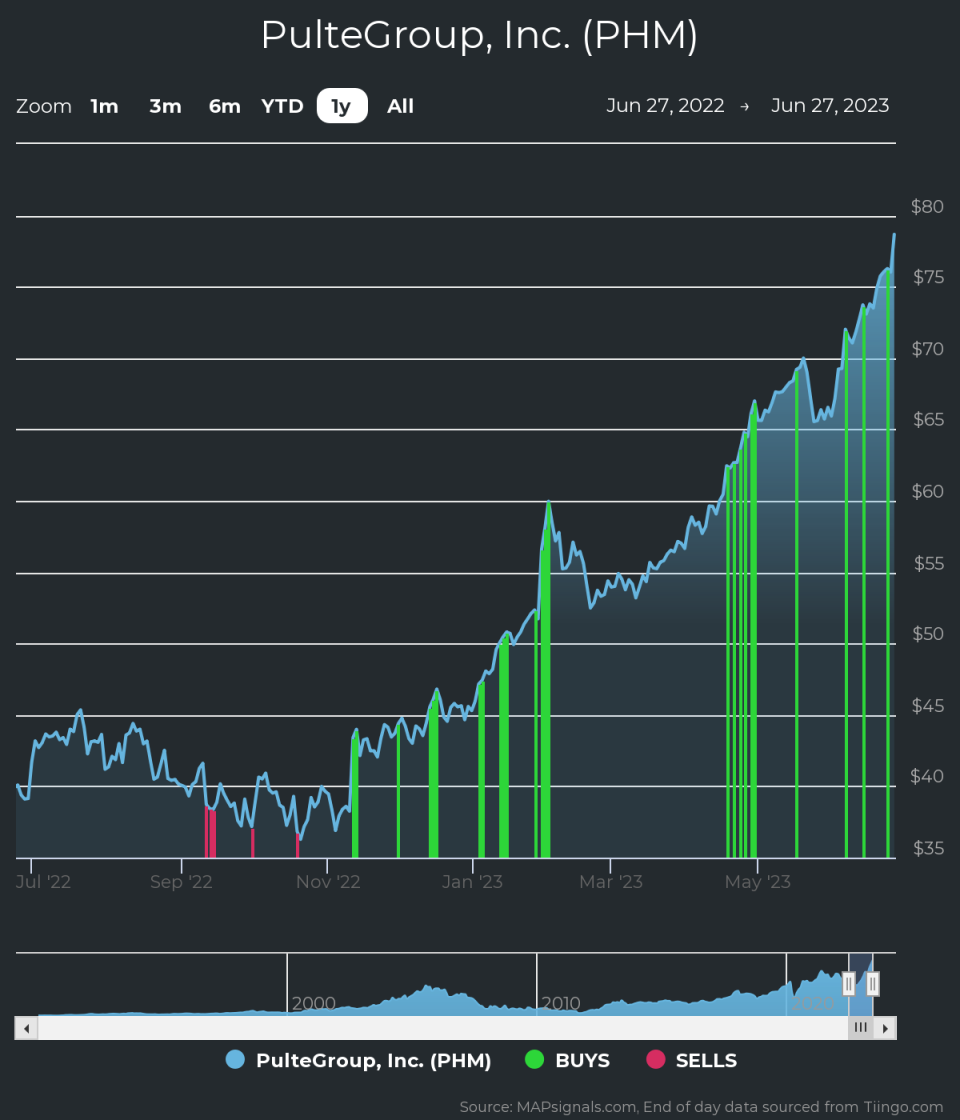

PulteGroup Inc. (PHM) Analysis

Next up is homebuilder PulteGroup Inc. (PHM). The stock has surged 72% in 2023 alone.

Large accumulation in the shares has likely helped the uptrend. Since last year there’ve been many instances where the stock jumped in price alongside outsized volumes. That can mean there’s institutional interest:

Follow the Big Money! The 12-month forward P/E is pegged at 8.4X according to FactSet.

This price action suggests investors are expecting growth for the company in 2023.

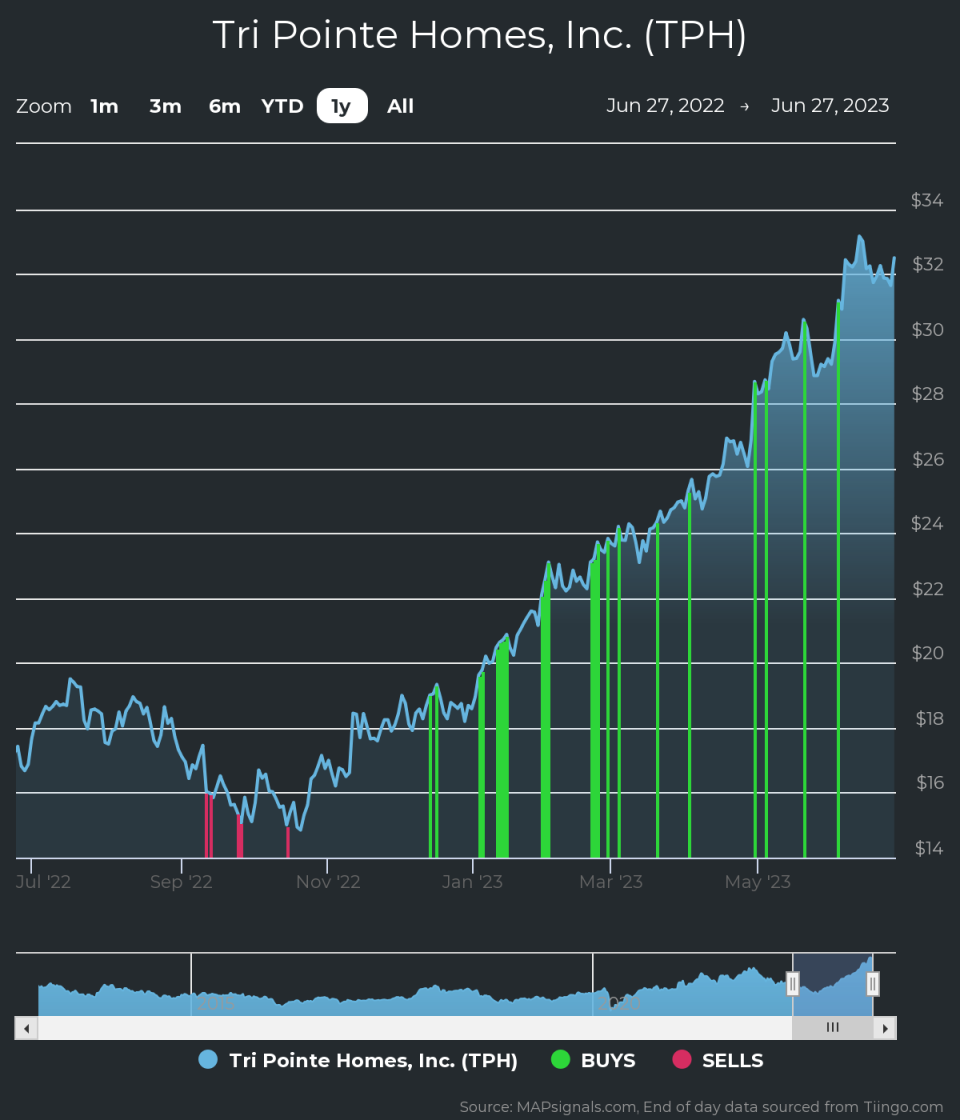

Tri Pointe Homes Inc. (TPH) Analysis

The number 3 homebuilding firm racing higher this year is Tri Pointe Homes Inc. (TPH). This is a much smaller company with a market cap of $3.3B. It may be lesser known to Main Street, but it’s been a constant magnet for Big Money according to our research.

The stock has been a major outperformer YTD, jumping 74%. The shares have seen constant large inflow signals YTD:

There’s no question the stock could be extended at these levels. However, this is one of the most in-demand stocks according to MAPsignals research.

Mechanical action is only one part of the story. Fundamentals matter too. TPH is expected to growth EPS 17.9% this year. It’s not surprising there’s been healthy appetite for the shares.

Our algos search for institutional footprints, that can identify the most powerful stocks in the market. We showcase stocks like this on a weekly basis.

Bottom Line

DHI, PHM, & TPH represent 3 of the top performing homebuilder stocks in 2023. Healthy institutional accumulation signals make these stocks worthy of extra attention.

To learn more about MAPsignals’ institutional process please visit: https://mapsignals.com/solutions/

Disclosure: As of the time of this writing, the author holds no positions in DHI, PHM, or TPH at the time of this writing.

For free weekly insights, visit here: https://mapsignals.com/map-blog/category/big-money-insights-weekly/

This article was originally posted on FX Empire