3 Biotech Stocks Most Wall Street Analysts Are Bullish About

The scenario for the biotech industry in 2024 looks upbeat after a challenging ride in 2023. New drug approvals, pipeline development, and an increase in mergers & acquisitions (M&A) activity boosted investor sentiment in the last couple of months, even though an uncertain macroeconomic environment was a headwind.

Pharma and biotech bigwigs are now looking to bolster their product portfolios and pipelines through collaborations and buyouts. Hence, M&A is back in the spotlight. Pharma giant AbbVie ABBV recently announced two back-to-back acquisitions — Cerevel Therapeutics for $8.7 billion and ImmunoGen for $10.1 billion. Bristol Myers is set to acquire oncology-focused company Mirati Therapeutics for a total equity value of $5.8 billion. Earlier, Novartis acquired Chinook Therapeutics. Biogen acquired Reata Pharmaceuticals, Inc.

The recent spate of acquisitions has put the spotlight on biotech companies with a focus on oncology and rare diseases as acquisition targets. Companies having obesity drugs in their portfolio/pipeline and gene-editing companies hold great potential, particularly with the FDA approval of two recent gene therapies, making them lucrative investment areas.

Given the continuous need for innovative medical treatments, irrespective of the state of the economy, the biotech industry can be a haven despite the inherent volatility and uncertain macroeconomic environment.

Here, we discuss three biotech stocks that put up a robust show in 2023 and are likely to maintain the same in 2024 on the back of a solid portfolio and a promising pipeline. These are CRISPR Therapeutics AG CRSP, Intra-Cellular Therapies, Inc. ITCI and Dynavax DVAX.

CRISPR Therapeutics AG

It is a leading gene editing company focused on developing CRISPR/Cas9-based therapeutics, which promise huge potential. The company received a significant boost with the FDA approval of exagamglogene autotemcel, a CRISPR/Cas9 genome-edited cell therapy, for the treatment of sickle cell disease in patients 12 years and older with recurrent vaso-occlusive crises. Exagamglogene autotemcel was approved under the brand name Casgevy, making it the first FDA-approved treatment to utilize a type of novel genome editing technology. The company has partnered with Vertex Pharmaceuticals for the development and commercialization of Casgevy. Hence, Vertex will make a $200 million milestone payment to CRISPR following the FDA’s approval of Casgevy.

The company is now solely focused on developing CRISPR/Cas9 gene-edited allogeneic CAR T cell product candidates — CTX112 and CTX131. As part of this decision, it will transition patients treated with first-generation candidates (CTX110 and CTX130) to long-term follow-up programs when needed.

CRISPR Therapeutics also recently announced its plans to expand the next-generation candidates beyond immuno-oncology indications. The company intends to expand CTX112 into autoimmune indications. In this regard, management intends to start a clinical study evaluating CTX112 in systemic lupus erythematosus indication by first-half 2024.

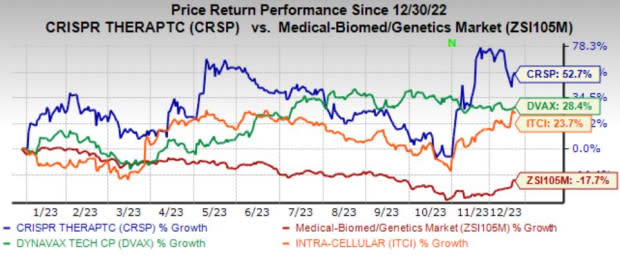

The approval of Casgevy and a strong pipeline has boosted investor sentiment. CRSP has put up a stellar performance in 2023, with shares surging 52.7% year to date against the industry’s decline of 17.7%. Loss estimates for 2023 and 2024 have narrowed by $1.83 and 92 cents, respectively, in the past 60 days. The current average target price of $86.5 for CRSP represents an upside of 39.34%. The stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Intra-Cellular Therapies

This biotech company experienced steady growth in 2023. Its prospects for 2024 look bright despite an extremely challenging space. The company is focused on the development and commercialization of drugs for neuropsychiatric and neurological disorders. The FDA approval for Caplyta (lumateperone) in December 2019 for the treatment of schizophrenia in adults (42mg/day) was a significant boost to the company. The drug’s label was expanded by the FDA in December 2021 for the treatment of bipolar depression in adults (42mg/day). The uptake of the drug has been good in the bipolar depression space despite the inherent challenges in the market.

Intra-Cellular’s efforts to further expand lumateperone’s label should also reap reward. The candidate is in late-stage development as a novel treatment for major depressive disorders. The company expects to file a supplemental new drug application with the FDA for the approval of lumateperone as an adjunctive therapy to antidepressants for the treatment of MDD in the second half of 2024. A potential approval of the drug for additional indications will boost the growth prospects.

Importantly, Intra-Cellular also owns a promising pipeline — lenrispodun (ITI-214) for Parkinson’s disease, ITI-1020 as cancer immunotherapy and ITI-333 for opioid use disorder and pain.

Intra-Cellular Therapies’ current average target price of $77.36 represents an upside of 18.43%. The stock currently carries a Zacks Rank #2. Loss estimates for 2023 and 2024 have narrowed by 42 cents and 15 cents, respectively, in the past 60 days. Shares of the company have gained 23.7% so far in 2023.

Dynavax

This commercial-stage biopharmaceutical company is developing and commercializing innovative vaccines against infectious diseases. It has two commercial products, HEPLISAV-B vaccine (Hepatitis B Vaccine [Recombinant], Adjuvanted), which is approved in the United States and the European Union for the prevention of infection caused by all known subtypes of hepatitis B virus in adults 18 years of age and older, and CpG 1018 adjuvant, currently used in multiple adjuvanted COVID-19 vaccines.

HEPLISAV-B revenues are being driven by continued market share growth and overall expansion of the adult hepatitis B market. HEPLISAV-B's total market share in the United States increased to approximately 41% at the end of the third quarter, compared with approximately 32% at the end of the third quarter of 2022. The company is also working to expand its label, which should boost the top line.

Dynavax is also advancing CpG 1018 adjuvant as a premier vaccine adjuvant with adjuvanted vaccine clinical programs for shingles and Tdap. The company has also formed global research collaborations and partnerships focused on adjuvanted vaccines for COVID-19, seasonal influenza, universal influenza and plague.

The consistent increase in the share price has generated steady returns for the company and the momentum is expected to continue in 2024. Shares of DVAX have gained 28.4% year to date. Loss estimates for 2023 have narrowed to 12 cents from 23 cents in the past 60 days, while the earnings estimate for 2024 currently stands at 18 cents per share.

The company currently has a Zacks Rank #2. Dynavax’s current average target price of $26.67 represents an upside of 95.24%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Intra-Cellular Therapies Inc. (ITCI) : Free Stock Analysis Report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report