3 Broadcast Radio & TV Stocks to Watch in a Challenging Industry

The Zacks Broadcast Radio and Television industry has been suffering from increased cord-cutting despite a spurt in demand for streaming content. However, industry participants like Warner Bros. Discovery WBD, Fox Corporation FOXA and fuboTV FUBO are benefiting from a massive spike in digital content consumption. Diversified content offerings, which are original, regional, short and suitable for small screens (smartphones and tablets); improved Internet speed and penetration and technological advancement benefit industry participants. As monetization and revenues, in terms of ad-spend, continue to be subdued, profit protection and cash management, with greater technology integration, have gained significance and are expected to aid these companies in driving the top line in the near term.

Industry Description

The Zacks Broadcast Radio and Television industry comprises companies offering entertainment, sports, news, non-fiction and musical content over television, radio and digital media platforms. These companies majorly derive revenues from selling television and radio programs, advertising slots and subscriptions. Notably, these industry players are increasing their spending on research and development, as well as sales and marketing, to stay afloat in an era of technological advancements, with increased demand for VR and Internet Radio. The industry is likely to be focused on sustenance at current levels, along with a renewed emphasis on flexibility, which would accelerate the move to a variable cost model and reduce fixed costs.

4 Broadcast Radio and Television Industry Trends to Watch

Shift in Consumer Preference a Key Catalyst: To adapt to the changes in the industry, companies are coming up with varied content for over-the-top (OTT) services in addition to linear TV. The availability of streaming services on a wide range of platforms is helping these services reach a global audience. It is also helping them expand their international user base, attracting advertisers to their platforms and boosting ad revenues. The use of services to help advertisers measure their ROI and enhance their use cases is expected to benefit advertisers and industry participants. Major leagues and events such as the NFL, NHL, Olympics, European Games, EPL and elections also attract significant ad revenues.

Increased Digital Viewing Aids Content Demand: Many industry participants, either launching their OTT services or acquiring other OTT services, are banking on user insights to deliver the right content. Increased digital viewing makes consumer data readily available to companies, allowing them to apply AI and machine-learning techniques to create/procure targeted content. The move not only boosts user engagement but also allows industry participants to raise the prices of their services at an appropriate time without the fear of losing subscribers.

Uncertain Macro-Economic Scenario Hurts Production and Ad Demand: Advertising is a significant revenue source for the Broadcast Radio and Television industry. Industry participants are bearing the brunt of persistently high inflation, rising interest rates, raised capital costs, a soaring U.S. dollar and an anticipated recession, which encouraged advertisers to trim ad budgets and are expected to impact their top-line growth in the near term. Moreover, the industry players face stiff competition from tech and social media companies for ad dollars. This has been a major impediment to industry participants’ growth.

Low-Priced Skinny Bundles Affect Revenues: Increased cord-cutting has forced industry participants to offer “skinny bundles.” These services, available through the Internet, often contain fewer channels than a traditional subscription and, therefore, are cheaper. The move is in line with changing consumer viewing dynamics, as growth in Internet penetration and advancements in mobile, video and wireless technologies have boosted small-screen viewing. The alternative services are expected to keep users glued to their platforms, increasing the need to produce additional content. However, the low-priced skinny bundles are likely to dampen top-line growth for the industry players.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Broadcast Radio and Television industry is housed within the broader Zacks Consumer Discretionary sector. It currently carries a Zacks Industry Rank #165, which places it in the bottom 35% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates dim near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 50% of the Zacks-ranked industries results from a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are pessimistic about this group’s earnings growth potential. Since Sep 30, 2022, the industry’s earnings estimates for 2023 have moved down 69.8%.

Despite the gloomy industry outlook, a few stocks are worth watching, as these have the potential to outperform the market based on a strong earnings outlook. But before we present such stocks, it is worth first looking at the industry’s shareholder returns and current valuation.

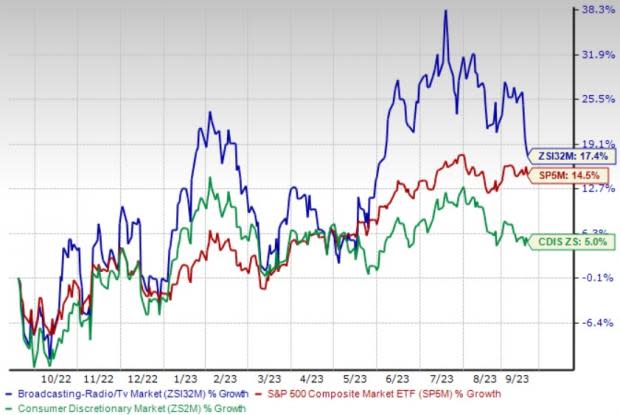

Industry Beats Sector and S&P 500

The Zacks Broadcast Radio and Television industry has outperformed the broader Zacks Consumer Discretionary sector and the S&P 500 Index over the past year.

The industry has gained 17.4% over this period compared with the S&P 500’s return of 14.5% and the broader sector’s rise of 5%.

One-Year Price Performance

Industry's Current Valuation

On the basis of trailing 12-month EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization), which is a commonly used multiple for valuing Broadcast Radio and Television stocks, the industry is currently trading at 8.13X versus the S&P 500’s 13.29X and the sector’s 8.02X.

Over the past five years, the industry has traded as high as 42.47X and as low as 7.21X, recording a median of 29.4X, as the chart below shows.

EV/EBITDA Ratio (TTM)

3 Broadcast Radio and Television Stocks to Buy

fuboTV: This Zacks Rank #2 company’s strengthening sports streaming offerings are expected to continue driving the top line in the near term. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earlier this month, fuboTV and FOX Sports announced coverage plans and broadcast schedules for the fifth and sixth rounds of UEFA EURO 2024 European Qualifiers. Fans streaming Fubo’s exclusive matches can get closer to the live action with the company’s proprietary interactive product features such as Multiview, which allows fans using Apple TV to stream up to four European Qualifiers matches simultaneously.

FuboTV has partnered with Men in Blazers, North America's largest soccer-focused media company. Fubo Canada subscribers can watch new and previously aired episodes of The Men in Blazers Show on television for the first time in Canada on Fubo Sports.

Fubo has quickly become one of the leading streaming platforms in Canada, offering consumers exclusive sports content, including English Premier League and Italy’s Serie A and Coppa Italia, expansive sports coverage through content partners like OneSoccer as well as live entertainment and news channels — at a fraction of the cost of cable TV. This is expected to draw both audience and sponsors for the network.

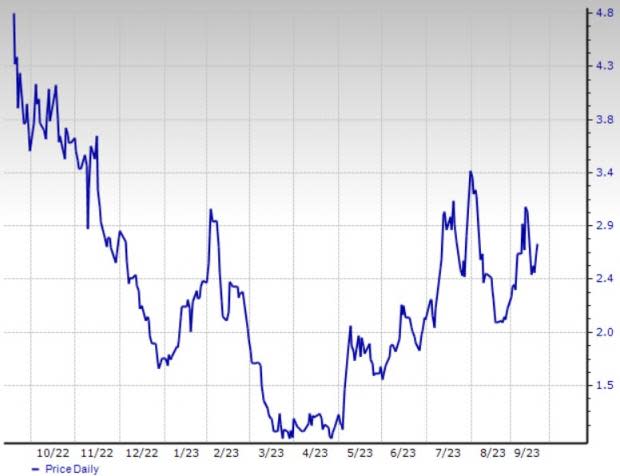

The Zacks Consensus Estimate for 2023 loss has remained steady at 88 cents per share over the past 30 days. FUBO’s shares have jumped 57.5% year to date.

Price and Consensus: FUBO

Warner Bros. Discovery: This Zacks Rank #3 (Hold) company’s expanding direct-to-consumer offerings are driving top-line growth. A steady ad-spending environment, primarily in the international markets, and growing viewership despite incremental spending on marketing and content are expected to drive revenues in the near term.

Its increasing content availability across linear, digital, over-the-top platforms like Hulu and Sling TV is a major positive. Discovery+ is off to an impressive start. In the second quarter, Warner Bros. Discovery introduced Max, its enhanced streaming service, which launched in the United States on May 23. This is expected to aid subscriber growth in the near term.

Moreover, the company launched WBD Stream, a new and unified digital video offering available to advertisers in the 2023-24 Upfront. The new destination for digital video offers advertisers seamless access to the most popular and premium content across Warner Bros. Discovery’s portfolio of sports, lifestyle, entertainment and news, including the websites and apps of top brands like Bleacher Report, Food Network, TNT, Animal Planet, ID and HGTV.

Earlier this month, the company revised its 2023 financial guidance in an attempt to navigate the challenges posed by the ongoing strikes in the entertainment industry by the Writers Guild of America (WGA) and Screen Actors Guild – American Federation of Television and Radio Artists (SAG-AFTRA). The company has guided lower adjusted EBITDA for the full year in the range of $10.5-$11 billion due to the strikes' continued impact. This reflects a negative impact of approximately $300 million to $500 million, primarily due to the ongoing strikes affecting the timing and performance of the 2023 film slate and content production.

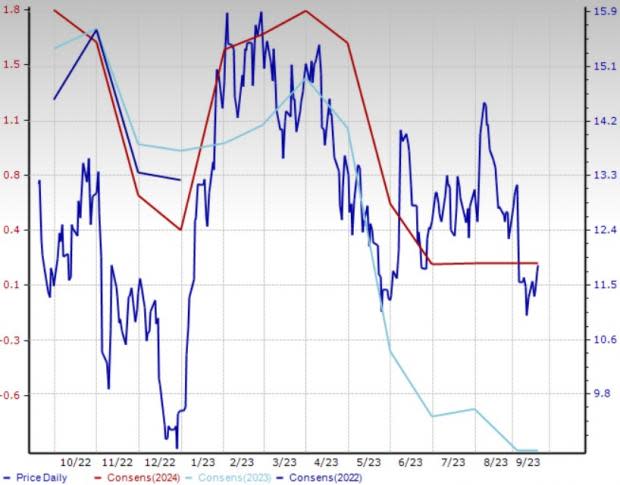

Markedly, the stock has returned 24.9% year to date. Notably, the Zacks Consensus Estimate for its 2023 loss has remained steady at 98 cents per share over the past 30 days.

Price and Consensus: WBD

Fox: The company is riding on the growing demand for live programming. The robust adoption of Fox News and Fox Business Network is expected to drive the user base in the near term. Fox Nation’s new shows released recently have been well received by the audience. These shows include titles like Life of Luxury, The Killer Interview and The Fall of The House of Murdaugh. These shows will boost the company’s top line in the upcoming quarter.

Tubi’s exclusive deal with VICE Media Group to debut eight Tubi Original documentaries is expected to boost the popularity and viewership on the platform in the near term.

This Zacks Rank #3 company generates a significant portion of advertising revenues from live programming, which is relatively immune to the rapidly intensifying competition from subscription-based video-on-demand services.

Moreover, recovering ad spending in the local advertising market is a major positive for Fox. Also, increasing affiliate-fee revenues are expected to drive Fox’s top line.

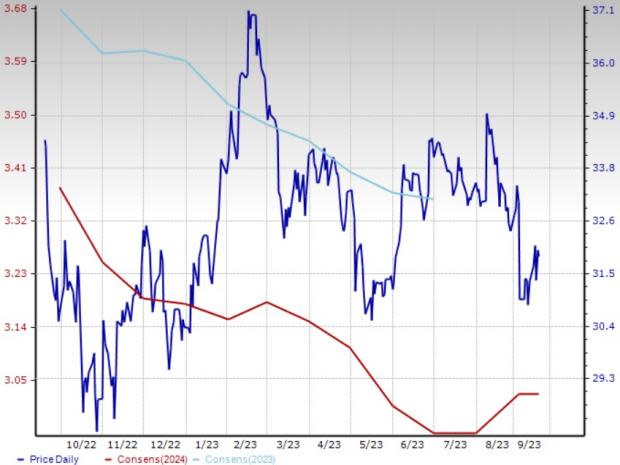

The Zacks Consensus Estimate for Fox’s fiscal 2024 earnings dropped 0.7% to $3.03 per share in the past 30 days. The stock is up 5% year to date.

Price and Consensus: FOXA

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Warner Bros. Discovery, Inc. (WBD) : Free Stock Analysis Report

Fox Corporation (FOXA) : Free Stock Analysis Report

fuboTV Inc. (FUBO) : Free Stock Analysis Report