3 Buy-Rated Energy Stocks Tailored Toward Momentum Investors

The Zacks Oils and Energy sector has displayed notable relative strength over the last three months, up nearly 10% and widely outperforming the S&P 500.

Rising energy prices have attracted investors in the space again, particularly following geopolitical concerns and OPEC+ production cuts in 2023. In fact, the sector is currently ranked #1 out of all 16 Zacks sectors, reflecting positive earnings estimate revisions.

Three stocks – Devon Energy DVN, Diamondback Energy FANG, and EOG Resources EOG – have all seen positive near-term earnings estimate revisions, indicating optimism among analysts. For those interested in riding recent momentum, let’s take a closer look at each.

EOG Resources

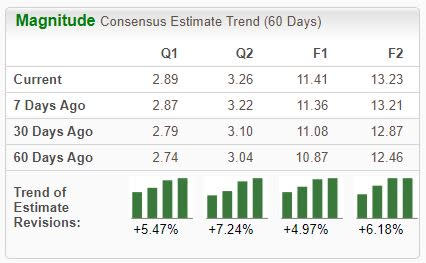

EOG Resources is engaged primarily in the exploration, development, and production of oil and natural gas, with operations spread across the United States. The stock is a Zacks Rank #2 (Buy), with expectations moving higher across the board.

Image Source: Zacks Investment Research

Income-focused investors could also find EOG shares attractive, currently yielding a solid 2.4% annually paired with a payout ratio sitting at 27% of the company’s earnings. And the company has shown a notable commitment to increasingly rewarding its shareholders, boasting a 37% five-year annualized dividend growth rate.

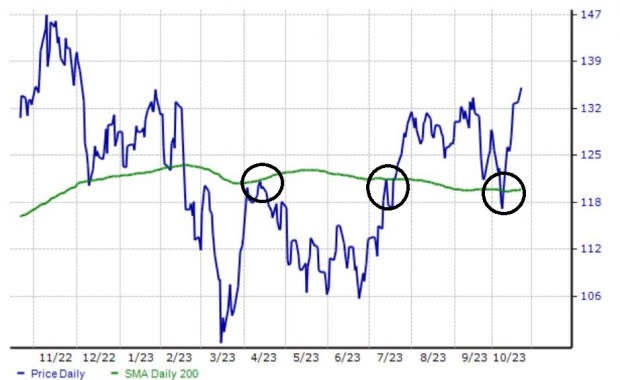

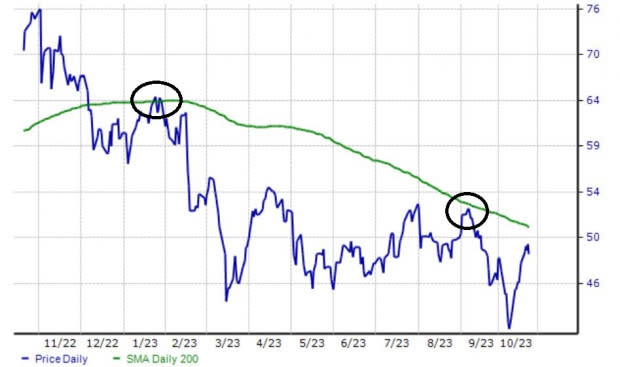

In addition, EOG shares recently bounced nicely off their 200-day daily moving average upon a re-test, a level that previously was met with resistance. This positive price action reflects a meaningful change in trend.

Image Source: Zacks Investment Research

Devon Energy

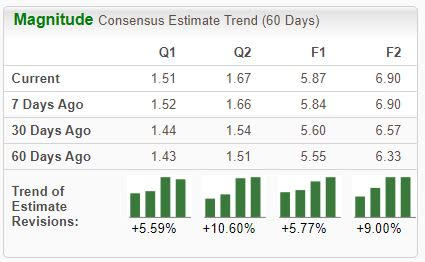

Devon Energy’s oil and gas operations are mainly concentrated in the onshore areas of North America, primarily in the United States. Analysts have raised their expectations, landing the stock into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

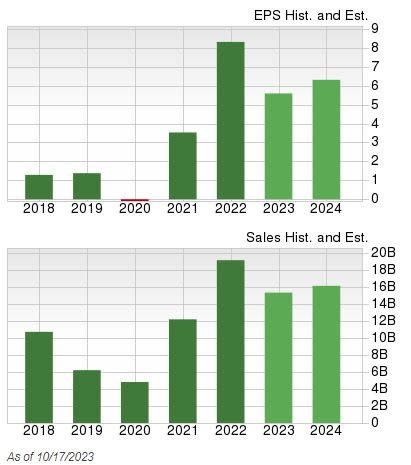

The company’s growth is forecasted to cool in its current year on hard comps from last year, with expectations alluding to a 30% earnings decline on 20% lower revenues. Still, growth resumes in FY24, with estimates suggesting an 18% uptick in earnings growth on 5% higher sales.

Image Source: Zacks Investment Research

Shares are trading below their current 200-day moving average, currently reflecting an unfavorable trend. Investors would likely be better off waiting to see if shares can clear this hurdle and hold, indicating a meaningful change in the long-term trend.

Image Source: Zacks Investment Research

Diamondback Energy

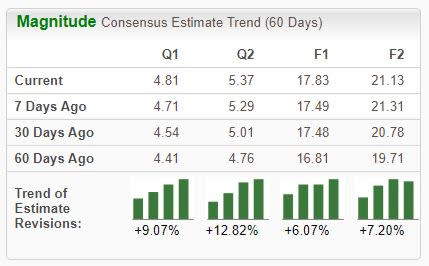

Diamondback’s primary operations are focused in the Permian basin, focusing on growth through a pairing of acquisitions and active drilling. Like those above, the stock has enjoyed favorable earnings estimate revisions.

Image Source: Zacks Investment Research

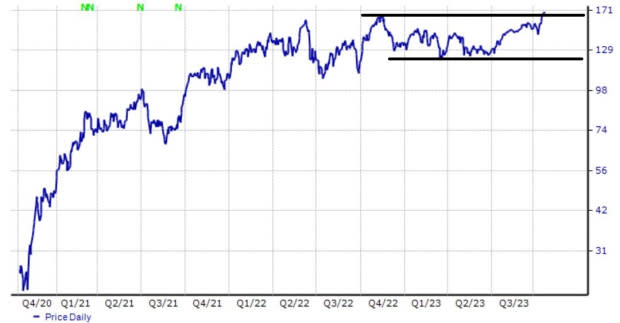

Shares are now breaking out and heading toward all-time highs, reflecting considerable positive momentum. This favorable price action has been illustrated below.

Image Source: Zacks Investment Research

Keep an eye out for the company’s upcoming release expected on November 6th, as the Zacks Consensus EPS Estimate of $4.81 has moved 9% higher over the last several months, reflecting a year-over-year decline of 25% from the year-ago period on hard comps.

Bottom Line

Targeting stocks displaying relative strength can allow investors to inject themselves into positive trends where buyers are in control. And when you add in rising earnings estimate revisions, these stocks have the fuel they need to continue climbing.

For those seeking stocks displaying considerable momentum, all three above – Devon Energy DVN, Diamondback Energy FANG, and EOG Resources EOG – deserve a spot on your watchlist.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report