These 3 Buy-Rated Stocks Are Long-Term Outperformers

Investors are always searching for stocks that deliver market-beating gains. Interestingly, many non-tech stocks have done precisely that over the last decade, exceeding the S&P 500’s impressive 220% gain and 12% annualized return.

Three stocks – The Progressive Corp. PGR, Copart CPRT, and Cintas Corp. CTAS – have all outperformed the S&P 500 over the last decade, posting at least a 20% annualized return. This is illustrated below.

Image Source: Zacks Investment Research

On top of market-beating performances, all three currently sport a favorable Zacks Rank, with analysts positively raising their expectations. Let’s take a closer look at each.

Copart

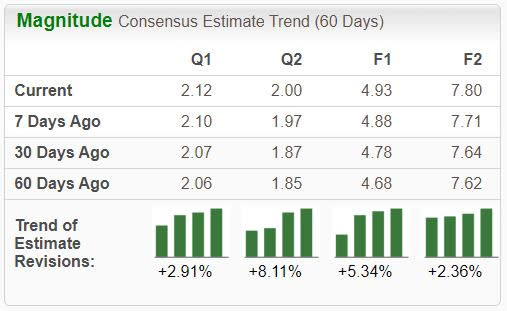

Copart, a Zacks Rank #1 (Strong Buy), provides online auctions and a wide range of remarketing services to process and sell salvage and clean title vehicles. The revision trends have been particularly notable for its current and next fiscal years.

Image Source: Zacks Investment Research

The company’s better-than-expected quarterly releases have helped power shares throughout 2023, with Copart exceeding both Zacks Consensus EPS and Revenue estimates in three consecutive releases. The company posted $997 million in sales in its latest release, growing 13% from the year-ago period thanks to improved service revenues.

Copart’s top line growth has remained on a healthy trajectory, as we can see illustrated below in the annual revenues chart.

Image Source: Zacks Investment Research

The Progressive Corp.

Progressive, a current Zacks Rank #2 (Buy), is an American insurance company, recently becoming the largest motor insurance carrier in the United States in late 2022. Analysts have moved their expectations higher across the board.

Image Source: Zacks Investment Research

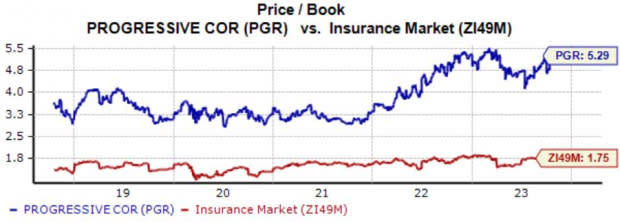

Value-focused investors may not find PGR shares as attractive, currently trading at a 5.2X trailing 12-month price-to-book ratio, above the respective Zacks Insurance industry average of 1.8X. The price-to-book ratio measures how much investors will pay for each dollar of a company's net assets.

Image Source: Zacks Investment Research

PGR shares saw buying pressure following its latest quarterly release, with Net Premiums Earned climbing 20% year-over-year to $14.9 billion and total Policies in Force growing 10% from the year-ago period. Regarding our expectations, PGR beat the Zacks Consensus EPS Estimate by 20% and posted a modest revenue surprise.

The company’s earnings are expected to be up 21% on 18% higher revenues in its current year, with estimates for FY24 suggesting an additional 58% earnings growth paired with a 12% sales bump. The stock sports a Style Score of “B” for Growth.

Image Source: Zacks Investment Research

Cintas Corp.

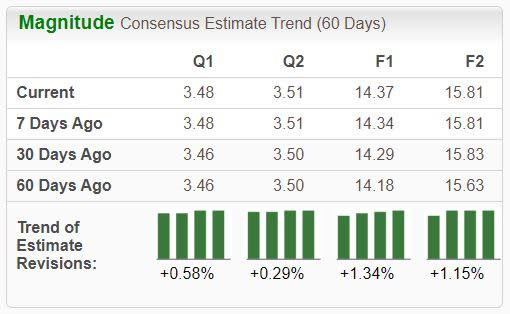

Cintas’ products and services include uniforms, floor care, restroom supplies, first aid, and safety products, taking care of any business needs. The stock is currently a Zacks Rank #2 (Buy), with expectations modestly moving higher across the board.

Image Source: Zacks Investment Research

Cintas is a great example of a company committed to increasingly rewarding shareholders, recently boosting its quarterly payout by 17% in late July. In fact, the company is a member of the elite Dividend Aristocrat group, further reflecting its shareholder-friendly nature.

Additionally, the company has been the definition of consistency within its quarterly results, exceeding the Zacks Consensus EPS Estimate in each quarter dating back to 2017. It’s worth noting that Cintas posted a record-high operating margin of 21.4% compared to the year-ago figure of 20.3% in its latest release.

Image Source: Zacks Investment Research

Bottom Line

Investors are always trying to beat the market. After all, we’re here to get the most bang for our buck.

And when it comes to delivering market-beating gains, all three stocks above – The Progressive Corp. PGR, Copart CPRT, and Cintas Corp. CTAS – have outperformed the S&P 500 over the last decade, all delivering at least 20% annualized returns during the period.

In addition, all three have seen their near-term earnings outlooks shift positively, reflecting optimism among analysts and providing fuel to continue their climbs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cintas Corporation (CTAS) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

Copart, Inc. (CPRT) : Free Stock Analysis Report