These 3 Buy-Rated Stocks Have Been Red-Hot

Stocks have been considerably strong throughout February, continuing recent bullishness and rewarding investors handsomely. And throughout the month, there have been several stand-out stocks, including Pegasystems PEGA, AppLovin APP, and Medpace MEDP.

Relative strength focuses on stocks that have performed at a higher level relative to the market or another relevant benchmark. By targeting stocks displaying this bullish price action, investors can find themselves in positive market trends where buyers are in control.

For those interested in momentum, all three stocks above have outperformed nicely over the last month, as we can see illustrated below.

Image Source: Zacks Investment Research

Let’s take a closer look at each.

Pegasystems

Pegasystems, a current Zacks Rank #2 (Buy), is a leading Customer Relationship Management software provider that enables transaction-intensive organizations to manage a broad array of customer interactions.

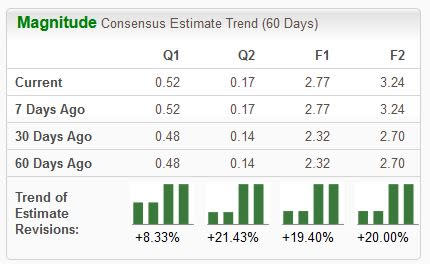

Analysts have taken their expectations higher across the board, particularly following its Q4 and FY23 release.

Image Source: Zacks Investment Research

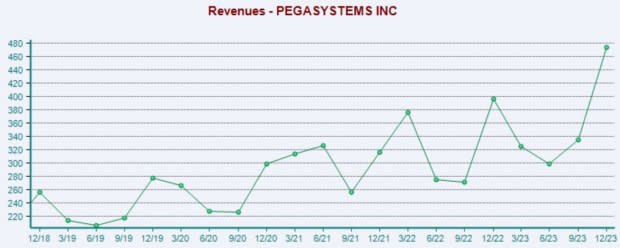

The company enjoyed a strong FY23, with its annual contract value growing 11% and also delivering record free cash flow. Shares soared following the release, with the market undoubtedly impressed. PEGA’s top line has seen an acceleration, as we can see below.

Image Source: Zacks Investment Research

Shares trade at elevated multiples, typical of those expected to grow at an above-average level. The current forward earnings multiple (F1) presently sits at 23.7X, with the company carrying a Style Score of ‘D’ for Value. Earnings are forecasted to climb 12% on 5% higher sales in its current year.

AppLovin

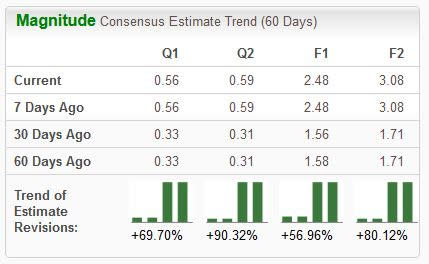

AppLovin's proprietary tech and software solutions optimize app monetization, empower data-driven marketing, and help deliver profitable growth. The stock is a Zacks Rank #1 (Strong Buy), with earnings expectations melting higher across the board.

Image Source: Zacks Investment Research

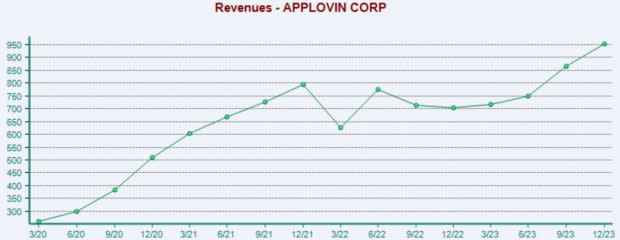

The company’s quarterly results have been considerably strong as of late, exceeding the Zacks Consensus EPS estimate by an average of 26% across its last four releases. Throughout its latest period, APP posted $953 million in quarterly revenue, showing 36% year-over-year growth.

Image Source: Zacks Investment Research

AppLovin’s growth profile is hard to ignore, underpinned by its Style Score of ‘A’ for Growth. Current consensus expectations for its current year suggest 150% earnings growth paired with a 23% sales bump, with FY25 estimates representing improvements of 24% and 10%, respectively.

Medpace

Medpace is a scientifically driven, global, full-service clinical contract research organization that provides Phase I-IV clinical development services to the biotechnology, pharmaceutical, and medical device industries.

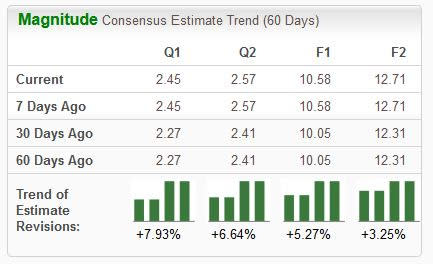

Like those above, analysts have taken their earnings expectations higher, helping land the stock into the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

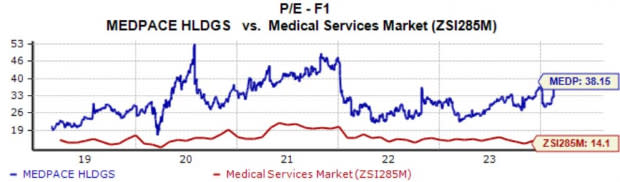

While the momentum is there, the valuation picture is a bit stretched, with the company carrying a Style Score of ‘F’ for Value. Shares presently trade at a 38.2X forward earnings multiple (F1), well above the 29.6X five-year median and the respective Zacks Medical Services industry average of 14.1X.

Image Source: Zacks Investment Research

Bottom Line

While February is generally known to be a bit ‘cold’ in the market, there have been many big-time winners throughout the month, including Pegasystems PEGA, AppLovin APP, and Medpace MEDP.

In addition to momentum, all three sport a favorable Zacks Rank, reflecting optimism among analysts.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pegasystems Inc. (PEGA) : Free Stock Analysis Report

AppLovin Corporation (APP) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report