These 3 Companies Have Seen Recent Insider Activity

Market participants closely follow insider activity, as the transactions can reflect current sentiment surrounding the trajectory of the business. Of course, investors also typically get a confidence boost upon seeing an insider swoop in for a buy.

Insiders are defined as a company's officers, directors, or someone controlling at least 10% of a company's equity securities. To little surprise, many strict rules apply to insiders. And they typically have a holding horizon longer than most, a critical aspect to be aware of.

As of late, the insiders of several companies, including American Express AXP, Occidental Petroleum OXY, and Sherwin-Williams SHW, have acquired shares. What did they see? Let’s take a closer look.

American Express

American Express is a diversified financial services company that offers charge/credit payment card products and travel-related services worldwide. A director of AXP recently purchased 1000 AXP shares, with the transaction totaling $144 thousand.

The company recently reported quarterly results on October 20th, exceeding the Zacks Consensus EPS Estimate handily but modestly falling short of revenue expectations. Earnings saw Y/Y growth of 33%, whereas revenue climbed 13%.

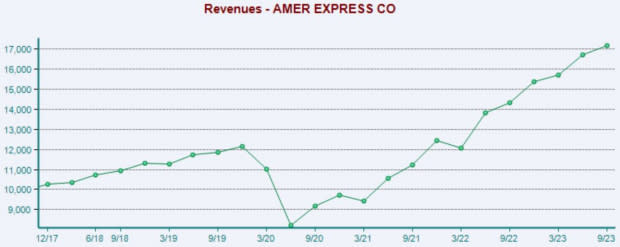

As illustrated below, AXP’s top line performance has remained strong post-pandemic lows.

Image Source: Zacks Investment Research

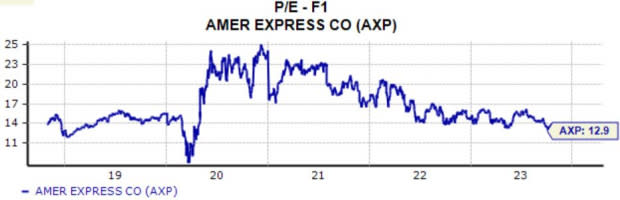

In addition, shares aren’t expensive on a relative basis, with the current 12.9X forward earnings multiple (F1) nicely beneath the 15.5X five-year median and highs of 20.4X in 2022. It’s worth noting that American Express is forecasted to see 13% earnings growth on 15% higher sales in its current year.

Image Source: Zacks Investment Research

American Express also boasts a shareholder-friendly nature, with its dividend payout growing by 8.6% annualized over the last five years. Shares currently yield 1.7% annually.

Occidental Petroleum

Warren Buffett-led Berkshire Hathaway recently made another splash, with the conglomerate buying a rough total of 4 million shares and the transaction totaling a sizable $246 million. The recent purchase adds to an already prominent position, reflecting a significant bet on energy.

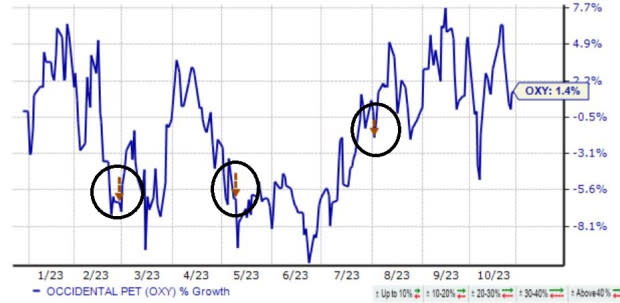

OXY shares haven’t done much year-to-date, primarily trading sideways but still managing to squeeze out a 1.4% gain. The company’s quarterly results have regularly brought volatility, with shares seeing buying pressure following its latest print.

Image Source: Zacks Investment Research

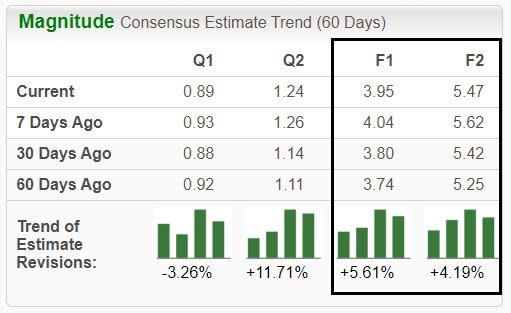

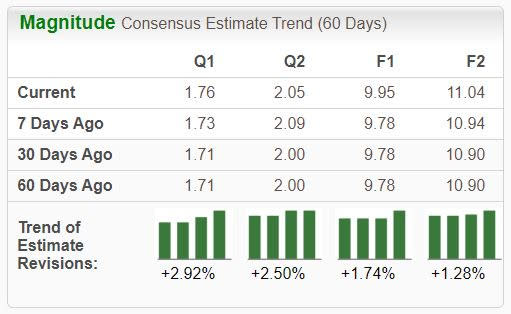

It’s worth noting that analysts have recently raised their earnings expectations across nearly all timeframes amid rising oil prices, with the revisions trends particularly notable for its current and next fiscal years.

Image Source: Zacks Investment Research

OXY’s growth is forecasted to cool in its current year (FY23) on hard comps from FY22, with earnings and revenue expected to decline 58% and 22%, respectively. Still, growth is expected to resume in FY24, as estimates allude to a 40% boost in earnings paired with a 6% revenue recovery.

Image Source: Zacks Investment Research

Sherwin-Williams

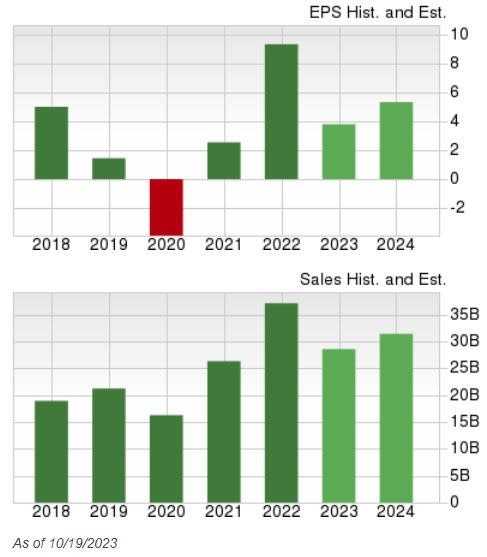

The CEO of Sherwin-Williams recently swooped in and purchased 2125 shares, with the transaction totaling just above $500 thousand. Similar to OXY, Sherwin-Williams has enjoyed positive earnings estimate revisions.

Image Source: Zacks Investment Research

The company’s quarterly results have been strong as of late, exceeding the Zacks Consensus EPS Estimate by an average of 12.6% across its last four prints. In its latest release, SHW posted a 15% EPS beat and reported revenue 2% ahead of expectations.

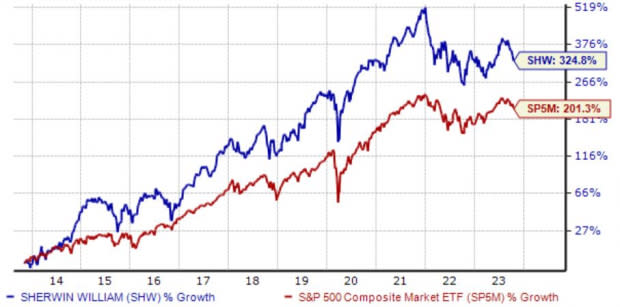

Interestingly enough, SHW shares have been long-term outperformers, with shares gaining more than 320% in value over the last decade vs. the S&P 500’s 200% gain. The annualized return over the period works out to be an impressive 15.5%.

Image Source: Zacks Investment Research

Bottom Line

It’s easy to understand why investors closely follow insider activity, as it can provide a snapshot of current sentiment surrounding a company's future. An insider buy is undoubtedly a positive, whereas a sell could carry negative undertones in certain situations.

And for those seeking stocks insiders are diving into, all three above – American Express AXP, Occidental Petroleum OXY, and Sherwin-Williams SHW – fit the criteria nicely.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Sherwin-Williams Company (SHW) : Free Stock Analysis Report

American Express Company (AXP) : Free Stock Analysis Report

Occidental Petroleum Corporation (OXY) : Free Stock Analysis Report