3 Crypto Stocks to Keep a Tab on in August

The cryptocurrency market has seen rampant growth since it began with Bitcoin (BTC) in 2009. Investments in cryptocurrency picked up largely in 2021, but the majority of the gains were exhausted in 2022. The Federal Reserve’s constant hiking of interest rates, along with the FTX fallout, weighed heavily on the cryptocurrency market.

However, 2023 began on a positive note for most of the cryptocurrencies. Even though these cryptocurrencies are trading at a narrow range for quite some time, their current prices are way below their all-time highs in the 2021 bull run, indicating significant upside potential.

Most importantly, cooling inflation and a relaxed macroeconomic scenario are expected to boost digital currencies. In June, retail inflation increased 3% year over year, but that’s way below the 9% peak it had hit last year.

Thus, with the prices of indispensable goods and services showing signs of cooling, the Fed is widely expected to be less aggressive with its monetary policy stance (read more: 5 Solid Stocks to Gain on Signs of Inflation Cooling Down).

Around 82.5% of market participants now expect the central bank not to hike interest rates in September, as it was done in June, per the CME FedWatch Tool. Needless to say, interest rate hikes always adversely impacted high-risk assets, including digital coins.

Additionally, renewed interest among financial behemoths in crypto is expected to drive the prices of digital coins higher in August. While BlackRock, Inc BLK has requested regulators to create a spot Bitcoin ETF, The Charles Schwab Corporation SCHW, in particular, has supported a new crypto exchange called EDX Markets.

Hence, it seems that the cryptocurrency market is poised to pull out of its doldrums, and it's judicious for risk-tolerant investors to cash on this bullish trend by keeping an eye on solid crypto stocks. These stocks comprise cryptocurrency miners, and companies specializing in blockchain technology. Prominent among them are HIVE Blockchain Technologies Ltd. HIVE, Block, Inc. SQ and CME Group Inc. CME.

Bitcoin mining company, HIVE Blockchain reported encouraging financial results in June. Moreover, HIVE Blockchain’s profit margins are expected to improve since the price of Bitcoin hasn’t fallen below $20,000, which, as a thumb rule, results in negative margins.

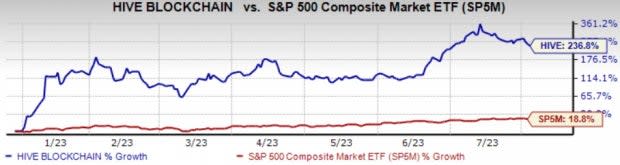

HIVE Blockchain’s shares have soared 236.8% so far this year, while the broader S&P 500 Index has gained 18.8% in the same period.

Image Source: Zacks Investment Research

HIVE Blockchain’s expected earnings growth rate for the current year is 77.4%. The Zacks Consensus Estimate for HIVE’s current-year earnings has moved up almost 54% over the past 60 days. HIVE Blockchain has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Block, by the way, is one of the biggest investors in Bitcoin. The company currently has about $235 million in Bitcoin on its balance sheet, per CoinGecko. Block is, at present, benefitting from its strong Cash App engagement, and the users of Cash App can easily purchase and sell Bitcoin.

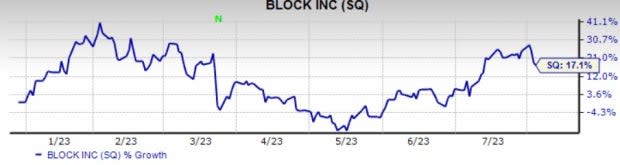

The company has made exponential investments in blockchain technology, and its CEO has converted the name of the company from Square to Block. Shares of Block have gained 17.1% in the year-to-date period.

Image Source: Zacks Investment Research

The company’s expected earnings growth rate for the current year is 69%. The Zacks Consensus Estimate for Block’s next-year earnings has moved up 0.9% over the past 60 days. Block has a Zacks Rank #1.

In terms of trading volume, CME Group is the largest futures exchange in the world. It is one of the pioneers to offer trading in Bitcoin futures, which were earlier being traded as unregulated securities. Shares of CME Group have gained 20.6% in the year-to-date period.

Image Source: Zacks Investment Research

The company’s expected earnings growth rate for the current year is 13.6%. The Zacks Consensus Estimate for CME Group’s current-year earnings has moved up 3.4% over the past 60 days. CME Group has a Zacks Rank #2 (Buy).

Now, since HIVE Blockchain, Block, and CME Group are primarily related to Bitcoin, they are further positioned to gain next year due to Bitcoin’s halving event. Halving lowers Bitcoin's supply, which in turn boosts its price. Last time, in the year 2020, the price of Bitcoin on the halving day was $8821.42, while the price 150 days later increased to $10,943, per cointelegraph.com (read more: 4 Crypto Stocks That Have Outshined Bitcoin This Year).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CME Group Inc. (CME) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

HIVE Digital Technologies Ltd. (HIVE) : Free Stock Analysis Report

Block, Inc. (SQ) : Free Stock Analysis Report