3 Crypto Stocks On a Roll as Bitcoin Tops $31,000

The crypto market took a beating at the end of last year. The bankruptcy of FTX amid an alleged fraud dragged the prices of cryptocurrencies, including Bitcoin, to multiyear lows. However, Bitcoin dismissed regulatory scrutiny and more than doubled this year from the trough of last year.

An improved economic environment coupled with new institutional participation in the crypto market encouraged investors to pile into the world’s numero uno cryptocurrency, resulting in a price surge that exceeded gains in the stock market.

And as market pundits expect Bitcoin’s epic run to continue in the second half of this year, stocks such as HIVE Blockchain Technologies Ltd. HIVE, Marathon Digital Holdings, Inc. MARA and Bitfarms Ltd. BITF are poised to gain.

Bitcoin Witness a Remarkable Surge

The price of Bitcoin, has recently breezed past the psychological threshold of $31,000 and established a solid support level. Notably, the price of Bitcoin notched its best first half of a year since 2019. The price of the largest-digital asset even surpassed the tech-laden Nasdaq’s best first-half gains in four decades.

Moreover, on Jul 4, Bitcoin’s trading volume soared 47.2% in 24 hours, a clear indication of investors’ interest in the digital asset. Bitcoin’s price, by the way, continues to hover above the 200-day simple moving average, indicating further upswing.

What’s Behind the Bitcoin Rally?

Bitcoin is zooming up, and it’s partly because of the Federal Reserves’ pause in interest rate hikes in its last policy meeting held in the month of June. Needless to say, an increase in interest rates was always a headwind in 2022, as higher rates weighed heavily on high-risk assets such as digital coins and tech stocks.

Meanwhile, the banking sector turmoil in March 2023 that heightened worries about an impending recession was also a blessing in disguise for Bitcoin. This is because, during such a crisis, many investors saw the digital asset as a safer investment than some of the regional banks.

But most importantly, it’s the renewed interest among large traditional financial institutions in crypto, including Bitcoin, that drove its prices northward. Financial bigwig BlackRock, Inc BLK, has applied, urging regulators to create a Bitcoin ETF. If the proposal gets accepted by the supervisory body, retail participation will increase and open opportunities for more institutional backing.

Similarly, financial heavyweights such as The Charles Schwab Corporation SCHW, Citadel Securities and Fidelity Digital Assets, to name a few, backed a new crypto exchange called EDX Markets. The exchange allows the trading of Bitcoin along with other prominent digital assets.

Crypto Stocks to Make the Most of the Bitcoin Rally

From an investment perspective, if you are looking to make money from Bitcoin’s current upsurge, it would be judicious to approach it in a roundabout way, by keeping an eye on companies that make use of Bitcoin and technologies that support it, like blockchain.

First on the list is HIVE Blockchain, which is one of the traded Bitcoin miners. As a thumb rule, miners do have negative margins when the price of Bitcoin falls below $20,000. But now, since the price is above this threshold, HIVE Blockchain’s profit margins are positioned to improve.

The Canadian Bitcoin mining company posted solid financial results in June, while its shares have surged 248.7% so far this year, backed by the Bitcoin rally. In comparison, the broader S&P 500 Index has gained 17.1% in the same period.

Image Source: Zacks Investment Research

HIVE Blockchain’s expected earnings growth rate for the current year is 54.2%. The Zacks Consensus Estimate for HIVE’s current-year earnings has moved up 6.6% over the past 60 days. HIVE Blockchain has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

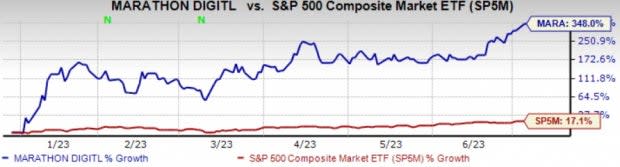

Another Bitcoin mining company, Marathon Digital, is experiencing exponential growth this year. This is because Bitcoin miners’ shares have a direct relationship with the price of Bitcoin. The profitability of Marathon Digital’s mining operation will improve banking in the value of Bitcoin.

Shares of Marathon Digital outperformed the S&P 500 Index year to date, by gaining a whopping 348%.

Image Source: Zacks Investment Research

Marathon Digital’s expected earnings growth rate for the current year is 113.7%. The Zacks Consensus Estimate for MARA’s current-year earnings has moved up 525% over the past 60 days. Marathon Digital has a Zacks Rank #3 (Hold).

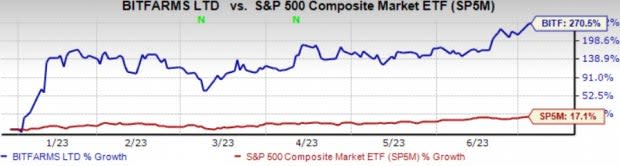

Also, Bitfarms specializing in mining Bitcoin, is expected to witness growth momentum soon. Its shares may have gained less than MARA stock, but it has reduced its debt considerably and has increased its mining capacity, which makes it all the more enticing for investors.

Bitfarms shares have skyrocketed 270.5% so far this year, thereby easily outdoing the S&P 500 Index.

Image Source: Zacks Investment Research

Bitfarms’ expected earnings growth rate for the current year is 86.1%. The Zacks Consensus Estimate for BITF’s current-year earnings has moved up 48.4% over the past 60 days. Bitfarms has a Zacks Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

HIVE Blockchain Technologies Ltd. (HIVE) : Free Stock Analysis Report

Marathon Digital Holdings, Inc. (MARA) : Free Stock Analysis Report

Bitfarms Ltd. (BITF) : Free Stock Analysis Report