3 Dividend-Paying Industrial Stocks to Combat Market Volatility

The Zacks Industrial Products sector has been experiencing muted growth since the end of 2022 amid a slowdown in the manufacturing sector, thanks to the Federal Reserve’s aggressive monetary policy tightening to curtail inflation.

With softness in manufacturing activities, industrial demand has dwindled across some key-end markets. Growing concerns of an approaching recession make it difficult to predict the timing of a turnaround in the manufacturing sector. Amid such volatile market conditions, it would be wise to invest in some quality dividend stocks like Emerson Electric Co. EMR, Apogee Enterprises APOG and Illinois Tool Works Inc. ITW.

Per the Institute for Supply Management (ISM) report, in May, the Manufacturing PMI (Purchasing Manager’s Index) touched 46.9%, contracting for the seventh consecutive month. A figure less than 50% indicates a contraction in manufacturing activity. The New Orders Index remained in contraction territory at 42.6%, declining 3.1 percentage points from the figure recorded in April.

Amid persistent weakness in the manufacturing sector, demand across key end markets such as petroleum & coal products, food, beverage & tobacco products, computer & electronic products and primary metals has declined.

Some end markets, such as the industrial, commercial aerospace aftermarket and automotive aftermarket have remained resilient. This coupled with improvement in supply chains has helped the industrial companies stay afloat. The sustained improvement in supply chains is evident from the ISM report’s Supplier Deliveries Index, which reflected faster deliveries for the eighth straight month in May.

Despite certain bright spots, the broad market uncertainty due to a slowdown in the economy and lingering fears of a recession, shrouds the industrial sector’s outlook. Against this bleak backdrop, one must invest in some good quality dividend stocks that not only ensure a steady source of income but also offer protection against downside risk. These stocks are generally less volatile and hence are dependable when it comes to long-term investment planning.

3 Industrial Stocks for Dividend Investors

In order to choose some of the best dividend stocks from the sector, we have run the Zacks Stock Screener to identify stocks with a dividend yield in excess of 2% and a sustainable dividend payout ratio of less than 60%.

Emerson: Headquartered in St. Louis, MO, Emerson is a diversified global engineering and technology company. EMR pays out a quarterly dividend of 52 cents per share ($2.08 annualized), which gives it a 2.41% yield at the current stock price. The company has increased its dividend five times over the past five years. This company’s payout ratio is 44%, with a five-year dividend growth rate of 1.53%. (Check Emerson’s dividend history here).

Emerson, carrying a Zacks Rank #2 (Buy), is poised for growth on the back of strong demand in the process and hybrid markets. Improving supply chains support its underlying sales growth. EMR focuses on transforming into a global automation company to drive growth and profitability. The company’s move to acquire National Instruments in an $8.2-billion deal is aligned with this objective. The acquisition, expected to be completed in the first half of fiscal 2024, will strengthen EMR’s global automation foothold, helping the company expand into the semiconductor and electronics, transportation, electric vehicles, aerospace and defense end-markets. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

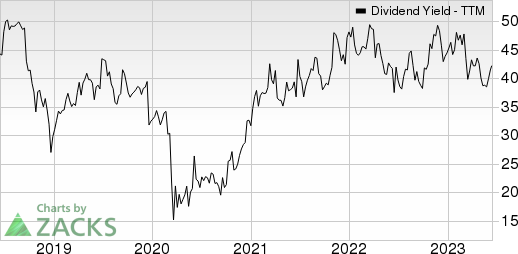

Emerson Electric Co. Dividend Yield (TTM)

Emerson Electric Co. dividend-yield-ttm | Emerson Electric Co. Quote

Apogee: It provides architectural glass, aluminum framing systems and installation services for buildings and value-added glass and acrylic for custom picture framing and displays. APOG pays out a quarterly dividend of 24 cents per share (96 cents annualized), which gives it a 2.24% yield at the current stock price. The company has increased its dividend five times in the past five years. This company’s payout ratio is 24%, with a five-year dividend growth rate of 8.41%. (Check Apogee’s dividend history here).

Pricing actions, cost-control measures and restructuring savings continue to drive Apogee’s growth. A solid backlog level on a strong project pipeline and improving orders should fuel this Zacks Rank #2 company’s growth. Strong demand in the construction end-market bodes well for APOG.

Apogee Enterprises, Inc. Dividend Yield (TTM)

Apogee Enterprises, Inc. dividend-yield-ttm | Apogee Enterprises, Inc. Quote

Illinois Tool: Headquartered in Glenview, IL, Illinois Tool is a worldwide manufacturer of highly engineered products and specialty systems. ITW pays out a quarterly dividend of $1.31 per share ($5.24 annualized), which gives it a 2.14% yield at the current stock price. The company has increased its dividend five times over the past five years. This company’s payout ratio is 56%, with a five-year dividend growth rate of 8.09%. (Check Illinois Tool’s dividend history here).

Illinois Tool, carrying a Zacks Rank #3 (Hold), is benefiting from growth across North America and International operations and strength in institutional end markets. Strength in the capital equipment business bodes well for ITW’s Test & Measurement and Electronics segment, while solid industrial and oil and gas businesses should drive the company’s Welding segment.

Illinois Tool Works Inc. Dividend Yield (TTM)

Illinois Tool Works Inc. dividend-yield-ttm | Illinois Tool Works Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Illinois Tool Works Inc. (ITW) : Free Stock Analysis Report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Apogee Enterprises, Inc. (APOG) : Free Stock Analysis Report