3 Dividend-Paying Transportation Stocks to Watch Currently

It is a well-known fact that expenses on oil are a key input cost for any transportation company. Oil price has increased roughly 12% in a month’s time and is currently trading at round $90 a barrel. This surge in a key input cost naturally hurts bottom-line growth of transportation companies. Oil prices have been on a tear since Russia and Saudi Arabia extended voluntary supply cuts through the end of the current year.

Adding to the woes, expenses are high on the labor front as well courtesy of the multiple pay-related deals being inked in the space lately. This is because the bargaining power of various labor groups has increased, given high travel demand and labor crunch in the post-COVID-19 world.

High costs apart, supply-chain disruptions continue to dent transportation stocks. The inflationary environment, together with supply-chain tightness, is pushing costs higher. Even though the Federal Reserve held interest rates steady at its meeting this month, it signaled another hike this year to tackle stubborn inflation.

Lackluster freight demand also represents a major headwind for transportation stocks. Highlighting the weak freight demand, the Cass Freight shipments Index declined 10.6% year over year in August. This measure deteriorated year over year in six of the eight months reported this year, confirming the overall declining trend.

But do the above challenges imply that investors interested in the transportation sector should shun investing in this key sector? The answer is a firm no. We believe dividend-paying transportation stocks should be on an investor’s watchlist to withstand headwinds and volatility. We have identified three stocks from the Zacks Transportation sector — FedEx Corporation FDX, Expeditors International of Washington EXPD and Delta Air Lines DAL. All three stocks currently carry a Zacks Rank #3 (Hold).

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here

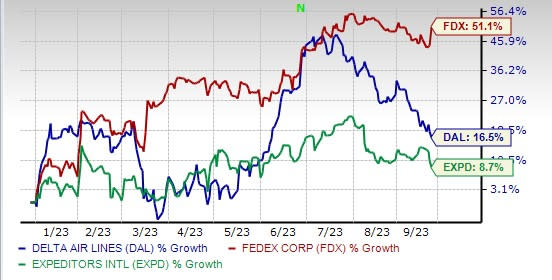

YTD Price Performance

Image Source: Zacks Investment Research

Adding dividend stocks to one’s basket shows prudence, as these provide an avenue of steady income and a cushion against market risks. Needless to say, investors are always on the lookout for companies with a consistent and incremental dividend history.

FedEx’s efforts to reward its shareholders even in these difficult times are praiseworthy. FDX is also active on the buyback front. During fiscal 2022, FedEx repurchased shares worth $2.2 billion. FedEx's liquidity position is also solid. FDX’s efforts to cut costs are driving its bottom line.

Despite the global weakness, FDX's first-quarter fiscal 2024 earnings per share exceeded expectations, driven by its cost-cutting measures. FDX surpassed the Zacks Consensus Estimate for earnings in each of the last four quarters, by an average of 16.94%.

The Zacks Consensus Estimate for FDX’s current fiscal-year earnings suggests growth of 1.62% from the year-ago reported number. The company pays out a quarterly dividend of $1.26 ($5.04 annualized) per share, giving a 1.92% yield at the current stock price. FDX’s payout ratio is 31%, with a five-year dividend growth rate of 13.15%. (Check FDX’s dividend history here.)

Expeditors is based in Seattle, WA. The freight forwarder’s efforts to reward its shareholders are commendable. EXPD’s liquidity position is encouraging too. EXPD outshined the Zacks Consensus Estimate in two of the past four quarters (missing the mark in the other two).

The company pays out a semi-annual cash dividend of 69 cents ($1.38 annualized) per share, giving a 1.22% yield at the current stock price. EXPD’s payout ratio is 21%, with a five-year dividend growth rate of 9.81%. (Check EXPD’s dividend history here.)

Delta is an airline heavyweight based in Atlanta. Improved air travel demand, particularly on the domestic front, is aiding Delta. Passenger revenues, which account for the bulk of the top line, have been very strong, with people taking to the skies again.

In June, Delta’s management announced the reinstatement of its quarterly dividend of 10 cents per share (40 cents annualized) after a COVID-induced hiatus, giving a 1.04% yield at the current stock price. (Check DAL’s dividend history here.)

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

Expeditors International of Washington, Inc. (EXPD) : Free Stock Analysis Report

FedEx Corporation (FDX) : Free Stock Analysis Report