3 Energy Stocks Suited Nicely for Income Investors

The Zacks Oils and Energy sector has displayed relative strength, gaining more than 4% over the last month compared to the S&P 500’s -0.9% decline. Rising oil prices have investors interested in the sector again, particularly following Saudi Arabia and Russia announcing an extension to their crude production cuts.

For those with a preference for income, there are several stocks within the sector currently paying investors handsomely, including Magellan Midstream Partners MMP, CVR Energy CVI, and Granite Ridge Resources GRNT.

For those that like payday, let’s take a closer look at each.

Magellan Midstream Partners

Magellan Midstream Partners owns and operates a diversified portfolio of energy infrastructure assets. The stock is a current Zacks Rank #2 (Buy), with earnings expectations creeping higher across several timeframes.

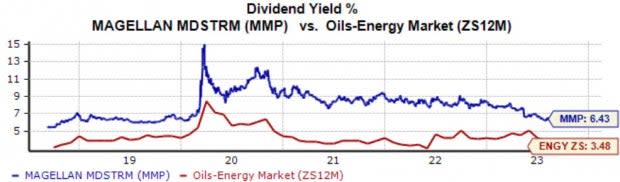

MMP shares currently yield a sizable 6.4% annually, nicely above the Zacks Oils and Energy sector average. Dividend growth is apparent, with the payout growing by 1.4% annualized over the last five years.

Image Source: Zacks Investment Research

Better-than-expected quarterly results have helped keep MMP shares on an upward trajectory, as we can see illustrated in the chart below. Just in its latest release, the company penciled in a 12% EPS beat and reported revenue nearly 10% ahead of expectations.

Image Source: Zacks Investment Research

In addition, Magellan is forecasted to witness solid growth in its current year, with the $5.10 Zacks Consensus EPS Estimate suggesting an improvement of 12% year-over-year on 7% higher revenues.

CVR Energy

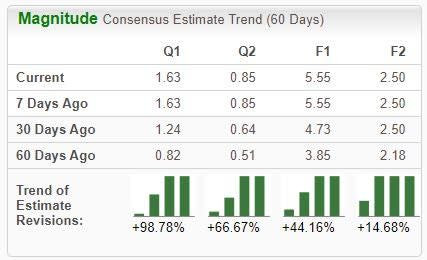

CVR Energy’s near-term earnings outlook has jumped higher across all timeframes over the last several months, landing the stock into the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

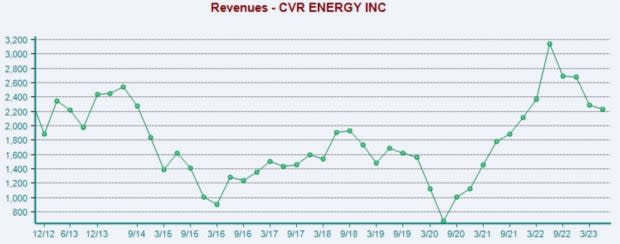

CVR Energy shares currently yield a solid 5.3% annually paired with a payout ratio sitting sustainably at 30% of the company’s earnings.

And like MMP, CVR Energy has consistently beat bottom line expectations, exceeding the Zacks Consensus EPS Estimate by an average of nearly 30% across its last four quarters. In its latest release, the company beat EPS expectations by 36% but fell short of revenue expectations.

Image Source: Zacks Investment Research

Granite Ridge Resources

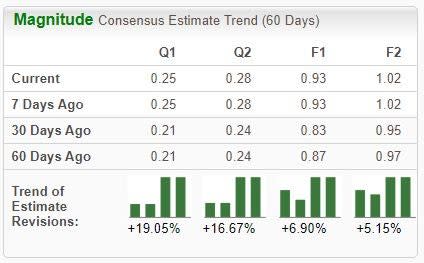

Granite Ridge, a current Zacks Rank #2 (Buy), is a scaled, non-operated oil and gas exploration and production company. The company’s earnings outlook has improved across the board, with shares currently yielding a solid 5.9% annually.

Image Source: Zacks Investment Research

GRNT shares have recently witnessed the ‘Golden Cross,’ as we can see illustrated below. The Golden Cross occurs when the shorter 50-day moving average rises above the 200-day moving average, indicating near-term momentum.

Image Source: Zacks Investment Research

Bottom Line

Energy stocks have displayed notable momentum over the last month, with rising oil prices providing a tailwind.

And for those interested in tapping into the momentum and reaping a passive income stream, all three stocks above – Magellan Midstream Partners MMP, CVR Energy CVI, and Granite Ridge Resources GRNT – could be considered.

All three pay their investors handsomely and sport favorable Zacks Ranks, with the latter indicating optimism among analysts.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Magellan Midstream Partners, L.P. (MMP) : Free Stock Analysis Report

CVR Energy Inc. (CVI) : Free Stock Analysis Report

Granite Ridge Resources, Inc. (GRNT) : Free Stock Analysis Report