3 Equity REIT Stocks to Gain Amid Healthy Industry Fundamentals

With the REIT and Equity Trust - Other industry offering the real estate structure for several economic activities, be it real or virtual, there are pockets of strength even in a challenging environment. Particularly, with the growth of the digital economy, commercial real estate like industrial and data centers, which support the industry, are likely to continue prospering in the foreseeable future. Also, the fundamentals of healthcare real estate remain resilient, while the resumption of travel is encouraging for Hotel REITs. Against this backdrop, Prologis PLD, EastGroup Properties EGP and Ryman Hospitality Properties RHP are likely to prosper.

Despite an improvement in the fundamentals of the real estate market from the onset of the pandemic, there are concerns stemming from high interest rates and any economic slowdown. These are affecting the leasing activity of several asset categories and hurting the industry’s overall prospects.

About the Industry

The Zacks REIT and Equity Trust - Other industry is a diversified group that covers REIT stocks from different asset categories like industrial, office, lodging, healthcare, self-storage, data centers, infrastructures and others. Equity REITs rent spaces in these properties to tenants and earn rental incomes. Economic growth plays a pivotal role in the real estate sector as economic expansion translates into greater demand for real estate, higher occupancy levels and landlords’ increased power to ask for higher rents. Also, the performance of Equity REITs depends on the underlying asset dynamics and the location of properties. Hence, delving into the fundamentals of these asset categories is essential before making any investment decision. It is important to figure out whether pandemic-induced behaviors result in only a short-term impact or long-term structural changes.

What's Shaping the Future of the REIT and Equity Trust - Other Industry?

Demand for Asset Categories Linked to Digital Economy to Remain Resilient: Industries such as industrial, infrastructure and data centers, which are crucial to the development of the digital economy, are expected to thrive in the foreseeable future. The demand for industrial real estate space will continue to be fueled by the expansion of e-commerce and advancements in supply-chain systems. Additionally, the strategic location of properties will be a key factor driving this demand. Enterprises' increasing reliance on technology and their swift adoption of digital transformation strategies are creating significant opportunities for data centers and infrastructure REITs. Especially during uncertain periods, data centers are likely to become more appealing to investors due to their resilient and predictable stream of earnings compared to other asset categories.

Certain Asset Categories to Remain Resilient, While Some Rebound: Healthcare REITs, which are poised to benefit from strong demographic demands amid the aging of the baby boomer generation, are experiencing an improvement in occupancy in senior housing assets. Moreover, the healthcare sector is expected to remain resilient, particularly during anticipated recessions. This is because these property types are characterized by non-cyclical demand. Moreover, the lodging and resort sector, which was hard-hit by the pandemic, is expected to continue rebounding with the waning of pandemic concerns and the easing of travel restrictions.

Economic Concerns and Office Sector Uncertainties: Rising debt costs, as well as high construction and operating expenses, are likely to lead to financial stress for REITs. Apart from high interest rates and constrained debt markets, softness in the job market, especially in a recessionary environment, could further strain the sector. Particularly, the office real estate market is facing significant challenges due to the rise of remote and flexible work arrangements. Many companies are re-evaluating their need for physical office space, leading to decreased demand and increased vacancy rates. Unless the economic outlook is clearer and more positive, any significant turnaround is likely to remain elusive.

Zacks Industry Rank Indicates Bright Prospects

The Zacks REIT and Equity Trust - Other industry is housed within the broader Finance sector. It carries a Zacks Industry Rank #121, which places it in the top 48% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates solid near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Before we present a few stocks that you might want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

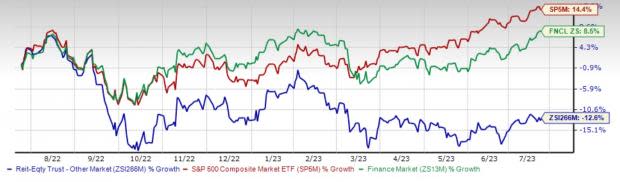

Industry Lags Stock Market Performance

The REIT and Equity Trust - Other Industry has underperformed both the S&P 500 composite as well as the broader Zacks Finance sector in a year.

The industry has declined 12.6% during this period against the S&P 500’s increase of 14.4%. Meanwhile, the broader Finance sector has risen 8.5%.

One-Year Price Performance

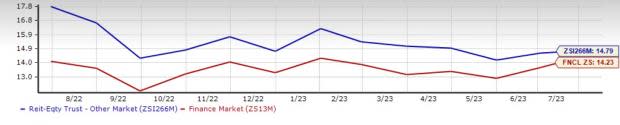

Industry's Current Valuation

On the basis of the forward 12-month price-to-FFO ratio, which is a commonly-used multiple for valuing REIT - Others, we see that the industry is currently trading at 14.79X compared with the S&P 500’s forward 12-month price-to-earnings (P/E) of 20.00X. However, the industry is trading above the Finance sector’s forward 12-month P/E of 14.23X. This is shown in the chart below.

Forward 12 Month Price-to-FFO (P/FFO) Ratio

Over the last five years, the industry has traded as high as 22.14X and as low as 14.18X, with a median of 17.79X.

3 Equity REIT - Other Stocks Worth Betting On

Ryman Hospitality Properties: Ryman Hospitality is a prominent REIT in the lodging and hospitality sector, with a primary focus on upscale convention center resorts and entertainment experiences.

The company is poised to benefit from the continuation of travel of its core group customers at more typical pre-pandemic levels. Also, its resorts remain popular leisure destinations. Moreover, during the quarter, it closed the acquisition of the JW Marriott San Antonio Hill Country Resort & Spa in San Antonio, TX, from Blackstone Real Estate Income Trust for $800 million.

RHP currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for Ryman Hospitality Properties’ 2023 funds from operations (FFO) per share has moved 2.2% north over the past week to $7.47. It calls for a 14.6% increase year over year. The stock has increased 3.7% over the past month. You can see the complete list of today’s Zacks #1 Rank stocks here.

Prologis: This is a leading industrial REIT that acquires, develops, operates and manages industrial properties in the United States and worldwide. The company continues to benefit from the scale of its platform.

The second-quarter 2023 results of this industrial REIT, which announced the acquisition of industrial properties from opportunistic real estate funds affiliated with Blackstone worth $3.1 billion in June, reflect healthy leasing activity and solid rent growth.

This industrial REIT behemoth’s performance in recent quarters reflects robust demand for its properties, an increase in rents and low vacancies. Along with the fast adoption of e-commerce, logistics real estate is anticipated to gain from a rise in inventory levels. Given Prologis’ capacity to offer high-quality facilities in key markets and robust balance-sheet strength, it is well-poised to bank on these trends.

Currently, PLD carries a Zacks Rank #2 (Buy). Over the past month, the Zacks Consensus Estimate for 2023 FFO per share has witnessed a marginal upward revision to $5.52, reflecting analysts’ bullish outlook. Prologis’ long-term growth rate is projected at 7.8%, ahead of the industry average of 6.6%. The stock has also rallied 5.4% over the past month.

EastGroup Properties: This REIT is engaged in the development, acquisition and operation of industrial properties and focuses on properties in major Sunbelt markets throughout the United States, emphasizing assets in Florida, Texas, Arizona, California and North Carolina.

With its strategy of ownership of high-quality distribution facilities clustered near major transportation features in supply-constrained submarkets, EGP is expected to benefit from the healthy fundamentals of the industrial real estate market.

EGP currently carries a Zacks Rank #2. The Zacks Consensus Estimate for EGP’s 2023 FFO per share has moved marginally north over the past month to $7.56, calling for an 8% increase year over year. The stock has also rallied 9.3% in the past month.

Note: Funds from operations (FFO) is a widely used metric to gauge the performance of REITs rather than net income as it indicates cash flow from their operations. FFO is obtained after adding depreciation and amortization to earnings and subtracting the gains on sales.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Prologis, Inc. (PLD) : Free Stock Analysis Report

EastGroup Properties, Inc. (EGP) : Free Stock Analysis Report

Ryman Hospitality Properties, Inc. (RHP) : Free Stock Analysis Report