3 Foreign Bank Stocks Worth a Look in a Prospering Industry

The Zacks Foreign Banks Industry is expected to continue benefiting from higher interest rates. Central banks across the globe will likely keep rates high in the near term. Thus, decent loan demand amid the high interest rate environment will likely support revenue growth for industry players like ICICI Bank Limited IBN, Itaú Unibanco Holding S.A. ITUB and Barclays PLC BCS.

While banks’ restructuring initiatives to focus on core operations are expected to be fruitful in the long run, these have resulted in higher costs. Uneven economic recovery in developed and emerging nations has been hurting revenue growth.

About the Industry

The Zacks Foreign Banks Industry consists of overseas banks with operations in the United States. Since a foreign banking organization may have federal and state-chartered offices in the country, the Federal Reserve plays a major role in supervising their U.S. operations. In addition to providing a broad range of products and services to customers in the United States, the banks offer financial services to corporate clients having businesses in the country. The financial firms establish relations with U.S. corporations operating in their home countries. Some units of foreign banks offer a broad range of wholesale and retail services, and conduct money-market transactions for their parent organizations. Some firms are involved in developing only specialized services.

3 Foreign Bank Industry Trends to Watch

Higher Interest Rates Likely to Aid Top-Line Growth: The efforts undertaken by the central banks across the globe to cushion economies from the pandemic-induced economic slowdown in 2020 (reducing benchmark interest rates to record lows) were successful in aiding immediate economic growth. However, it eroded banks’ profitability to a great extent. The pace of economic recovery, which is uneven in the developed (home to a number of major foreign banks) and emerging nations, hampered banking operations globally. Nevertheless, almost all central banks across the globe have raised interest rates since the beginning of 2022 to counter inflation, which has supported banks’ top-line growth. Banks are expected to continue to witness growth in net interest income and margins in the higher interest rate environment.

Restructuring Efforts to Keep Costs Elevated: Several foreign banks are undertaking business restructuring efforts. Many banks have been divesting/closing non-core operations to increase focus on core businesses and regions. While restructuring efforts are expected to boost growth in the long run, these have been leading to higher expenses. Increased costs related to technology upgrades are likely to keep hampering banks’ bottom-line growth to some extent in the near term.

Uneven Global Economic Recovery Poses a Concern: After the coronavirus outbreak, business confidence was shattered across the globe as the pandemic loomed over corporate earnings and economic growth. While the economy has recovered from the negative impacts of the pandemic in most parts of the world, growth has slowed in some regions because of certain other geopolitical concerns. Banks’ performance is directly linked to the performance of the overall economy. Thus, uneven economic growth may hurt banks’ finances to some extent in the near term.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Foreign Banks Industry is a 64-stock group within the broader Zacks Finance Sector. The industry currently carries a Zacks Industry Rank #62, which places it in the top 25% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates outperformance in the near term. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a solid earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gaining confidence in the group’s bottom-line growth potential. The industry’s most recent 2023 earnings estimates have been revised 10.5% upward since August 2022-end.

Thus, we present a few stocks from the prospering industry that you may keep an eye on. But before that, let’s check out the industry’s recent stock market performance and valuation picture.

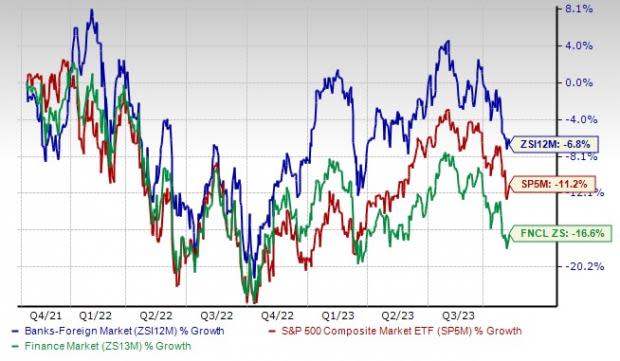

Industry Outperforms S&P 500 and the Finance Sector

The Zacks Foreign Banks Industry has outperformed the S&P 500 and its sector in the past two years.

Stocks in the industry have collectively gained 2.1%. The S&P 500 composite has lost 0.5% and the Zacks Finance Sector has depreciated 6.4%.

Two-Year Price Performance

Industry's Current Valuation

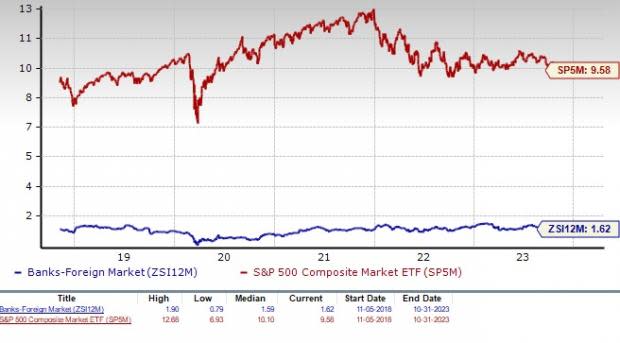

One might get a good sense of the industry’s relative valuation by looking at its price-to-tangible book ratio (P/TBV), which is commonly used for valuing banks because of large variations in their earnings results from one quarter to the next.

The industry currently has a trailing 12-month P/TBV of 1.69X. When compared with the highest level of 1.90X over the past five years, there is a slight upside left. Notably, the current value compares with the median value of 1.58X.

Additionally, the industry is trading at a significant discount when compared with the market at large, as the trailing 12-month P/TBV for the S&P 500 is 10.69X.

Price-to-Tangible Book Ratio (TTM)

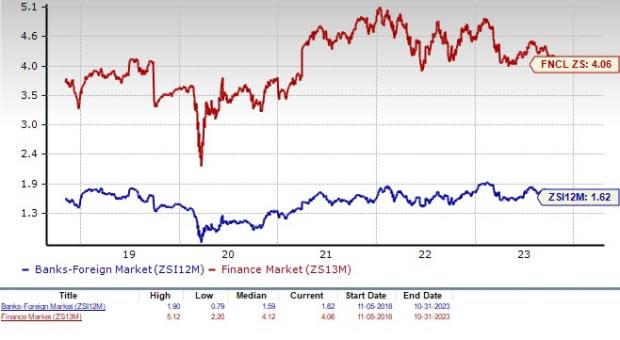

As finance stocks typically have a lower P/TBV ratio, comparing foreign banks with the S&P 500 might not make sense to many investors. However, a comparison of the group’s P/TBV ratio with that of its broader sector ensures that it is trading at a decent discount. The Zacks Finance Sector’s trailing 12-month P/TBV of 4.45X and the median level of 4.05X for the same period are above the Zacks Foreign Banks Industry’s ratios.

Price-to-Tangible Book Ratio (TTM)

3 Foreign Banks to Consider

ICICI Bank: Headquartered in Mumbai, India, this Zacks Rank #2 (Buy) company provides a wide range of banking products and financial services to corporate and retail customers.

ICICI Bank has made commendable progress in improving its digital banking services for retail and corporate clients. The bank has been striving to provide superior end-to-end seamless digital services, personalized solutions and value-added features to further enable data-driven cross-sell and up-sell opportunities.

Notably, the company’s digital platform for businesses — InstaBIZ — along with supply-chain platforms, has witnessed tremendous growth in the past few quarters. These efforts are leading to a rapid increase in end-to-end digital sanctions and disbursements across various products.

Moreover, IBN has been successfully leveraging its technological initiatives to augment the contribution of non-interest income toward its top line. In the first quarter of fiscal 2024 (ended Jun 30), almost 36% of the company’s mortgage loan sanctions and 31% of its personal loan disbursements by volume were end-to-end digital. Driven by these efforts, non-interest income continues to improve. Its efforts to digitize operations and a rise in mobile banking transactions will likely continue to help the company garner more fee income going forward.

Further, while ICICI Bank has wide international loan coverage, domestic loans represent a substantial part of its overall loans (97% as of Jun 30, 2023). As a result, the company is secure with respect to loans and is less likely to be affected by global concerns.

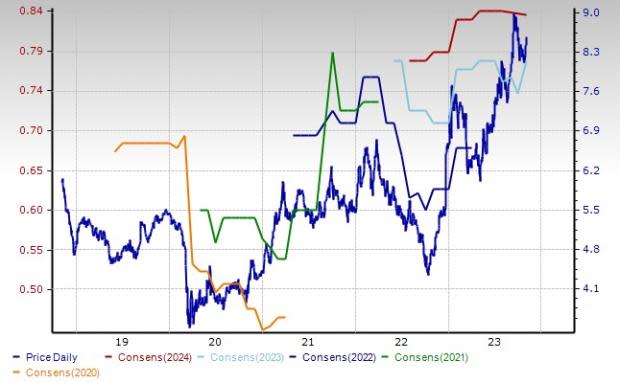

Shares of the company have gained 1.8% on the NYSE in the past three months. The Zacks Consensus Estimate for the company’s fiscal 2024 and 2025 earnings has moved up 9.2% and 5.8%, respectively, in the past 60 days.

Price and Consensus: IBN

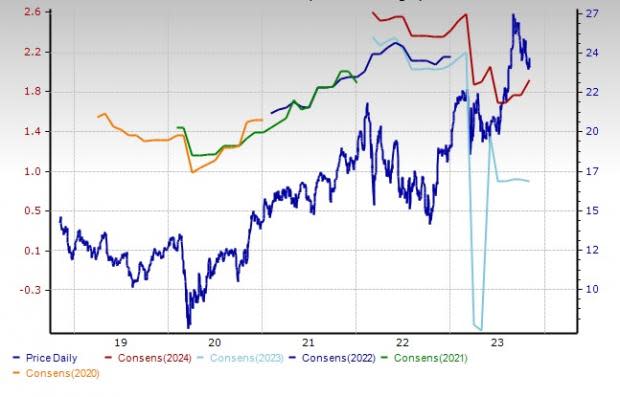

Itaú Unibanco: Headquartered in Sao Paulo, Brazil, the bank provides a vast array of credit and other financial services to a diverse customer base of individuals and companies in and outside Brazil via its international branches, subsidiaries and affiliates.

As a premier banking brand in Brazil, the company has a large branch network in geographic areas with high economic activities. Branches are concentrated in Southeast Brazil, the country’s wealthiest region. Moreover, as part of its internationalization strategy, the company has consolidated its presence in other countries of the Southern Cone — Argentina, Chile, Paraguay and Uruguay — with branches positioned in regions where activity levels are high.

ITUB also expanded its presence in Colombia and Panama, followed by the merger between Banco Itaú Chile and CorpBanca in April 2016. Itau Unibanco is focused on its strategy to expand operations. The company has completed various deals over the past few years. Inorganic growth efforts to diversify its product mix are expected to support its top line in the upcoming quarters.

ITUB’s ongoing investments in technology will likely contribute to improving processes, reducing costs and increasing productivity gains. The company initiated a transformational strategy, iVarejo 2030, at its retail operations unit. It adopted the omnichannel approach, as well as the e-Commerce model, to improve in-person services and revamp its branch networks. Through these efforts, it targets to increase digital sales in the long term.

The Zacks Consensus Estimate for the company’s 2023 earnings has been revised upward by 1.4% over the past 60 days. Earnings estimates for 2024 have been unchanged over the same period. Shares of ITUB have gained 3.5% on the NYSE in the past three months. The company currently carries a Zacks Rank #2.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: ITUB

Barclays: Headquartered in London, the major global banking and financial services company has £1,549.7 billion ($1,962.2 billion) in total assets as of Jun 30, 2023.

The company’s initiatives to improve efficiency over the past few years have been bearing fruit, as evident by a fall in expenses. While total operating expenses increased in 2022, the same declined, seeing a compound annual growth rate (CAGR) of 2.4% over the six-year period ended 2021. Overall costs are expected to be manageable as business restructuring initiatives continue to offer support. The company intends to undertake further cost-saving actions to improve efficiency. Over the medium term, the cost-to-income ratio is targeted to be below 60%.

Moreover, Barclays has been striving to simplify operations and focus on core businesses over the past few years. With this aim, the company restructured its business lines into two divisions and divested/closed several non-strategic and less profitable operations globally. Also, the bank completed the ring-fencing of its investment banking operations in April 2018, while reintegrated its non-core division to the company’s core operations in July 2017.

The company acquired Kensington Mortgage, which will bolster its mortgage business in the U.K. Driven by these initiatives, the company’s profitability is expected to improve over time.

The Zacks Consensus Estimate for the company’s 2023 earnings has increased 1.2% over the past 60 days. Earnings estimates for 2024 have been revised 1.1% upward for the same period. Shares of BCS have lost 2.1% on the NYSE in the past three months. The company currently carries a Zacks Rank #3 (Hold).

Price and Consensus: BCS

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Barclays PLC (BCS) : Free Stock Analysis Report

ICICI Bank Limited (IBN) : Free Stock Analysis Report

Itau Unibanco Holding S.A. (ITUB) : Free Stock Analysis Report