3 Gaming Stocks to Strengthen Your Portfolio in 2024

The gaming industry is experiencing an upside thanks to increased visitation and spending per visit, especially from younger demographics. Favorable developments in Macau's gaming revenues are playing a significant role in driving the sector forward. Also, strong demand for sports betting is contributing to the industry's positive trends.

An increase in hotel bookings and a growing fascination with non-gaming amenities suggest the possibility of a revival in growth. Casino operators are adopting a disciplined operational strategy by streamlining business processes, enhancing marketing approaches and renegotiating contracts with vendors and third parties. There is an intense emphasis on improving service quality and staffing levels to cater to gamers better.

Gaming Revenues Improving

In third-quarter 2023, the U.S. commercial gaming sector achieved strong revenues, generating $16.17 billion and rising 6.1% from the previous year’s levels. This marks the industry's most lucrative third quarter to date, with continuous annual revenue growth for the 11th consecutive quarter.

The industry is also benefiting from improving Macau visitation. In November, Macau’s gross gaming revenues (GGR) surged 435% year over year to MOP$16.04 billion (US$2 billion). For the first 11 months of 2023, GGR is up 324.9% year over year. Robust investment will continue to aid the gaming industry in Macau. In the next 10 years, six casino companies will invest nearly $15 billion.

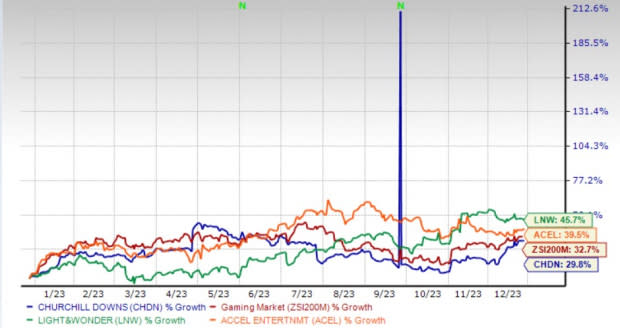

Investing in the gaming sector might sound profitable right now. It is worth noting that the Zacks Gaming industry is currently in the top 20% (with the rank of 51) of the 251 Zacks industries, which hints at further growth.

Image Source: Zacks Investment Research

3 Solid Picks

Light & Wonder, Inc. LNW: Headquartered in Las Vegas, NV, the company is benefiting from robust SciPlay and iGaming revenues. In the third quarter, the company achieved its 10th consecutive quarter of increased consolidated revenues and marked its fifth consecutive quarter of year-over-year growth in the double digits.

Shares of this presently Zacks Rank #2 (Buy) company have surged 45.7% in the past year. In the past 30 days, earnings estimates for 2024 have increased 69.5% to $1.78. You can see the complete list of today’s Zacks #1 Rank stocks here.

Accel Entertainment, Inc. ACEL: Headquartered in Burr Ridge, IL, the company is benefiting from an increase in locations and gaming terminals. In third-quarter 2023, the company’s locations and gaming terminals increased 5% and 7% year over year, respectively.

Shares of this presently Zacks Rank #2 player have increased 39.5% in the past year. Moreover, ACEL’s 2024 sales are anticipated to increase by 2.7% from the year-ago reported figures. In the past seven days, earnings estimates for 2024 have witnessed upward revisions of 10.8%.

Headquartered in Louisville, KY, Churchill Downs Incorporated CHDN operates as a racing, online wagering and gaming entertainment company in the United States. Shares of the Zacks Rank #2 company have gained 29.8%. The Zacks Consensus Estimate for Churchill Downs’ 2024 sales and earnings per share calls for a rise of 12.2% and 15.8%, respectively, from the year-ago period’s levels. The company is benefiting from robust sports and casino net revenues. CHDN is gaining from expansion efforts.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Churchill Downs, Incorporated (CHDN) : Free Stock Analysis Report

Accel Entertainment, Inc. (ACEL) : Free Stock Analysis Report

Light & Wonder, Inc. (LNW) : Free Stock Analysis Report