3 Gaming Stocks to Watch Out For in 2022 Defying Odds

The coronavirus pandemic has rattled the Gaming industry. Traffic has been a major concern for the gaming industry since the coronavirus pandemic hit last year. Despite occupancy improving sequentially every month, it is still below the pre-pandemic level. Resurgence in coronavirus cases in some parts of the world is affecting the industry.

In September, the Gaming industry’s road to recovery from the coronavirus-induced blues hit a roadblock. With reports of stricter Macau casino regulations and a fresh surge of coronavirus cases, the U.S. casino companies having operations in Macau are left facing a double whammy. The arrest of Alvin Chau, head of Macau’s biggest junket operator, Suncity, has impacted the industry as VIP gaming rooms made up nearly a third of Macau’s gaming revenues in 2019. He is accused of creating an illegal cross-border gambling network.

Per Fitch Ratings, Macau’s GGR in 2022 is expected to be more than 40 percent below 2019 levels. In 2023, revenues will recover to 10% below the 2019 tally. Notably, companies have been focusing on levels of services and staffing with selective amenities and enhanced safety and social-distancing protocols in the gaming floor to welcome gamers.

The Macau and Singapore recovery is slow and it is still not clear when the market will return to pre-pandemic levels. Macau’s recovery will depend on frictionless travel between Macau, Hong Kong and Mainland China.

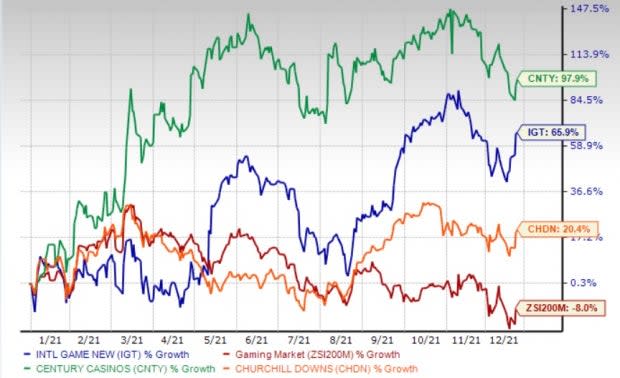

The Zacks Gaming industry is grouped within the broader Zacks Consumer Discretionary sector. It carries a Zacks Industry Rank #169, which places it in the bottom 33% of more than 253 Zacks industries. Year to date, the industry has declined 8% compared with the S&P 500 rally of 26.5%.

Is There Hope?

The gaming industry in the United States is recovering faster than anticipated. According to data from the American Gaming Association, revenues from gambling hit a record high of $13.89 billion in third-quarter 2021. In the first nine months of 2021, the nationwide commercial gaming revenues reached $38.67 billion. The industry has already surpassed the revenues it generated in 2020. It is likely to surpass the annual record of $43.65 billion set in 2019. Gambling was already flourishing in the United States till the pandemic hit early last year.

AGA president and CEO Bill Miller, stated, “Two straight quarters of record gaming revenue is an incredible accomplishment in any context, let alone after the most challenging year in industry history. Our recovery is not a flash in the pan, but rather a sustained result of our leadership in responsible reopening, world-class entertainment offerings and widespread favorability.”

The industry participants are focused on expanding their sports betting footprint. The legalization of sports betting across the United States has increased significantly from 2019, with online gambling now legal in more than two dozen states and Washington, D.C. Several states, including Arizona, Connecticut, Florida, Louisiana and New York, have approved legislation in some form but are yet to allow betting platforms to launch.

Stocks like International Game Technology PLC IGT, Century Casinos, Inc. CNTY and Churchill Downs Incorporated CHDN show promise, backed by their solid growth potential.

Stock Picks

The gaming space is likely to remain volatile in the near term owing to coronavirus woes and regulatory issues in Macau. Investors can still bet on some gaming stocks, which can counter the current market headwinds and come up with convincing bottom-line results. It might be an uphill task to pick the right stocks for greater investment rewards amid worries. This is where our Zacks Stock Screener comes in handy to help identify the best bets.

We shortlisted three stocks backed by a Zacks Rank #2 (Buy) and impressive price performance. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Headquartered in London, International Game Technology provides gaming technology products and services globally. Shares of the Zacks Rank #1 (Strong Buy) company have surged 65.9%. The Zacks Consensus Estimate for International Game Technology’s 2022 sales and earnings per share (EPS) suggests growth of 2.2% and 7.3%, respectively, from the year-ago period’s levels. IGT is benefiting from continued player demand in the global lottery, robust digital and betting and strong global gaming revenues.

Image Source: Zacks Investment Research

Based in Colorado Springs, CO, Century Casinos operates as a casino entertainment company worldwide. Shares of the Zacks Rank #2 (Buy) company have surged 97.9%. The company is benefiting from property reopenings. The Zacks Consensus Estimate for Century Casinos’ 2022 sales and EPS suggests an increase of 16.7% and 44.7%, respectively, from the year-ago period’s levels. The company is benefiting from property reopenings. CNTY also has a robust balance sheet, with no significant debt maturing before 2026.

Headquartered in Louisville, KY, Churchill Downs operates as a racing, online wagering and gaming entertainment company in the United States. Shares of the Zacks Rank #2 company have gained 20.4%. The Zacks Consensus Estimate for Churchill Downs’ 2022 sales and earnings per share calls for a rise of 15.1% and 39.9%, respectively, from the year-ago period’s levels. The company is benefiting from robust sports and casino net revenues. CHDN is gaining from expansion efforts.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Game Technology (IGT) : Free Stock Analysis Report

Century Casinos, Inc. (CNTY) : Free Stock Analysis Report

Churchill Downs, Incorporated (CHDN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research