3 Growth Stocks for the Long Term

Successful investors generally overweight growth stocks, and it's easy to see why: Growth stocks are shares of companies that are growing their sales and profits faster than the industry and the market at large, which eventually leads to solid capital appreciation and rich rewards for shareholders. More often than not, the longer you hold growth stocks, the higher your returns.

So we asked three Motley Fool contributors to recommend growth stocks for the long term. They offered some solid ideas from diverse industries: A.O. Smith (NYSE: AOS), Trex Company (NYSE: TREX), and Microsoft (NASDAQ: MSFT).

This surprising star performer should continue to outshine

Neha Chamaria (A.O. Smith): In a world where tech stocks rule the high-flyer list, would you believe that a water-heater manufacturer's shares have risen a whopping 800% in just the past ten years? A.O. Smith has been the dark horse of the industrials sector, and it's likely to continue growing rapidly. The reason: a massive addressable market in some of the fastest-growing economies.

After cornering the water-heater market in North America, A.O. Smith has now set its eyes on countries like China and India, where rising disposable incomes and expanding middle and upper classes are driving demand for consumer durables like purifiers and heaters. A.O. Smith's sales from China topped $1 billion last year, thanks to its more than 9,000 retail counters, and e-commerce that brought in almost a quarter of those sales.

Buying and holding growth stocks for the long term can prove richly rewarding. Image source: Getty Images.

These numbers show how aggressively A.O. Smith is growing. In its most recent quarter, the company handily beat estimates and upgraded its adjusted earnings-per-share (EPS) outlook for fiscal 2018, guiding for a solid 20% growth at the midpoint from last year. Between 2010 and 2017, A.O. Smith grew its adjusted EPS at a compound annual rate of 26%.

A.O. recently hit another milestone -- that of becoming a Dividend Aristocrat, having increased its dividends for 25 consecutive years. Yet the company still plows back a major chunk of its profits into the business for growth, which can also be credited for almost all of the stock's gains over the years. That makes A.O. Smith a growth stock in the traditional sense of the word, and an excellent choice for the long haul.

The undisputed leader in a fast-growing niche

Jason Hall (Trex): Recycled-decking manufacturer Trex Company has made recent investors a lot of money:

It's a rare investment that delivers over fourfold gains in a five-year period. Yet even with these remarkable returns Trex is worth buying right now, because its future remains very bright.

The company has a dominant position in the wood-alternative decking industry, commanding over 40% of North American sales, but regular wood still makes up more than 85% of the total volume of decking lumber sold each year. That goes to show just how big the market opportunity really is for Trex, despite so many years of huge growth already.

Furthermore, I expect the burgeoning population of millennial homebuyers could be a boon for the company, further accelerating future growth. Trex's value as a more environmentally friendly choice than virgin wood decking resonates with younger buyers. Add the significant reduction in maintenance and multiple decades of use before needing to replace it, and Trex is likely to appeal to an even higher portion of new homeowners in the years to come.

With a huge lead over its competitors, a solid long-term opportunity for growth, and a great management team in place, Trex makes the cut as a top growth stock to buy now and hold for the long term.

A large, growing software company

Ashraf Eassa (Microsoft): Software giant Microsoft, which you probably know as the maker of the popular Windows operating system and the ubiquitous Office productivity suite, is a large and extremely profitable company that pays a respectable dividend (as of this writing, Microsoft shares yield 1.58%). What might be more interesting, though, is that Microsoft has also delivered a substantial amount of revenue growth during its life as a publicly traded company:

MSFT Revenue (TTM) data by YCharts.

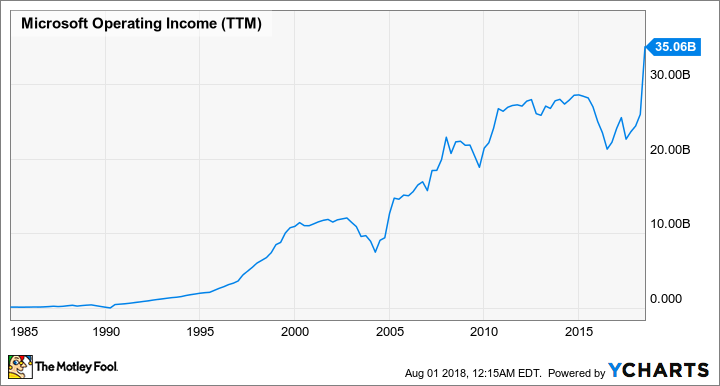

That growth continued during its most recent fiscal year, with the software giant raking in $110.4 billion in revenue -- a figure that was up 14% from the company's prior fiscal year. It also churned out $35.1 billion in operating income -- a 21% year-over-year boost. Not only is Microsoft showing that it can deliver respectable revenue growth, but it's translating that revenue growth into fat profits for its shareholders, something that it's historically proven it can do well:

MSFT Operating Income (TTM) data by YCharts.

Digging deeper into the company's fiscal-year 2018 results, we see that each of its three major reporting segments delivered double-digit year-over-year growth rates:

Metric | Productivity and Business Processes | Intelligent Cloud | More Personal Computing |

|---|---|---|---|

Total revenue | $9.668 billion | $9.606 billion | $10.811 billion |

Year-over-year revenue growth | 13% | 23% | 17% |

Data source: Microsoft fiscal fourth-quarter 2018 earnings release.

The fact that Microsoft's growth comes from a diverse set of businesses, rather than from a single superstrong business while the others languish, seems like a good thing.

Looking ahead, analysts expect Microsoft to enjoy 11.2% revenue growth during its fiscal year 2019 (the year that just started), then add another 10.3% revenue growth on top of that during its fiscal year 2020. The software giant's EPS is also expected to grow by 10.3% and 14.7%, respectively, during those years.

Microsoft has a solid track record of delivering both revenue and profit growth over a long period of time. So if you're looking for a growth stock that you can count on to be here today, tomorrow, and likely ten years from now, the software giant is worth a look.

More From The Motley Fool

Teresa Kersten is an employee of LinkedIn and is a member of The Motley Fool’s board of directors; LinkedIn is owned by Microsoft. Ashraf Eassa has no position in any of the stocks mentioned. Jason Hall owns shares of Trex. Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Trex. The Motley Fool has a disclosure policy.