3 Highly Ranked Energy Stocks to Buy as Earnings Approach

There are a number of top-rated stocks set to report their quarterly results on Thursday, November 2 with several belonging to the Zacks Oils & Energy sector.

To that point, energy stocks continue to stand out this earnings season with crude oil prices hovering over $80 a barrel during the third quarter. Here is a look at three of these stocks that currently covet a Zacks Rank #1 (Strong Buy) ahead of their Q3 reports.

Baytex Energy BTE

Rising earnings estimates are a strong reason to consider Baytex Energy’s stock which operates a conventional oil and gas income trust fund focused on maintaining its production and asset base through internal property development.

Third quarter earnings estimates have soared 13% in the last 60 days with fiscal 2023 and FY24 EPS estimates climbing 12% and 17% respectively. This makes the case that Baytex Energy’s stock is vastly undervalued trading at $4 a share and 5.9X forward earnings.

Image Source: Zacks Investment Research

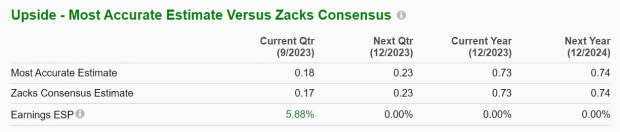

Plus, the Zacks ESP (Expected Surprise Prediction) indicates Baytex Energy could surpass earnings expectations with the Most Accurate Estimate having Q3 EPS at $0.18 per share and above the Zacks Consensus of $0.17 a share.

Image Source: Zacks Investment Research

Petroleo Brasileiro PBR

Brazil-based Petroleo Brasileiro is worthy of consideration ahead of its Q3 report as the nation's largest integrated energy firm.

While it will be hard to compete against a prior year quarter that saw EPS at $1.35 per share, Petroleo Brasileiro’s Q3 EPS is expected at $0.90 a share with PBR trading at $15 and just 3.8X forward earnings.

Furthermore, over the last 30 days, Q3 earnings estimates have climbed 23% with annual EPS estimates rising 8% for FY23 and 9% for FY24. Notably, the Zacks ESP indicates Petroleo Brasileiro should reach its Q3 earnings expectations with the Most Accurate Estimate also having Q3 EPS at $0.90 per share.

Image Source: Zacks Investment Research

PBF Energy PBF

As a leading refiner of crude oil PBF Energy is also expected to reach earnings expectations with the Most Accurate Estimate having Q3 EPS at $4.75 per share and on par with the Zacks Consensus.

Although this would be a drop from very stellar EPS of $7.96 per share in Q3 2022 PBF’s stock trades at $48 and a 4.1X forward earnings multiple. More importantly, over the last two months, Q3 earnings estimates have now skyrocketed 46% with FY23 and FY24 EPS estimates still up 14% and 19% respectively.

Image Source: Zacks Investment Research

Bottom Line

Investors searching for value will certainly want to consider these highly ranked Zacks Oils & Energy sector stocks as the trend of earnings estimate revisions remains compelling ahead of their Q3 reports. This largely supports the notion that Baytex Energy, Petroleo Brasileiro, and PBF Energy’s stock are undervalued considering their very attractive P/E valuations making now an ideal time to buy.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Petroleo Brasileiro S.A.- Petrobras (PBR) : Free Stock Analysis Report

PBF Energy Inc. (PBF) : Free Stock Analysis Report

Baytex Energy Corp (BTE) : Free Stock Analysis Report