3 HMO Stocks in Focus Despite High Tech Costs & Nursing Shortage

The U.S. health insurance industry, referred to as Health Maintenance Organization (“HMO”), is expected to gain from a growing customer base that fetches higher premiums. Contract wins from federal or state authorities, and the pursuit of mergers and acquisitions are added tailwinds. An aging U.S. population is likely to sustain the solid demand for health insurers’ Medicare plans. Though technology investments are means to expand digital capabilities, they may often lead to elevated costs for industry participants. The shortage of nurses continues to grapple the players. Despite the challenges, companies like The Cigna Group CI, Centene Corporation CNC and Molina Healthcare, Inc. MOH are better placed to counter the industry downsides.

About the Industry

The Zacks HMO industry consists of entities (either private or public) that take care of subscribers’ basic and supplemental health services. Companies in this space primarily assume risks and assign premiums to health and medical insurance policies. Industry participants also provide administrative and managed-care services for self-funded insurance. Services are generally provided by a network of approved care providers (called in-network), which include primary care physicians, clinical facilities, hospitals and specialists. However, out-of-network exceptions are made during emergencies or when it is medically necessary. Health insurance plans can be availed through private purchases, social insurance or social welfare programs.

4 Trends Defining the HMO Industry's Future

Technology Advancements: Owing to the ongoing digitization across every sphere of life, individuals often prefer to receive healthcare services from the comfort of their homes. The solid demand for remote delivery of healthcare services is expected to sustain in the days ahead. As a result, players in the HMO space make significant technology investments to stay abreast with the digital trend. Per Research and Markets, the global Telehealth and Telemedicine market is anticipated to witness a 23.2% CAGR over 2023-2028. This further substantiates the continual need for health insurers to pursue investments and upgrade digital capabilities, which, in turn, diversify revenue streams. However, bringing its share of worries, these investments might escalate costs and dampen one’s margins.

Staffing Shortage: The U.S. healthcare industry has been suffering from a scarcity of nurses and other medical personnel. An aging U.S. population, a lack of potential educators, high burnout rates and inequitable workforce distribution can be identified as some of the reasons behind the shortage. Health insurers collaborate with hospitals, physicians and other facilities to arrange for discounted care access for plan members. This service is lucrative for individuals to opt for a particular health insurer’s plan. Thereby, an insufficient nursing workforce can dampen a hospital’s ability to deliver quality care services to the plan members. This, in turn, can indirectly impact the customer base of health insurers. The resumption of elective procedures in the recent quarters, as COVID constraints are subsiding, also requires the availability of nurses in adequate numbers.

Expanding Customer Base: Affordable health plans devised by health insurers bring growth to the most vital component of a health insurer’s top line — premiums. The industry players often integrate attractive features within these plans in order to welcome more members, and catch the eye of federal or several state authorities from time to time. As a result, they may win contracts or renew existing ones from these authorities, which may serve as other means to boost membership growth. An aging U.S. population sounds well for health insurers, as it can sustain the demand for health insurers’ Medicare plans (meant for 65 years and above). However, continued inflationary challenges can affect the spending habits of consumers and their uninterrupted ability to make healthcare premium payments.

Pursuit of Merger & Acquisition (M&A) Strategies: Apart from pursuing technology investments, M&A strategies often become means for the industry participants in devising a digital solutions suite. The strategy also gives an opportunity to foray into new markets, expand its foothold in existing ones, increase its customer base and bring diversification benefits. With the Fed signaling rate cuts in 2024, borrowing costs are likely to decrease, which will make it easier for health insurers to opt for loans to enter M&A deals and continually upgrade their portfolios. Per Morgan Stanley Investment Banking, after witnessing a muted year in 2023, M&A activities are likely to set for a rebound in 2024.

Zacks Industry Rank Indicates Bearish Outlook

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all member stocks, indicates tepid near-term prospects. The Zacks Medical-HMOs industry is housed within the broader Zacks Medical sector. It currently carries a Zacks Industry Rank #222, which places it in the bottom 11% of more than 250 Zacks industries.

Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1. The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of the negative earnings outlook for the constituent companies in aggregate.

Despite the dismal scenario, we will present a few stocks that one can buy or retain, given their solid growth endeavors. But before that, it is worth looking at the industry’s recent stock-market performance and the valuation picture.

Industry Underperforms S&P 500 But Outperforms Sector

The Zacks Medical-HMO industry has gained 4.2% compared with the Zacks S&P 500 composite’s 22.1% growth but outperformed the Zacks Medical sector’s rally of 4% in the past year.

One-Year Price Performance

Image Source: Zacks Investment Research

Industry's Current Valuation

On the basis of the forward 12-month price-to-earnings (P/E) ratio, which is commonly used for valuing medical stocks, the industry trades at 16.45X compared with the S&P 500’s 20.89X and the sector’s 23.28X.

Over the past five years, the industry has traded as high as 19.57X and as low as 11.79X, the median being 16.06X, as the chart below shows.

Forward 12-Month Price/Earnings (P/E) Ratio

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

3 Stocks to Watch

We present three stocks from the space with a Zacks Rank #2 (Buy) or #3 (Hold). Considering the current industry scenario, it might be prudent for investors to buy or retain these stocks in their portfolios, as these are well-placed to generate growth in the long haul.

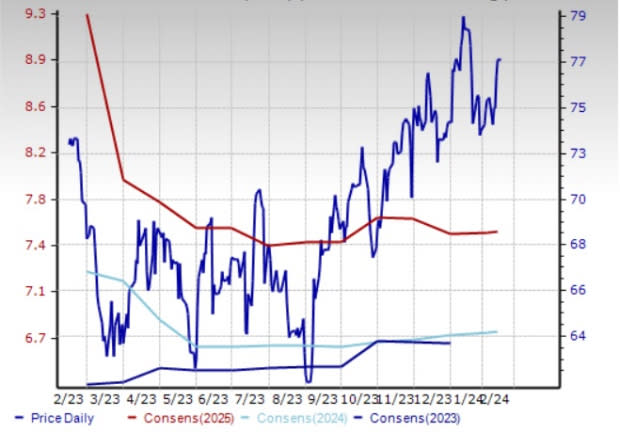

Centene: The Missouri-based company witnessed an uptick in revenues on strength in the Medicare and Medicaid businesses. A well-diversified healthcare suite and solid nationwide presence have fetched numerous contract wins and deal renewals for CNC. This Zacks Rank #2 health insurer follows an inorganic growth route, which, in turn, bolsters its capabilities and provides an opportunity to boost top-line growth.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Centene’s 2024 earnings is pegged at $6.75 per share, indicating a 1.1% rise from the year-ago reported figure. CNC’s earnings surpassed estimates in three of the last four quarters and missed the mark once, the average beat being 7.07%.

Price & Consensus: CNC

Image Source: Zacks Investment Research

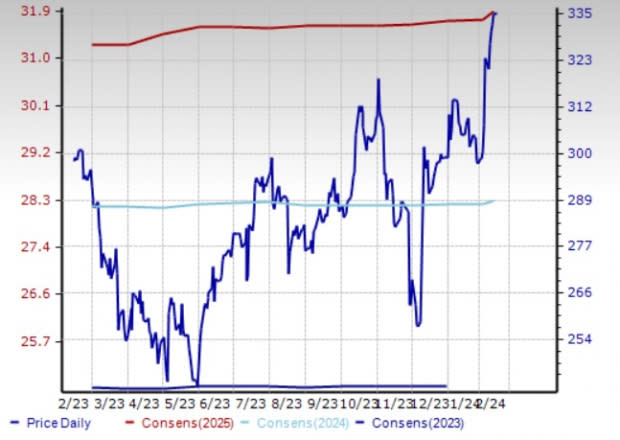

Cigna: This Connecticut-based health insurer has been gaining from solid performances of the Evernorth and Cigna Healthcare segments. The Cigna Healthcare unit is aided by growing premiums resulting from an extensive customer base. Management expects to achieve average annual adjusted EPS growth of 10-13% in the long term. This Zacks Rank #3 company also benefits from continuous product expansions.

The Zacks Consensus Estimate for Cigna’s 2024 earnings is pegged at $28.32 per share, suggesting 12.9% growth from the prior-year reported figure. CI’s earnings surpassed estimates in each of the last four quarters, the average being 2.94%.

Price & Consensus: CI

Image Source: Zacks Investment Research

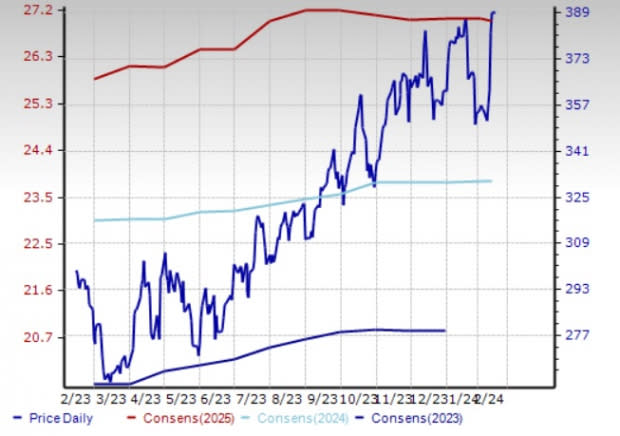

Molina Healthcare: This California-based health insurer devises affordable Medicare and Medicare plans infused with widespread benefits that have often endowed contract wins. Management is optimistic to achieve long-term premium revenue growth of 13-15%. A series of acquisitions made over the years have expanded the business portfolio of the Zacks Rank #3 health insurer.

The Zacks Consensus Estimate for Molina Healthcare’s 2024 earnings is pegged at $23.80 per share, indicating a 14% rise from the year-ago reported figure. MOH’s earnings beat estimates in each of the last four quarters, the average being 7.62%.

Price & Consensus: MOH

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cigna Group (CI) : Free Stock Analysis Report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report