3 Hotels & Motels Stocks to Buy From a Promising Industry

The Zacks Hotels and Motels industry benefits from increasing demand, RevPAR and ADR. The industry participants focus on expansion efforts, hotel conversions, strategic partnerships and loyalty programs. The industry has exhibited resilience behind cost-saving initiatives and digital enhancements. Hotel owners continue to focus on maintaining a balance between maximizing hotel profitability and driving guest satisfaction. The industry players, namely Hilton Worldwide Holdings Inc. HLT, InterContinental Hotels Group PLC IHG and Choice Hotels International, Inc. CHH, have been gaining from the prevailing scenario.

Industry Description

The Zacks Hotels and Motels industry comprises companies that own, lease, manage, develop and franchise hotels. Some vacation ownership and exchange firms are also a part of the industry. Several industry participants own, construct and operate resorts. Some companies develop lodges, villages and mobile accommodations, including modular, skid-mounted ones, and central amenities that provide long-term and temporary workforce accommodations. Some industry players develop, market, sell and manage vacation ownership and associated products. Few hoteliers also offer studios, one-bedroom suites and accommodations to mid-market business and personal travelers.

3 Trends Shaping the Future of the Hotels & Motels Industry

Strong RevPAR & ADR Driving Growth: The industry benefits from robust ADR and RevPAR. Per STR, ADR and RevPAR for the week ended Oct 7 came in at $163.19 and $110.68, up 5.4% and 5.2%, respectively, compared with the same period’s levels in 2022. The uptrend was driven by a solid leisure demand in the United States. Hotel demands in 2023 are likely to be driven by leisure travelers from Europe and Asia-Pacific.

Digitalization to Drive Growth: Hotel owners are focused on maintaining the balance between maximizing hotel profitability and driving guest satisfaction. To this end, hoteliers have leveraged mobile and web check-in and mobile key technologies. These hoteliers have also increased the use of these digital tools to strengthen infrastructure, grow online package sales, enable self-service bookings, make real-time offerings and enhance the overall customer experience. This and an emphasis on pricing optimization and merchandising capabilities will likely help hoteliers capture additional market share.

High Costs & Inflation Remain a Woe: Higher costs remain a concern for the industry participants. Rising salaries, wages and benefits have been adding to labor costs. High inflation is likely to curb consumer spending, which will hurt the industry.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Hotels and Motels industry is grouped within the broader sector.

The group's Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. The Zacks Hotels and Motels industry currently carries a Zacks Industry Rank #77, which places it in the top 31% of the 251 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry's position in the top 50% of the Zacks-ranked industries results from a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, analysts are gradually gaining confidence in this group's earnings growth potential. Since Mar 31, 2023, the industry's earnings estimates for 2023 have increased 11.3%.

Before we present a few stocks you may want to keep an eye on, let's look at the industry's recent stock-market performance and valuation picture.

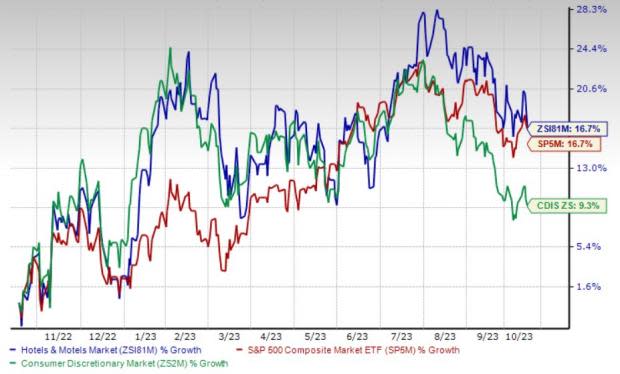

Industry Outperforms the Sector

In the past year, the Zacks Hotels and Motels industry has outperformed its sector. Over this period, the industry increased by 16.7% compared with the sector's increase of 9.3%. Meanwhile, the Zacks S&P 500 composite has also increased 16.7%.

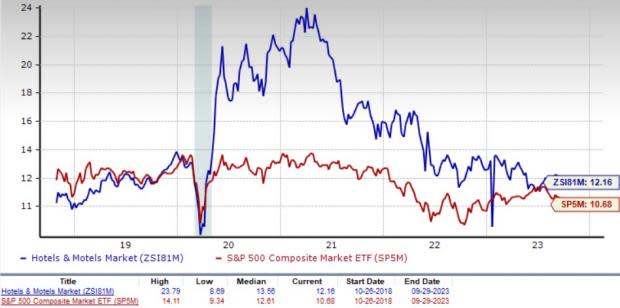

Hotels & Motels Industry's Valuation

On the basis of the forward 12-month EV/EBITDA, which is a commonly used multiple for valuing Hotels and Motels stocks, the industry is currently trading at 12.16X compared with the S&P 500's 10.68X. It is also below the sector's trailing 12-month EV/EBITDA ratio of 8.69X.

Over the last five years, the industry has traded as high as 23.79X and as low as 8.69X, with the median being at 13.56X, as the chart below shows.

3 Hotels & Motels Stocks to Watch Out For

Hilton: The is benefiting from its focus on unit expansion, hotel conversions, strategic partnerships and loyalty programs. The company expects positive development trends to continue on the back of new development and conversion opportunities. For third-quarter 2023, management anticipates system-wide RevPAR to increase in the 4-6% band on a year-over-year basis. You can see the complete list of today’s Zacks #1 Rank stocks here.

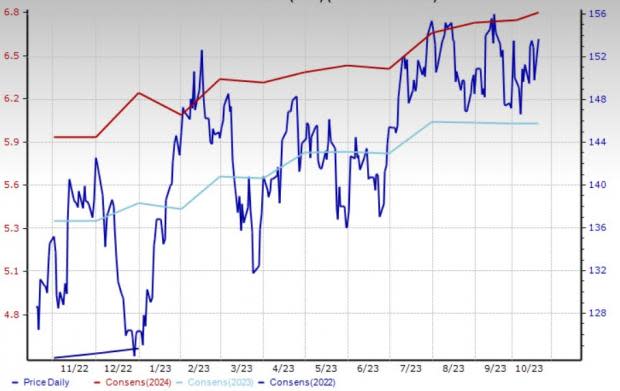

HLT currently carries a Zacks Rank #2. The Zacks Consensus Estimate for Hilton 2023 earnings per share and sales suggests growth of 23.7% and 14.8%, respectively, from the year-ago period. HLT's shares have gained 19.8% in the past year.

Price and Consensus: HLT

InterContinental Hotels Group: InterContinental Hotels has been gaining from robust leisure travel demand and improvement in RevPAR. Robust group bookings and international trips continue to drive the company’s performance.

InterContinental Hotels Group currently carries a Zacks Rank #2. In the past 30 days, the Zacks Consensus Estimate for 2023 earnings has been revised upward by 1.4%. The Zacks Consensus Estimate for InterContinental Hotels 2023 earnings per share and sales suggests growth of 31.6% and 59%, respectively, from the year-ago period’s figures. IHG's shares have inched up 0.4% in the past year.

Price and Consensus: IHG

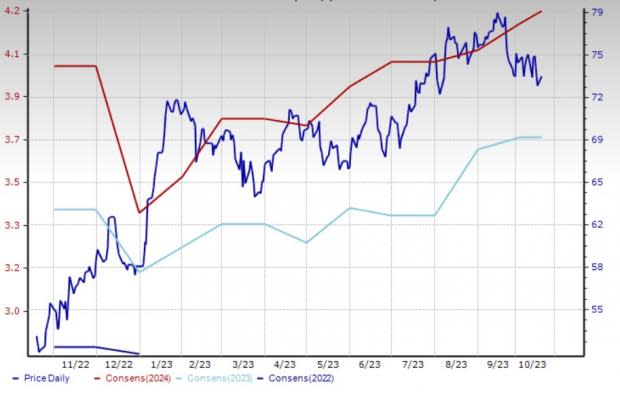

Choice Hotels International: The company is benefiting from synergies through the Radisson Hotels Americas integration and momentum in the conversion projects pipeline. Also, its focus on continual expansion strategies through acquisitions and franchise agreements bodes well.

CHH currently carries a Zacks Rank #2. The Zacks Consensus Estimate for Choice Hotels 2023 earnings per share and sales suggests growth of 13.7% and 10.7%, respectively, from the year-ago period’s levels. PLYA's shares have gained 20.3% in the past year.

Price and Consensus: CHH

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

Intercontinental Hotels Group (IHG) : Free Stock Analysis Report

Choice Hotels International, Inc. (CHH) : Free Stock Analysis Report