3 Industrial Manufacturing Stocks to Overcome Demand Softness

The Zacks Manufacturing – General Industrial industry is poised to benefit from the gradual easing of supply chain disruptions. Strategic acquisitions and investments in product development and innovation are expected to foster growth of the industry participants. However, amid successive interest rate hikes, the slowdown in manufacturing activities and a decline in industrial demand make the industry’s near-term prospects appear dull.

Nevertheless, lessening supply chain issues and easier availability of materials are expected to benefit IDEX Corporation IEX, Applied Industrial Technologies AIT and Manitex International MNTX.

About the Industry

The Zacks Manufacturing – General Industrial industry comprises companies engaged in the production of a wide range of industrial equipment. Some industry players offer power transmission products, bearings, engineered fluid power components and systems, industrial rubber products, vapor-abrasive blasting equipment, vehicle-powered truck refrigeration systems, adhesive, gel coat equipment, flow-control components and linear motion components. In addition, industrial manufacturing companies reconstruct and assemble pumps, valves, speed reducers and hydraulic motors. The companies provide services to original equipment manufacturing, and maintenance, repair and overhaul customers. These end users belong to the mining, oil and gas, forest products, agriculture and food processing, fabricated metals, chemicals and petrochemicals, transportation, and utilities industries.

3 Trends Shaping the Future of the Manufacturing General Industrial Industry

Low Demand Environment: The Federal Reserve’s aggressive monetary policy tightening is weighing on industrial demand, as evident from the Institute for Supply Management’s (ISM) latest report on manufacturing activity in the United States. In November, the Manufacturing PMI (Purchasing Manager’s Index) touched 49%, 1.2 percentage points lower than the figure recorded in October. A figure less than 50% indicates a contraction in manufacturing activity. The index declined with a decrease in new orders and a drop in Imports Index. Amid growing economic uncertainties and fears of a recession, the industry is likely to experience lower customer demand and softer volumes in the near term.

Ease in Supply Chain Disruptions: Supply chain disruptions, primarily related to electronic components and semiconductor shortages, are weighing on industry participants’ operations. Lately, the situation has eased and its impact on output has lessened, as evident from the ISM report’s Supplier Deliveries Index reflecting faster deliveries. This bodes well for the industry’s near-term prospects.

Acquisition-Based Growth Strategy: The industry participants focus on an acquisition-based growth strategy to expand network and product offerings. This helps them foray into new markets and solidify their competitive position. Exposure to various end-markets helps industrial manufacturing companies offset risks associated with a single market. Continuous investments in product development and innovation, automation and technological advancements augur well for the industry’s growth.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Manufacturing – General Industrial industry housed within the broader Zacks Industrial Products sector currently carries a Zacks Industry Rank #150. This rank places it in the bottom 40% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates dull near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of negative earnings outlook for the constituent companies in aggregate.

Despite the industry’s drab near-term prospects, we will present a few stocks, worth considering for your portfolio. But before that, it’s worth taking a look at the industry’s stock market performance and current valuation.

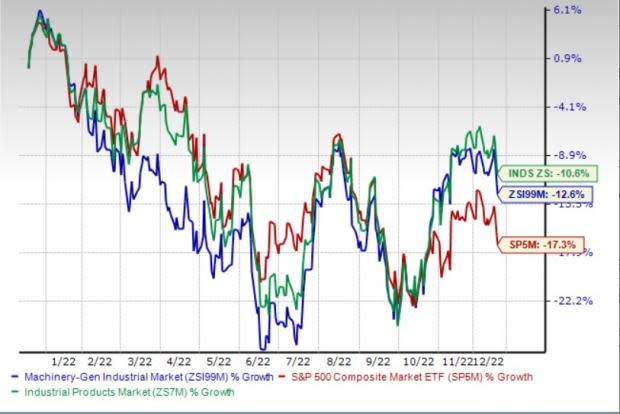

Industry Lags Sector but Outperforms S&P 500

While the Zacks Manufacturing – General Industrial industry has underperformed the broader sector in the past year, it outperformed the Zacks S&P 500 composite index.

Over this period, the industry has declined 12.6% compared with the sector and the S&P 500 Index’s decline of 10.6% and 17.3%, respectively.

One-Year Price Performance

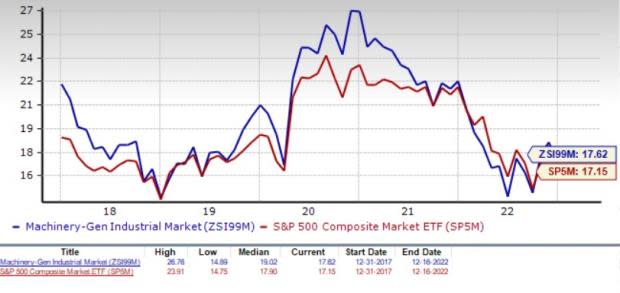

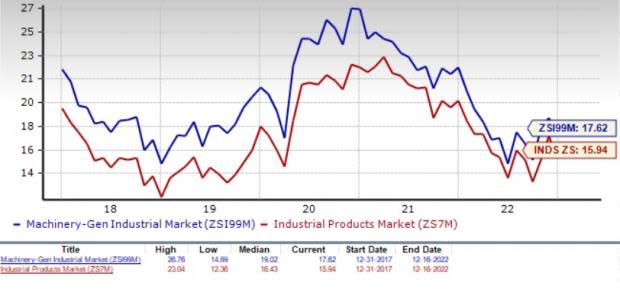

Industry's Current Valuation

On the basis of forward 12-month Price-to-Earnings (P/E), which is a commonly used multiple for valuing manufacturing stocks, the industry is currently trading at 17.62X compared with the S&P 500’s 17.15X. It is also above the sector’s P/E ratio of 15.94X.

Over the past five years, the industry has traded as high as 26.76X, as low as 14.89X and at the median of 19.02X as the chart below shows.

Price-to-Earnings Ratio

Price-to-Earnings Ratio

3 Manufacturing-General Industrial Stocks Leading the Pack

Here we have discussed three stocks from the industry that have solid growth opportunities despite the prevalent headwinds.

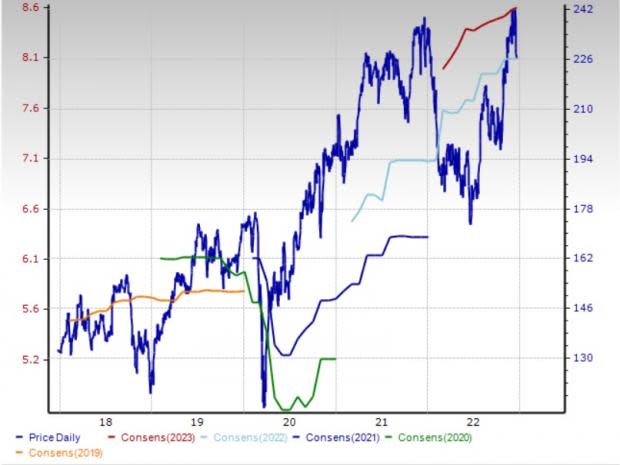

Applied Industrial: The company is poised to benefit from strength across the food & beverage, mining, metals, agriculture, chemicals and technology end-markets. Investments in expanding automation, industrial internet of things (IIot), digital offerings and customer development initiatives are key catalysts to Applied Industrial’s growth. The company sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Applied Industrial distributes value-added industrial products — including engineered fluid power components, bearings, specialty flow control solutions, power transmission products and miscellaneous industrial supplies. The Zacks Consensus Estimate for AIT’s fiscal 2023 earnings has been revised upward by 4.6% in the past 60 days. Shares of the company have rallied 23.3% in the past six months.

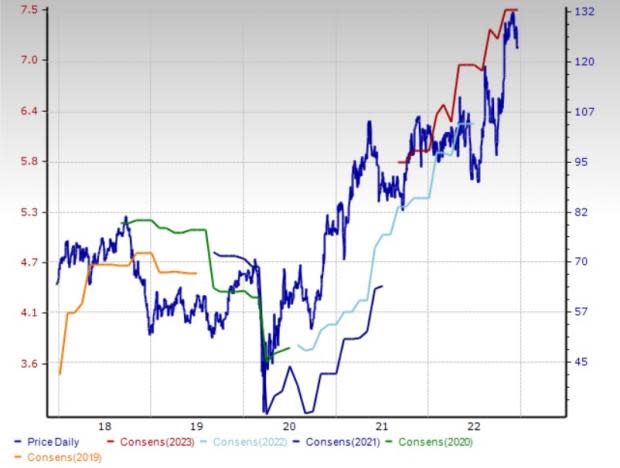

Price and Consensus: AIT

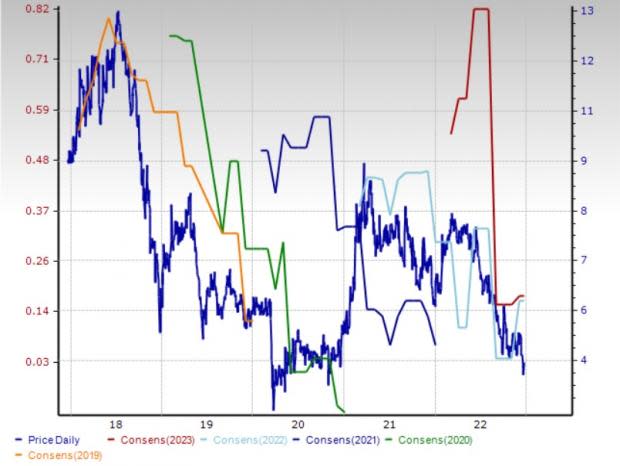

Manitex: Manitex’s focus on improving margins through increased efficiency and operational initiatives is encouraging. The Rabern Rentals acquisition (completed in second-quarter 2022) is contributing significantly to MNTX’s top line as well as margins. The company flaunts a Zacks Rank #1.

Manitex provides mobile truck cranes, industrial lifting solutions, aerial work platforms, construction equipment and rental solutions for general construction, crane companies, and heavy industry. The Zacks Consensus Estimate for the company’s 2022 and 2023 earnings has been revised upward by more than 300% and 12.5% in the past 60 days, respectively. Shares of MNTX have declined 38.2% in the past six months.

Price and Consensus: MNTX

IDEX: Strength across the energy, mining, infrastructure markets, semiconductor and life sciences markets bode well for IDEX’s growth. The Muon Group acquisition, expanding the Health & Science Technologies segment’s operations, is expected to bolster the company’s top line. The stock carries a Zacks Rank #2 (Buy).

Headquartered in Lake Forest, IL, IDEX is an applied solutions company specializing in a diverse range of applications such as fluid and metering technologies; health and science technologies; and fire, safety and other products built to customer specifications. The Zacks Consensus Estimate for the company’s 2022 and 2023 earnings has been revised upward by 1.8% and 1.5% in the past 60 days, respectively. Shares of IEX have appreciated 28.4% in the past six months.

Price and Consensus: IEX

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

IDEX Corporation (IEX) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Manitex International, Inc. (MNTX) : Free Stock Analysis Report