3 Industrial Products Stocks to Buy for Value at Year's End

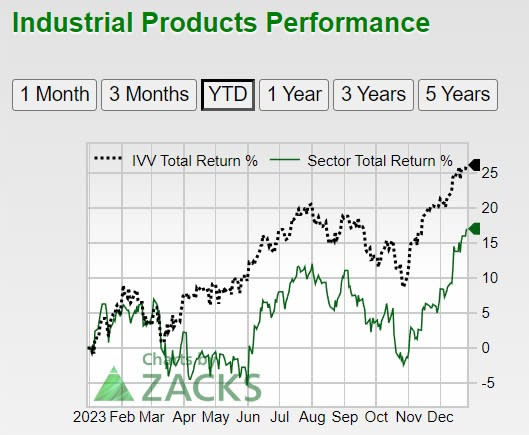

Mirroring the S&P 500, The Zacks Industrial Products sector has rebounded and risen sharply again since November and now has total gains of +17% in 2023 when including dividends.

The end-of-the-year rally among these equities may have legs as several top-rated Zacks stocks are standing out in terms of value at the moment and hail from the industrial products sector.

Here is a look at three of these industrial product companies that are making the case for being viable value stocks going into 2024.

Image Source: Zacks Investment Research

Amcor (AMCR)

Outside of its attractive stock price of under $10 a share, Amcor is starting to offer nice value to investors as a global leader in developing and producing packaging for food, beverage, medical, and personal care products among others.

At current levels, Amcor trades roughly on par with the Zacks Containers-Paper and Packaging industry average of 13.8X forward earnings with EPS forecasted to dip -5% in its current fiscal 2024 but rebound and rise 6% in FY25 to $0.73 per share. Plus, total sales are forecasted to be down -1% in FY24 but rebound and rise 3% in FY25 to $14.91 billion.

Image Source: Zacks Investment Research

Amcor’s price-to-sales (P/S) ratio of 0.97X is also on par with its industry average and nicely beneath the optimum level of less than 2X while being comfortably below the S&P 500’s 3.9X. In terms of price-to-cash flow, Amcor’s P/CF of 10X is attractively under the preferred value of less than 20X with it being noteworthy that the company still had over $600 million in cash and equivalents at the end of its most recent fiscal first quarter. This is more reassuring considering Amcor currentlly has a 5.17% annual dividend yield that is very enticing to investors.

Image Source: Zacks Investment Research

Crawford United Corporation CRAWA

As a diverse manufacturer of products for various markets, Crawford United Corporation’s stock stands out in terms of value and growth at the moment.

Crawford primarily serves healthcare, education, automotive, aerospace, trucking, and petrochemical industries. Most compelling is that Crawford’s stock trades at a 9.5X forward earnings multiple with EPS now forecasted to climb 77% in FY23 to $3.35 per share versus $1.89 a share last year.

After what has been a very stellar year, FY24 EPS is expected to dip to $2.58 per share but this would still be a 46% increase over the last five years with earnings at $1.76 a share in 2020. Furthermore, Crawford’s stock trades at a steep discount to the Zacks Manufacturing-General Industrial industry average of 23.5X forward earnings and the S&P 500’s 22.4X.

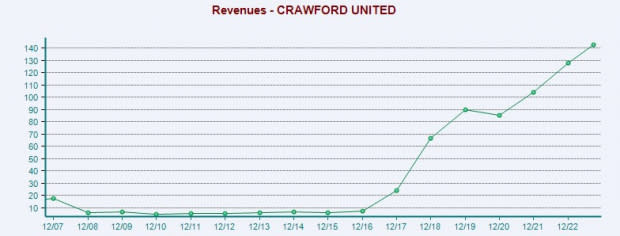

Image Source: Zacks Investment Research

Crawford’s total sales are projected to jump 13% this year and rise another 6% in FY24 to $154 million. Even better, FY24 sales projections would represent 81% growth over the last five years with sales at $85 million in 2020. Plus, Crawford’s price-to-sales ratio of 0.79X is noticeably below the S&P 500’s 3.9X and its industry average of 1.5X.

Image Source: Zacks Investment Research

H&E Equipment Services HEES

Last but not least, H&E Equipment Services stock is appealing among the industrial products sector as well. Focused on providing heavy construction and industrial equipment, H&E is one of the largest integrated equipment services companies in the United States.

H&E’s stock certainly stands out in terms of value and growth trading at a very reasonable 11.9X forward earnings multiple with EPS anticipated to leap 21% in FY23 and jump another 8% in FY24 to $4.87 per share. Total sales are projected to climb 17% this year and rise another 8% in FY24 to $1.59 billion with H&E having an attractive P/S ratio of 1.3X. The cherry on top is that H&E also provides a generous 2.05% annual dividend yield at the moment.

Image Source: Zacks Investment Research

Bottom Line

The industrial products sector has been a strong contributor to the end-of-the-year rally among the broader market and these stocks could have more room to run. To that point, Amcor, Crawford United Corporation, and H&E Equipment Services stock all sport a Zacks Rank #2 (Buy) right now and have an “A” Zacks Style Scores grade for Value.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

H&E Equipment Services, Inc. (HEES) : Free Stock Analysis Report

Crawford United Corporation (CRAWA) : Free Stock Analysis Report

Amcor PLC (AMCR) : Free Stock Analysis Report