3 Insurance Stocks to Buy as Powell Hints at More Rate Hikes

The Federal Reserve Chair Jerome Powell’s latest hawkish testimony to Congress, along with the central bank officials’ indications of further interest rate hikes in the months ahead, imply that insurers surely stand to benefit.

After all, the relationship between insurance companies and interest rates is straightforward, meaning greater growth for insurers when rates are higher. This calls for investing in solid insurance companies such as Unum Group UNM, MGIC Investment MTG and Radian Group RDN for sturdy returns.

Powell’s Hawkish Remarks

Jerome Powell recently reiterated the need for increasing interest rates this year, even after the central bank kept rates unchanged in its policy meeting this month. This is because rate hikes are required to curb inflation, which still remains above the Fed’s desired goal of 2%.

The Fed’s favored inflation index, the personal consumption expenditure (PCE) price gauge, had jumped 4.7% in April from the year-ago levels, added the Commerce Department. Similarly, the consumer price index (CPI) climbed 4% year over year in May, according to the Bureau of Labor Statistics.

Insurers to Gain

An increasing interest rate environment acts as a boon for insurance companies. This is because an insurance company generates investment income from investing premiums that they derive from policyholders in the form of government and corporate bonds.

Notably, when interest rates increase, the yields on these bonds rise, helping the insurer to invest the premiums at a higher yield and generate more investment income.

3 Solid Choices

With interest rate hikes impending and expected to boost the profit margins of insurers or any company affiliated with the insurance industry, it’s prudent to invest in their stocks for solid gains. We have, thus, selected three such stocks that flaunt a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Unum Group is known for providing long-term care insurance, disability insurance, and life insurance, to name a few. Unum has been able to provide solid benefits coupled with conservative pricing, which in due course has helped the company register strong sales.

Thanks to improving premium income and growth in products, UNM shares are well-poised to scale upward shortly. The company’s expected earnings growth rate for the current year is 20.6%.

Unum’s estimated earnings growth rate for the next five-year period is 8.4%. Its shares have already gained 6.8% over the past five years. The Zacks Consensus Estimate for its current-year earnings has moved up 10.6% over the past 60 days. UNM, currently, sports a Zacks Rank #1.

MGIC Investment is one of the primary mortgage insurers in the United States. From superb credit quality to opening new businesses to higher premiums, MGIC Investment looks well poised for the long run.

Thanks to the growing housing market, and an improvement in its capital position, MGIC Investment’s shares are positioned to move northward soon. MTG had $5.9 billion in consolidated cash, cash equivalents and investment portfolio as of Mar 31, 2023 (read more: 3 Housing Stocks to Buy on Bullish Homebuilders' Sentiment).

The company’s expected earnings growth rate for the next year is 6.4%. MGIC Investment’s estimated earnings growth rate for the next five-year period is 5%. Its shares have already gained 16% over the past five years. The Zacks Consensus Estimate for its current-year earnings has moved up 3.3% over the past 60 days. MTG, at this time, has a Zacks Rank #2.

Radian Group provides its clients with an array of private mortgage insurance. Improvement in the operating environment, a decline in primary delinquent loans, and declining claim payments are expected to boost Radian’s shares shortly.

Radian’s claims paid came in at $3 million in the first quarter of 2023, a decline of 40% from the same period last year.

Radian Group’s estimated earnings growth rate for the next five-year period is 5%. Its shares have already gained 19% over the past five years. The Zacks Consensus Estimate for its current-year earnings has moved up 6.5% over the past 60 days. RDN, at present, has a Zacks Rank #2.

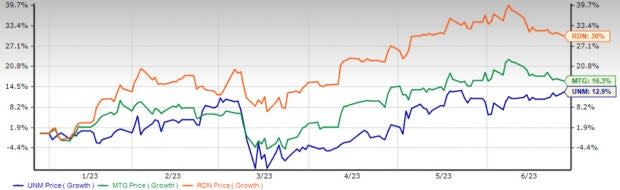

Shares of Unum Group, MGIC Investment, and Radian Group, by the way, have gained 12.9%, 16.3%, and 30%, respectively, so far this year.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGIC Investment Corporation (MTG) : Free Stock Analysis Report

Unum Group (UNM) : Free Stock Analysis Report

Radian Group Inc. (RDN) : Free Stock Analysis Report