3 Large-Cap Stocks up More Than 20% Year-To-Date

Price action has been primarily strong this week, a development that any investor can celebrate. The way things are shaping up, the S&P 500 is on its way to recording its third weekly close in the green out of the last ten.

It goes without saying that it’s been a harsh environment to invest in throughout 2022. A hawkish Fed, supply chain issues resulting from the war in Ukraine, and COVID-19 uncertainties have all negatively impacted financial markets year-to-date.

Nonetheless, the market rolls on.

Surprisingly enough, there are companies out there in the green year-to-date, including Cigna Corp. CI, Merck MRK, and Valero Energy Corp. VLO. The year-to-date chart below shows the performance of all three companies’ shares while blending in the S&P 500 as a benchmark.

Image Source: Zacks Investment Research

As we can see, all three companies have enjoyed strong performances year-to-date, easily outperforming the S&P 500.

All three are large-cap companies with strong Zacks Ranks – a significant perk that instills confidence in these companies’ share performances moving forward.

Large-cap companies are typically less volatile investments and generally pay dividends. After all, who doesn’t enjoy getting paid?

Let’s examine each company closely to see why they’d be solid portfolio adds moving forward.

Cigna Corp.

Cigna CI is a global health services company that delivers choice, predictability, affordability, and access to quality care through integrated capabilities and connected, personalized solutions that advance whole-person health. Cigna is a Zacks Rank #2 (Buy) with an overall VGM Score of an A.

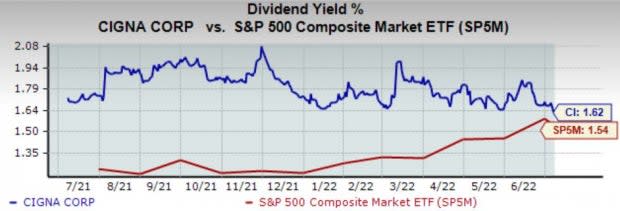

The company rewards its shareholders via its annual dividend that yields 1.6%, with a payout ratio sitting sustainably at 21% of earnings. What sticks out to me is the company’s five-year annualized dividend growth rate of a triple-digit 224%.

In addition, the yield is higher than that of the S&P 500.

Image Source: Zacks Investment Research

CI also sports enticing valuation metrics. Its 12.1X forward earnings multiple is well below 2017 highs of 20.5X and represents an attractive 36% discount relative to its Zacks Industry.

Image Source: Zacks Investment Research

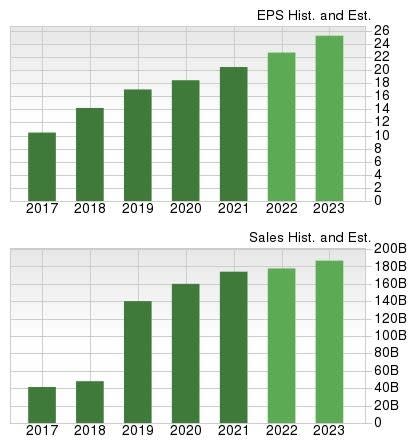

The $22.68 per share consensus EPS estimate for the current fiscal year reflects a notable double-digit increase in earnings of nearly 11% year-over-year. Additionally, for the upcoming quarterly report, earnings are forecasted to grow 4% from the year-ago quarter.

The top-line is forecasted to expand nicely as well. The FY22 revenue estimate of $177 billion pencils in a 2% uptick in revenue year-over-year. Quarterly revenue is forecasted to reach $44 billion in the upcoming quarter, reflecting a respectable 3% increase in revenue from the year-ago quarter.

Image Source: Zacks Investment Research

Merck

Headquartered in New Jersey, Merck MRK is an American multinational pharmaceutical company that develops and produces medicines, therapies, and other health products. Merck is a Zacks Rank #2 (Buy) that boasts an overall VGM Score of an A.

Merck has a robust annual dividend that yields 2.9%, with a payout ratio sitting sustainably at 39% of earnings. Impressively, the company has increased its dividend six times over the past five years, with a five-year annualized dividend growth rate sitting at 9%.

Furthermore, the yield is much higher than that of the S&P 500.

Image Source: Zacks Investment Research

MRK also sports an enticingly low 12.7X forward P/E ratio, well below 2019 highs of 18.4X and nicely underneath its five-year median value of 14.4X. Additionally, the value reflects a deep 40% discount relative to its Zacks Industry.

Image Source: Zacks Investment Research

Top-line forecasts for the current fiscal year display strength. In FY22, MRK is forecasted to rake in a mighty $58 billion, which translates to a 16% expansion in the top-line year-over-year. Quarterly revenue also looks to remain strong, with the company forecasted to increase its quarterly sales by 21% in the upcoming quarter.

Image Source: Zacks Investment Research

In addition, the $7.31 EPS estimate for the current fiscal year represents a strong double-digit expansion in the bottom-line of nearly 22%.

Valero Energy Corp.

Valero Energy VLO is the largest independent refiner and marketer of petroleum products in the US. The company has refineries located in the US, Canada, and the United Kingdom. VLO sports a Zacks Rank #1 (Strong Buy) with an overall VGM Score of an A.

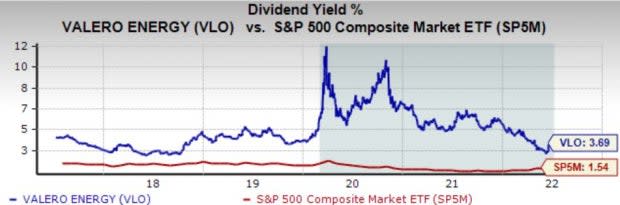

Valero Energy’s annual dividend yield sits on the higher side at 3.7%, with a slightly steep payout ratio sitting at 60% of earnings. The company has been dedicated to rewarding its shareholders, as displayed by its three dividend increases over the past five years and a five-year annualized dividend growth rate of 7.2%.

Image Source: Zacks Investment Research

VLO sports a 0.3X forward price-to-sales ratio, which is nowhere near 2018 highs of 0.5X. In addition, the value represents an enticing 51% discount relative to its Zacks Industry.

Valero Energy has a Style Score of a B for Value.

Image Source: Zacks Investment Research

For the upcoming quarter, the $7.13 per share estimate pencils in a massive quad-digit growth in earnings of 1385% from the year-ago quarter. Furthermore, the $18.08 per share estimate for FY22 translates to a triple-digit expansion in the bottom-line of more than 540% year-over-year.

Clearly, the company has benefitted from the rise in energy prices, which is a big reason analysts have revised their earnings estimates substantially over the last 60 days.

Revenue is forecasted to climb to a massive $154 billion in FY22, a substantial 36% increase year-over-year. Additionally, the $40 billion revenue estimate for the upcoming quarter translates to a 41% increase in quarterly revenue compared to the year-ago quarter.

Image Source: Zacks Investment Research

Bottom Line

All three companies’ shares have been a bright spot in 2022, meaning buyers have remained in control throughout the year.

All three companies have strong dividend metrics, solid year-over-year growth for the current fiscal year, and carry a strong Zacks Rank. For investors looking to add some quality stocks to their portfolios, these three would be a great place to start.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

Cigna Corporation (CI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research