3 Medical Device Stocks With Potential to Fight Deflation Risk

Amid rate hikes by Fed to tame inflation, a risk of deflation looms. The Fed has increased interest rates by 5% in almost one and a half year to mitigate the risk of rising prices. However, there are concerns that the significant rise in interest rate in such a short period of time may lead to deflation.

Risk of Deflation

Per Morgan Stanley analyst Mike Wilson’s podcast, the U.S. economy may face deflation or falling prices, which could hurt corporate earnings and stock prices.

Wilson said that inflation, which has eased recently, is likely to come down faster than expected due to the lagged effect of rate hike by the Federal Reserve. This could lead to not just disinflation, but outright deflation, where prices decline. He warned that deflation would reduce companies' pricing power and future earnings, which would be detrimental to stocks. Wilson added that stock valuations are already quite extended and deflation can prove harmful for earnings growth.

He pointed at several signs of deflation, such as falling housing prices, car prices, and even prices of airlines and hotels, and advised that equity investors should be careful for what they wish for, as falling inflation was great news for the Fed, but not for stocks.

Contrarian View

In this YouTube video, Wall Street analyst Jim Bianco warns that the U.S. economy could face further setbacks as the Fed continues to raise interest rates to fight inflation. He says that core inflation, which excludes food and energy, is still too high at 5% over the last six months. Bianco thinks that the Fed has not yet reached the neutral or restrictive level of monetary policy. He also thinks that inflation is more persistent than the markets expect and that the economy will not slow down enough to lower it. Bianco notes that the Fed has already hiked rates by 5% since April 2022 and that higher rates have caused some financial stress in the past.

Stock Market Impact of Potential Deflation

Per this Business Insider article, Wermuth Asset Management states that stocks are "dangerously overpriced" as the S&P 500 has surged 16% this year, despite the weakening outlook for corporate earnings. It is of the view that businesses could face lower profits as financial conditions remain tight and inflation cools off. Per a Morgan Stanley's prediction, this could lead to one of the worst earnings recessions since 2008 and a 16% drop in stocks.

Wermuth Asset Management also highlights the trouble in the commercial real estate market, where $1.5 trillion debt will soon need to be refinanced, but interest rates are higher and banks are less willing to lend. The Capital Economics estimates that this could cause commercial property prices to crash 40%.

A falling inflation will be driven by a slowing GDP growth across major global economies, including the United States.

Now, we discuss three medical device stocks — Abcam plc ABCM, Integer Holdings Corporation ITGR and RxSight Inc. RXST — with market cap in the range of $1-$5 billion, Zacks Rank #1 (Strong Buy) or #2 (Buy) and strong long-term growth outlook. A robust outlook suggests potential uptrend for these stocks going forward that will help offset deflationary and recessionary risks.

3 Medical Device Stocks to Bet on Potential Deflation Risk

Abcam is a life sciences company. It researches, develops and distributes biological reagents and tools for research, drug discovery and diagnostics. The company operates principally in the United States, China, Japan, Germany, the United Kingdom and internationally.

This Zacks Rank #2 company’s earnings are expected to witness a CAGR of 28.8%, reflecting strong growth potential for the stock. You can see the complete list of today’s Zacks #1 Rank stocks here.

The favorable Zacks Rank also makes it a suitable bet for investors. The Zacks Consensus Estimate for 2023 earnings and revenues is pegged at 44 cents per share and $531.8 million, respectively, indicating a year-over-year growth rate of 46.7% and 32.6%.

Abcam PLC Sponsored ADR Price

Abcam PLC Sponsored ADR price | Abcam PLC Sponsored ADR Quote

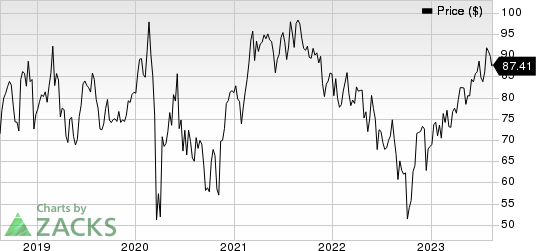

Integer Holdings manufactures and develops medical devices and components primarily for original equipment manufacturers that depend on it to design, develop and produce intellectual property protected medical device technologies.

The company carries a Zacks Rank of 2 at present. Its earnings are estimated to grow at a rate of 12.1% for the next five years. ABCM’s earnings beat estimates in each of the last four quarters, delivering an average surprise of 8.43%. The Zacks Consensus Estimate for 2023 earnings and revenues is pinned at $4.53 per share and $1.54 billion, respectively, implying a year-over-year growth rate of 11.6% and 11.8%.

Integer Holdings Corporation Price

Integer Holdings Corporation price | Integer Holdings Corporation Quote

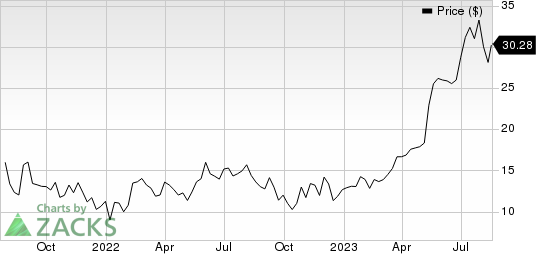

RxSight is a commercial-stage medical technology company focused on patients following cataract surgery. The RxSight Light Adjustable Lens system comprises of the RxSight Light Adjustable Lens(R), RxSight Light Delivery Device and accessories.

The company currently carries a Zacks Rank of 2. Its earnings are estimated to grow at a rate of 19% for the next five years. RXST’s earnings beat estimates in each of the last four quarters, delivering an average surprise of 17.3%. The Zacks Consensus Estimate for 2023 earnings is pinned at a loss of $1.66 per share and the same for revenues is pegged at $84.14 million, reflecting year-over-year improvement of 31.1% and 71.7%, respectively.

RxSight, Inc. Price

RxSight, Inc. price | RxSight, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Abcam PLC Sponsored ADR (ABCM) : Free Stock Analysis Report

RxSight, Inc. (RXST) : Free Stock Analysis Report