3 Medical Device Stocks With Solid Dividend Yield: CAH & Others

The Zacks Medical sector is facing headwinds in the form of raging inflation, higher interest rates, supply-chain disruptions and high operating costs. These factors are likely to hurt the industry players’ margin.

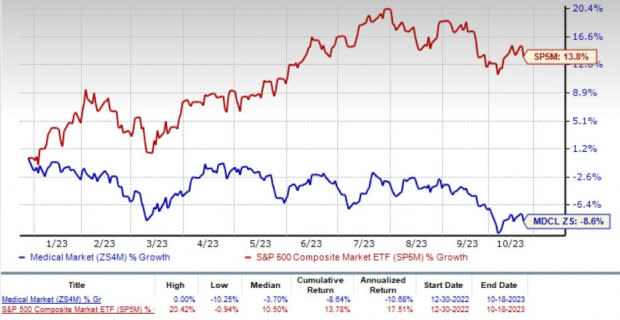

Amid these ongoing headwinds, the sector has lost 8.6% until Oct 18, underperforming the S&P 500 Index’s 13.8% gain.

Owing to the rising market volatility, it would be a wise decision to invest in some dividend-paying companies like Cardinal Health CAH, Baxter International BAX and Fresenius Medical Care FMS from the medical device industries to create a steady income source. These companies have consistently announced dividend hikes, thereby highlighting their pro-shareholder stance.

Image Source: Zacks Investment Research

Stocks with a strong history of dividend growth belong to mature companies and are less susceptible to large swings in the market. They act as a hedge against economic or political uncertainty as well as stock market volatility. At the same time, they also offer downside protection with a consistent rise in payouts.

Additionally, these companies have superior fundamentals like a sustainable business model, a long track of profitability, rising cash flows, good liquidity, a strong balance sheet and some value characteristics.

3 Medical Products Stocks to Embrace Now

In order to choose some of the best dividend stocks from the industry, we have run the Zacks Stock Screener to identify those with a dividend yield in excess of 2% and a sustainable dividend payout ratio of less than 60%.

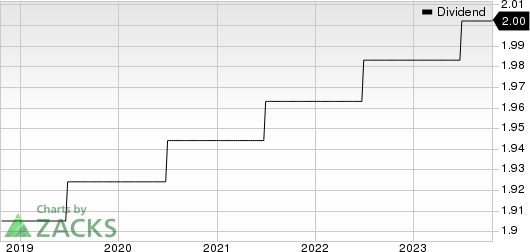

Cardinal Health: Headquartered in Dublin, OH, Cardinal Health is a nationwide drug distributor and provider of services to pharmacies, healthcare providers and manufacturers. The company pays out a quarterly dividend of 50 cents ($2.00 annualized) per share, which gives it a 2.13% yield at the current stock price. This company’s payout ratio is 34%, with a five-year dividend growth rate of 1.02%. (Check Cardinal’s dividend history here.)

The company is also active on the buyback front. During fiscal 2023 that ended in June 2023, CAH deployed $2 billion for share repurchase. As of June-end, it had $4.3 billion available for repurchase under the share repurchase program, authorized by the board of directors in the previous years.

Cardinal Health, Inc. Dividend (TTM)

Cardinal Health, Inc. dividend-ttm | Cardinal Health, Inc. Quote

Baxter International: Headquartered in Deerfield, IL, Baxter engages in the development, manufacture and sale of a broad range of products, digital health solutions and therapies used by hospitals and other care-giving organizations, including at-home physicians.

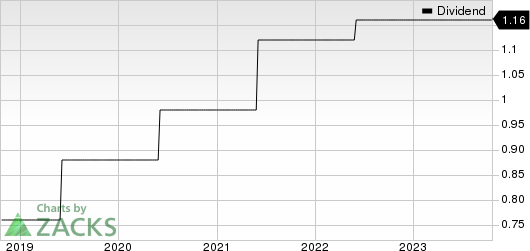

Baxter pays annualized dividends of $1.16 per share, resulting in a 3.62% yield at the current stock price. This company’s payout ratio is 41%, with a five-year dividend growth rate of 9.65%. (Check Baxter’s dividend history here.)

The company also has buyback plans. Although it did not repurchase shares during the first half of 2023, it had $1.3 billion under its share repurchase authorization as of June 2023. BAX had repurchased 500,000 shares in 2022.

Baxter International Inc. Dividend (TTM)

Baxter International Inc. dividend-ttm | Baxter International Inc. Quote

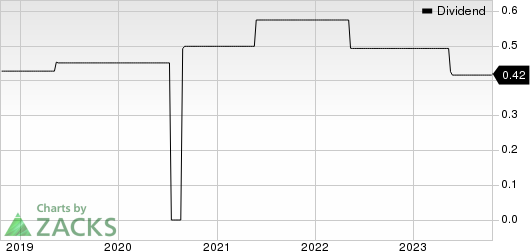

Fresenius Medical Care: Headquartered in Germany, Fresenius Medical is one of the largest integrated providers of products and services for individuals undergoing dialysis following chronic kidney failure. FMS pays out an annual dividend of 42 cents per share, which gives it a 2.42% yield at the current stock price. This company’s payout ratio is 29%, with a five-year dividend growth rate of 1.89%. (Check Fresenius Medical’s dividend history here.)

Fresenius Medical Care AG & Co. KGaA Dividend (TTM)

Fresenius Medical Care AG & Co. KGaA dividend-ttm | Fresenius Medical Care AG & Co. KGaA Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baxter International Inc. (BAX) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Fresenius Medical Care AG & Co. KGaA (FMS) : Free Stock Analysis Report