3 Medical Instruments Stocks Countering Industry-Wide Headwinds

The Medical Instruments industry is gradually coming out of the two-and-a-half-year-long healthcare crisis-oriented development approach. The key focus of medical device R&D is again shifting from COVID-related PPE, testing and distant care options to point-of-care testing, heavy as well as minimally invasive implants, elective procedures, and so on and so forth.

Meanwhile, AI and robotics for medical Internet of Things (IoT), which rose to the limelight during the pandemic phase, continue to be popular. Digital enhancement, while optimizing costs, proves to be better for clinical outcomes. However, deteriorating international trade, with global inflationary pressure leading to a tough situation related to raw material and labor cost as well as freight charges, has put the industry in a tight spot again. Further, staffing shortages and supply chain-related hazards are denting growth. Meanwhile, industry players like Alcon ALC, STERIS STE and Inari Medical NARI have adapted well to changing consumer preferences and are still witnessing an uptrend in their stock prices.

Industry Description

The Zacks Medical - Instruments industry is highly fragmented, with participants engaged in research and development (R&D) in therapeutic areas. This FDA-regulated industry comprises an endless number of products, starting from transcatheter valves to orthopedic products to imaging equipment and robotics. Prior to the pandemic, the Medical Instruments space was advancing well in terms of R&D. Among the recent path-breaking inventions, bone growth stimulators, 3D mapping of CT scans, wireless brain sensors and human-brain pacemakers are worth mentioning. During the COVID-hit years, many non-COVID and non-emergency-line innovations were stuck or delayed. However, with the severity of the pandemic easing, the industry players are again more focused on strengthening their pipeline.

3 Trends Shaping the Future of the Medical Instruments Industry

M&A Trend Continues: The medical instruments space has been benefiting from the ongoing merger and acquisition (M&A) trend. In fact, various reports suggest that M&A has been the key catalyst in the U.S. MedTech space of late. It is a known fact that smaller and mid-sized industry players attempt to compete with the big shots through consolidation. The big players attempt to enter new markets through a niche product. According to an Evaluate MedTech report, in 2022, M&A in this sector represented just under $65 billion in deals. This trend has significantly slowed down in 2023, thanks to the tremendously volatile global macroeconomic situation, which resulted in restrained venture capital investment. In the first half of 2023, M&A transactions totaled $13 billion, spanning just 42 deals. Per the Evaluate report, if this trend continues through the second half of the year, it would make 2023’s total the lowest in a decade. Meanwhile, per GlobalData’s Deals Database, as recently published in Medical Device Network, in the third quarter of 2023 alone, this industry had 107 M&A deals initiated, worth a total value of just $4 billion. Among the completed deals of the third quarter, Globus Medical closed the $3.1 billion deal to acquire spine technology company, NuVasive.

Business Trend Disruption: Considering the ongoing macroeconomic situation, the IMF came up with its October 2023 World Economic Outlook Update. Per the baseline forecast, growth is expected to decelerate from 3.5% in 2022 to 3% in 2023 before settling at 2.9% in 2024. IMF expects developed economies to see an especially pronounced slowdown in growth, from 2.6% in 2022 to 1.5% in 2023. IMF specifically noted that global headline inflation in the baseline is going to fall from 8.7% in 2022 to 6.9% in 2023 due to a tighter monetary policy aided by lower international commodity prices. However, underlying (core) inflation is likely to decline more slowly. Inflation’s return to target is unlikely before 2025 in most cases. Per the report, following a strong initial rebound from the COVID-19 pandemic-led market disruption, the pace of recovery has moderated. Several forces that are holding back the recovery include Russia’s war in Ukraine and increasing geoeconomic fragmentation. Other major factors denting growth are the effects of monetary policy tightening to reduce inflation and the withdrawal of fiscal support amid high debt. Overall, Medical Instruments industry players are expected to collectively report a year-over-year decline in their earnings due to logistical challenges and higher unit costs.

Digital Revolution: With an increase in the adoption of digital platforms within the medical device space, robotic surgeries, big-data analytics, bioprinting, 3D printing, electronic health records, predictive analytics, real-time alerting and revenue cycle management services are gaining prominence in the United States. A June 2019 Health Care News report suggested that this market, valued at $123 billion in 2018, has been witnessing a CAGR of 25%. Various other reports suggest that companies that adopted AI witnessed a 50% reduction in treatment costs. Telemedicine stocks received an impressive response when, in 2021, the Centers for Disease Control and Prevention asked healthcare service communities to broaden the use of telemedicine.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Medical Instruments industry’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates dull near-term prospects. The industry, housed within the broader Zacks Medical sector, currently carries a Zacks Industry Rank #144, which places it in the bottom 43% of more than 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

We will present a few stocks that have the potential to outperform the market based on a strong earnings outlook. But it’s worth taking a look at the industry’s shareholder returns and current valuation first.

Industry Underperforms S&P 500 and Sector

The industry has underperformed the Zacks S&P 500 composite as well as its sector in the past year.

The industry has declined 9.2% compared with the broader sector’s decline of 6.2%. The S&P 500 has risen 10.5% in a year.

One-Year Price Performance

Industry's Current Valuation

On the basis of the forward 12-month price-to-earnings (P/E), which is commonly used for valuing medical stocks, the industry is currently trading at 26.35X compared with the broader industry’s 21.44X and the S&P 500’s 17.79X.

Over the past five years, the industry has traded as high as 42.12X, as low as 25.01X and at the median of 32.18X, as the charts show below.

Price-to-Earnings Forward Twelve Months (F12M)

Price-to-Earnings Forward Twelve Months (F12M)

3 Stocks to Buy Right Now

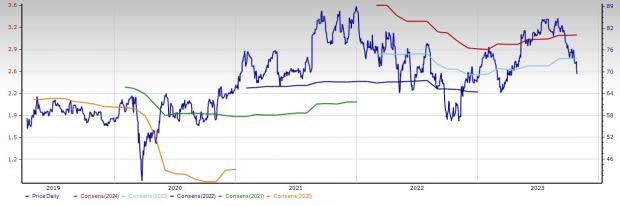

Alcon: Headquartered in Geneva, Switzerland Alcon researches, develops, manufactures, distributes, and sells a full suite of eye care products. Alcon currently leads the market in Presbyopia-correcting Intraocular Lens (PCIOLs) with over 60% of the global share and over 80% share in the United States. In Surgical, the company maintained a strong market share in PCIOLs, solidifying its market-leading position, driven by strong demand for products like PanOptix and Vivity despite new market entrants.

The consensus estimate for this Zacks Rank #2 (Buy) company’s 2023 sales is pegged at $9.48 billion, indicating a 9.5% rise year over year. The consensus mark for Alcon’s 2023 EPS is pegged at $2.75, indicating an increase of 22.8% from the year-ago period reported figure.

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: ALC

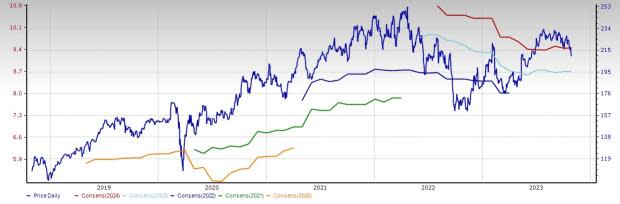

STERIS: Ohio-headquartered STERIS plc develops, manufactures and markets infection prevention, decontamination, microbial reduction, and surgical and gastrointestinal support products and services. The company’s Healthcare segment is gaining from the successful market adoption of its comprehensive offerings, including infection prevention consumables and capital equipment. Further, its services to maintain that equipment, repair reusable procedural instruments and outsource instrument reprocessing services are gaining traction.

The consensus estimate for this Zacks Rank #2 company’s fiscal 2024 sales is pegged at $5.43 billion, indicating a 9.5% rise year over year. The consensus mark for STERIS’ fiscal 2024 EPS is pegged at $8.74, indicating an increase of 6.6% from the year-ago period reported figure.

Price and Consensus: STE

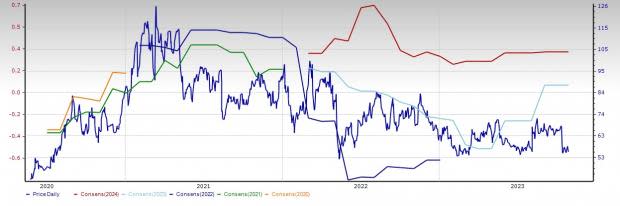

Inari Medical: Irvine, CA-based Inari Medical is a commercial-stage medical device company committed to developing products to treat and change the lives of patients suffering from venous diseases. Inari Medical is spearheading the creation and commercialization of devices that are built keeping in mind the specific characteristics of the venous system, its diseases and its unique clot morphology.

The Zacks Consensus Estimate for Inari Medical’s 2023 sales is pegged at $488.9 million, indicating a 27.5% rise year over year. The same for NARI’s adjusted earnings is pegged at 4 cents per share, a huge 107.3% projected improvement from 55 cents of loss in 2022. Inari Medical carries a Zacks Rank #2.

Price and Consensus: NARI

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alcon (ALC) : Free Stock Analysis Report

STERIS plc (STE) : Free Stock Analysis Report

Inari Medical, Inc. (NARI) : Free Stock Analysis Report