3 Medical Product Stocks Set to Outpace Q2 Earnings Estimates

So far, the second-quarter reporting cycle has displayed a year-over-year earnings deterioration for the Medical sector, including the medical product companies. The key medical product stocks that have released their earnings so far showed market share gain within their base businesses through the months of the second quarter compared with the corresponding period of 2022. These companies reported rising as well as better-than-expected earnings and revenues. However, ongoing macroeconomic headwinds in the form of inflation and currency woes put pressure on the bottom line.

The Earnings Trends report indicates that as of Aug 9, 91.4% of the companies in the Medical sector, representing 96% of the sector’s market capitalization, reported quarterly earnings. About 86.8% of the participants beat on earnings while 77.4% beat on revenues. While earnings declined 30.7% year over year, revenues rose 5% from the year-ago period’s level. Revenues were driven by improving demand for medical products while the same remained subdued due to rising inflationary pressure and interest expense. Overall, second-quarter earnings of the Medical sector are expected to decline 30% and sales are expected to increase 5.4% from the year-ago quarter’s respective reported figures.

Zeroing in on Winners

Below, we have highlighted three medical product companies — Neogen NEOG, Patterson Companies PDCO and Definitive Healthcare DH — that are expected to deliver a beat in their upcoming quarterly result.

Earnings ESP is our proprietary methodology for determining the stocks with the best chance to deliver an earnings surprise. Earnings ESP shows the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate.

According to the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. The selection can be made with the help of the Zacks Stock Screener.

Our research shows that the chance of an earnings surprise for stocks with this combination is as high as 70%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

3 Medical Product Stocks That Match the Criteria

Neogen

Neogen develops and markets food and animal safety products. Neogen has an Earnings ESP of +7.69% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for second-quarter earnings is pegged at 13 cents per share.

Neogen’s earnings beat estimates in three of the last four quarters and missed the same in one, delivering an average surprise of 130.31%. NEOG is expected to report earnings on Sep 26.

Neogen Corporation Price and EPS Surprise

Neogen Corporation price-eps-surprise | Neogen Corporation Quote

Patterson Companies

The company is a value-added specialty distributor of dental and animal health products. It has an Earnings ESP of +5.66% and a Zacks Rank #1 at present. The Zacks Consensus Estimate for second-quarter earnings is pegged at 40 cents per share.

Patterson Companies’ earnings beat estimates in three of the last four quarters and missed the mark in one, delivering an average surprise of 4.52%. PDCO is expected to report earnings on Sep 7.

Patterson Companies, Inc. Price and EPS Surprise

Patterson Companies, Inc. price-eps-surprise | Patterson Companies, Inc. Quote

Definitive Healthcare

Definitive Healthcare provides healthcare commercial intelligence. The company's SaaS platform creates new paths in the healthcare market. Definitive Healthcare has an Earnings ESP of +55.55% and a Zacks Rank #3 at present. The Zacks Consensus Estimate for second-quarter earnings is pinned at 5 cents per share.

Definitive Healthcare’s earnings beat estimates in each of the last four quarters, delivering an average surprise of 33.75%. DH is slated to report earnings on Aug 14, after market close.

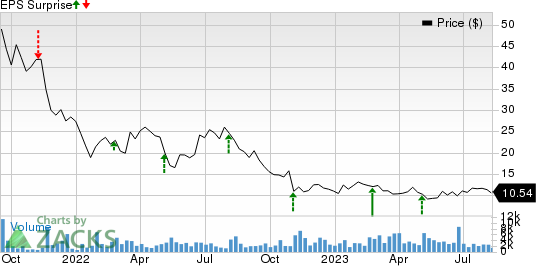

Definitive Healthcare Corp. Price and EPS Surprise

Definitive Healthcare Corp. price-eps-surprise | Definitive Healthcare Corp. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

Neogen Corporation (NEOG) : Free Stock Analysis Report

Definitive Healthcare Corp. (DH) : Free Stock Analysis Report