3 Medical Products Stocks to Consider as Earnings Approach

There is a plethora of top-rated stocks set to report their quarterly results on Thursday, November 2 with many belonging to the Zacks Medical sector.

Among them, several Zacks Medical-Products Industry stocks are standing out with Baxter International BAX and Insulet Corporation PODD both sporting a Zacks Rank #2 (Buy) while Haemonetics Corporation HAE boasts a Zacks Rank #1 (Strong Buy).

Baxter International (BAX)

Baxter distributes a broad range of products along with digital health solutions and therapies used by hospitals and other care-giving organizations.

Offering a generous 3.58% dividend yield, Baxter’s stock stands out in terms of valuation trading at 12.7X forward earnings which is well below its industry average of 19.2X and the S&P 500’s 19.7X.

Image Source: Zacks Investment Research

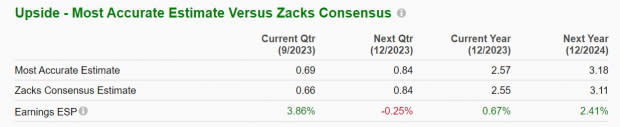

Furthermore, the Zacks ESP (Expected Surprise Prediction) indicates Baxter could surpass its third-quarter earnings expectations with the Most Accurate Estimate having Q3 EPS at $0.69 per share and 4% above the Zacks Consensus of $0.66 a share.

Image Source: Zacks Investment Research

Insulet Corporation (PODD)

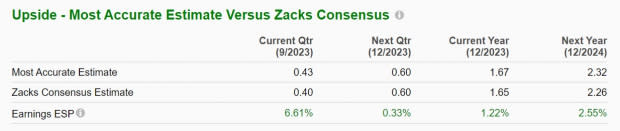

As a leading developer of the Omnipod Insulin Management System, the Zacks ESP also indicates Insulet could beat its Q3 earnings expectations with the Most Accurate Estimate having Q3 EPS at $0.43 per share and 6% above the Zacks Consensus of $0.40 a share.

Image Source: Zacks Investment Research

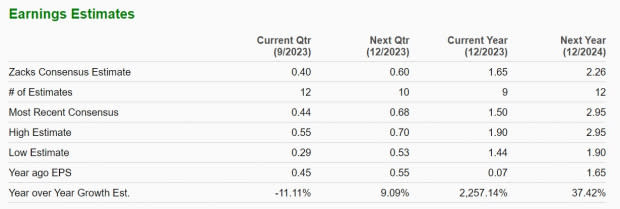

Insulet is experiencing stellar growth with annual earnings now forecasted to skyrocket to $1.65 per share in fiscal 2023 compared to $0.07 a share in 2022. Plus, FY24 earnings are anticipated to climb another 37% to $2.26 per share.

Image Source: Zacks Investment Research

Haemonetics Corporation (HAE)

As for Haemonetics which provides blood management solutions, the company’s growth is very intriguing and is expected to post robust quarterly growth.

Reporting its fiscal second quarter results on Thursday, Haemonetics' Q2 earnings are forecasted to be up 13% year over year to $0.94 per share with sales expected to rise 7% to $319.18 million. More impressive, Haemonetics has now surpassed earnings expectations for seven consecutive quarters most recently beating the Zacks Consensus for Q1 EPS by 38%.

Image Source: Zacks Investment Research

Haemonetics' annual earnings are now projected to leap 26% in its current fiscal 2024 and rise another 6% in FY25 to $4.07 per share. Even better, FY24 and FY25 earnings estimates have remained higher over the last quarter which largely attributes to Haemonetics’ strong buy rating.

Image Source: Zacks Investment Research

Bottom Line

Investors will certainly want to pay attention to these top-rated Zacks Medical sector stocks going into their quarterly reports with now looking like an ideal time to invest in Baxter International, Insulet Corporation, and Haemonetics Corporation.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baxter International Inc. (BAX) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report