3 Medical Services Stocks to Buy Amid Improving Industry Trends

Over the past two years, digital healthcare treatment has become indispensable. The medical services industry has been witnessing significant demand for telemedicine-focused online medical and AI-powered technology services. Remote healthcare companies like Medpace MEDP, HealthEquity HQY and Apollo Medical AMEH have seen their stocks rally amid economic volatility. During the pandemic, observing the surging demand for distant treatment options, many healthcare companies that were not tech-based traditionally transformed themselves into technology-based ones to survive in the market.

The pandemic dealt a huge blow to the manual workforce in healthcare infrastructure and the effect lingers. Per a February 2023 report by Research and Markets, WHO estimates that by 2030, there will be a shortage of 10 million health workers in low- and lower-middle-income countries.

Industry Description

The Zacks Medical Services industry comprises third-party service providers and caregivers appointed by core healthcare companies for economies of scale. The industry includes pharmacy benefit managers, contract research organizations, wireless MedTech companies, third-party testing labs, surgical facility providers, and healthcare workforce solutions providers among others. Over the years, this industry has strategically moved from volume- to value-based care. This changing pattern of care calls for advanced facilities, thus increasing the need to appoint specialized external service providers. With the growing importance of effective healthcare management, the medical service industry has become an integral part of the modern healthcare system.

3 Trends Shaping the Future of the Medical Services Industry

Staffing Shortage: Although the severity of the COVID-19 pandemic has declined significantly, the trauma of the past two years’ uncertainty and commotion has forced frontline workers like doctors and medical staff to leave the field. Going by a National Institute of Health (NIH) report of 2022, the U.S. Bureau of Labor Statistics projects that more than 275,000 additional nurses are needed from 2020 to 2030. Going by the Research and Markets report, the gap between healthcare demand and supply of nurses and doctors is widening and more evident in developing countries due to the limited capacity and number of medical schools. Accordingly, employment opportunities for nurses are projected to grow at a faster rate than all other occupations.

Digital Revolution Amid the Pandemic: With an increase in the adoption of digital platforms within the medical device space, remote monitoring, robotic surgeries, big-data analytics, 3D printing and electronic health records are gaining prominence in the United States. A 2020 Digital Health Market report suggests that this market, valued at $106 billion in 2019, will witness a 28.5% CAGR through 2026. Other reports suggest that the companies that adopted artificial intelligence technologies witnessed a 50% reduction in treatment costs and experienced more than 50% improvement in patient outcomes. Amid the pandemic, this line of healthcare became a leading choice for contactless healthcare services.

Nursing Care Market Boom: With rising cognizance about the benefits of specialized medical caregiving, the need for healthcare workforce/staffing service providers has increased significantly. For example, the demand for nurses has increased manifold, driven by the rising incidence of chronic disorders in the United States, and is expected to be high in the days ahead. Going by a Research and Markets report, the global healthcare staffing market size is expected to reach $62.8 billion by 2030, registering a CAGR of 6.93% from 2023 to 2030.

Zacks Industry Rank Indicates Good Prospects

The Zacks Medical Services industry falls within the broader Zacks Medical sector. It carries a Zacks Industry Rank #92, which places it in the top 37% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates encouraging near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

We will present a few stocks that have the potential to outperform the market based on a strong earnings outlook. But it’s worth taking a look at the industry’s shareholder returns and current valuation first.

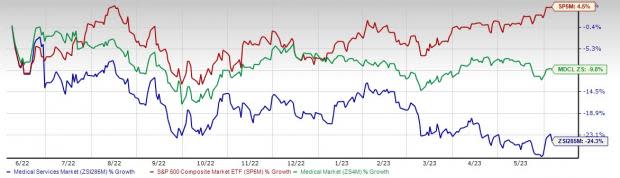

Industry Underperforms Sector and S&P 500

The Medical Services Industry has underperformed its own sector as well as the S&P 500 over the past year. The stocks in this industry have collectively lost 24.3% during the said time frame against the S&P 500 composite’s rise of 4.5%. The Medical sector has declined 9.8% in the same time frame.

One Year Price Performance

Industry's Current Valuation

On the basis of forward 12-month price-to-earnings (P/E), which is commonly used for valuing medical stocks, the industry is currently trading at 15.63X compared with the S&P 500’s 19.03X and the sector’s 22.32X.

Over the last five years, the industry has traded as high as 22.04X, as low as 11.89X, and at the median of 15.59X, as the charts below show.

Price-to-Earnings Forward Twelve Months (F12M)

Price-to-Earnings Forward Twelve Months (F12M)

3 Stocks to Buy Right Now

Below are three stocks within the Medical Services industry that have been witnessing positive earnings estimate revisions and carry a Zacks Rank #1 (Strong Buy) or #2 (Buy) at present.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Apollo Medical: Headquartered in Alhambra, CA, Apollo Medical is a physician-centric, technology-powered healthcare company focused on enabling providers in the successful delivery of value-based care. In the last reported first quarter of 2023, the company recorded 28% revenue growth, banking on organic growth in its Care Partners segment and steady profitability. Apollo Medical continues to invest in people and infrastructure within Care Enablement segment and expand its high-quality clinical footprint in the Care Delivery segment.

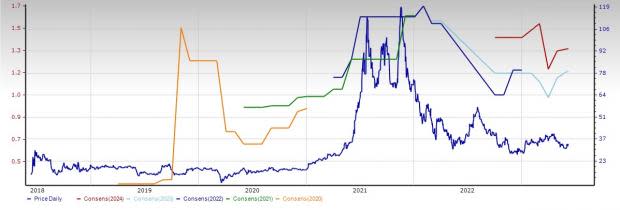

Apollo Medical’s 2024 earnings growth rate is pegged at 13.9%. The Zacks Consensus Estimate for Apollo Medical’s 2024 revenues indicates a year-over-year rise of 16.1%. The stock sports a Zacks Rank #1.

Price and Consensus: AMEH

Medpace: Based in Cincinnati, OH, Medpace is a scientifically-driven, global, full-service clinical contract research organization (CRO) providing Phase I-IV clinical development services to the biotechnology, pharmaceutical and medical device industries. In the last reported first quarter of 2023, the company registered a 31.2% increase in revenues, reflecting a backlog conversion rate of 18.6%.

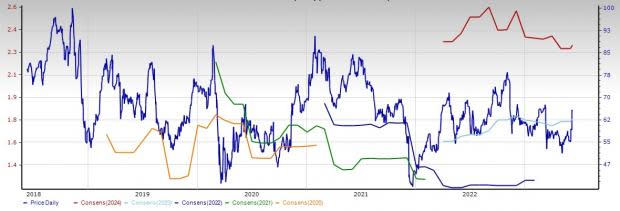

Medpace’s 2024 expected earnings growth rate is pegged at 13.4%. The Zacks Consensus Estimate for Medpace’s 2024 revenues indicates a year-over-year rise of 11.5%. The stock carries a Zacks Rank #2.

Price and Consensus: MEDP

HealthEquity: Draper, UT-headquartered HealthEquity provides integrated solutions for healthcare account management, health reimbursement arrangement and flexible spending accounts for health plans, insurance companies and third-party administrators in the United States. HealthEquity offers multiple cloud-based platforms, accessed by its members online via a desktop or mobile device. Individuals can make health saving and spending decisions, and pay healthcare bills, among other activities, via these platforms.

HealthEquity’s 2024 expected earnings growth rate is pegged at 31.2%. The Zacks Consensus Estimate for HealthEquity’s 2024 revenues indicates a year-over-year rise of 13.9%. The stock carries a Zacks Rank #2.

Price and Consensus: HQY

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Apollo Medical Holdings, Inc. (AMEH) : Free Stock Analysis Report