3 Medtech Stocks Likely to Top Estimates This Earnings Season

The fourth-quarter reporting cycle is in full swing. The MedTech companies (Zacks-defined Medical Products stocks) within the broader Medical sector have witnessed a year-over-year deterioration in earnings.

The MedTech stocks that have released their earnings so far showed market share gain within their base businesses through the months of the fourth quarter compared with the same period in 2022. However, ongoing macroeconomic headwinds in the form of inflation and labordemics put pressure on the bottom line.

Even if we consider the performance on a sequential basis, the fourth-quarter earnings of the majority of the companies are likely to have declined. Replicating the market-wide trend, this sector’s fourth-quarter results are likely to be significantly dampened by the ongoing macroeconomic threat in the United States and outside.

Here, we talk about three stocks — Globus Medical GMED, Glaukos Corporation GKOS and PROCEPT BioRobotics PRCT — that are expected to beat earnings estimates in the ongoing reporting cycle.

Major Q4 Trends

The fourth-quarter reporting cycle is expected to depict a year-over-year improvement in base sales volumes. There has been continued market share gain for the elective legacy businesses of MedTech companies with particular expansion happening in Wearable Tech, Women’s Health and Precision Medicine spaces. Meanwhile, the fourth-quarter results of the diagnostic testing companies are already reflecting a year-over-year decline in testing demand compared to the year-ago period’s COVID-induced surge in testing levels.

At the same time, considering the deteriorating trade situation, in terms of raw material and labor costs as well as freight charges, we expect fourth-quarter results to be disappointing in comparison to the year-ago period.

In this regard, IMF, in its October World Economic Outlook Update, noted that per the baseline forecast, growth is expected to decelerate from 3.5% in 2022 to 3% in 2023 before settling at 2.9% in 2024.

According to the IMF, the deceleration in growth from 2022 to 2023 can be attributed to developed economies, with weaker manufacturing, as well as idiosyncratic factors, which offset stronger services activity. IMF noted that the rise in central bank policy rates to fight inflation, along with the gradual withdrawal of fiscal policies amid high debt, continues to dent economic growth.

This is expected to be reflected in the fourth-quarter results of the MedTech companies in the form of logistical challenges and higher unit costs, resulting in corporate profitability cuts.

Q4 Scorecard Thus Far

Per the latest Earnings Preview, quarterly results so far have been dull year over year, reflecting ongoing macroeconomic headwinds and inflationary pressure worldwide. Going by the sector’s scorecard, 56.7% of the companies in the Medical sector, constituting 85.8% of the sector’s market capitalization, reported earnings till Feb 7. Of these, 67.6% beat both earnings and revenue estimates. However, earnings declined 17.7% year over year on 7% higher revenues.

Overall, fourth-quarter earnings of the Medical sector are expected to plunge 18.2% despite 6.3% revenue growth. This compares with the third-quarter earnings decline of 16.7% on revenue growth of 6.6%.

Key MedTech Releases

Edwards Lifesciences Corporation EW is one of the MedTech companies whose base-business performance registered a strong market share gain.

In the fourth quarter, global sales in the legacy Transcatheter Aortic Valve Replacement (TAVR) product group improved 13% year over year. In the United States, the company witnessed the continued expansion and adoption of the SAPIEN 3 Ultra RESILIA platform. The company’s Surgical Structural Heart sales in the quarter were up 11% from the year-ago quarter’s level. Growth was driven by the adoption of Edwards' premium products, RESILIA products and overall procedure growth.

However, rising costs and expenses put huge pressure on margins. During the reported quarter, gross margin contracted 413 basis points (bps) to 76.7%. Operating margin contracted 532 bps to 27.8% in the fourth quarter.

Quest Diagnostics’ DGX revenues in the fourth quarter declined 1.9% year over year. While its legacy Base business improved 4.7% year over year, COVID-19 testing revenues nosedived 79.9% in the fourth quarter.

Quest Diagnostics’ gross margin contracted 32 bps to 32.2% in the fourth quarter.

Zacks Methodology

Given the high degree of diversity in the Medtech industry, finding the right stocks with the potential to beat estimates might be quite a daunting task.

However, our proprietary Zacks methodology makes the task fairly simple.

We are focusing on stocks that have the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Our research shows that for stocks with this combination, the chances of an earnings surprise are as high as 70%.

Earnings ESP provides the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Our Picks

Here, we present three MedTech stocks that are expected to beat earnings estimates in this reporting cycle.

Despite an uncertain macro environment, Globus Medical is expected to have gained market share in the musculoskeletal solutions space, banking on the strong performance of its implantable devices, biologics, accessories, and unique surgical instruments used in an expansive range of spinal, orthopedic and neurosurgical procedures. The company is particularly expected to have seen notable gains across its product portfolio in expandables, biologics, MIS screws, 3D printed implants and cervical offerings.

Globus Medical’s Earnings ESP of +1.85% and a Zacks Rank #3 raise the possibility of an earnings surprise in the to-be-reported quarter.

Globus Medical is slated to release results for the fourth quarter of 2023 on Feb 20.

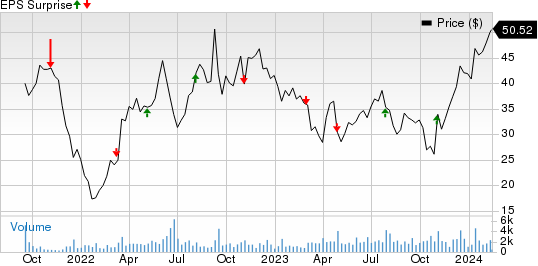

Globus Medical, Inc. Price and EPS Surprise

Globus Medical, Inc. price-eps-surprise | Globus Medical, Inc. Quote

Glaukos, in the fourth quarter, might have continued to gain from multiple product launches. Continued strong demand across international glaucoma and Corneal Health franchises is expected to have aided top-line growth in the to-be-reported quarter. The commercial launch of iStent infinite earlier in 2023 is expected to have boosted the U.S. glaucoma franchise sales in the fourth quarter.

Glaukos is scheduled to release fourth-quarter 2023 results on Feb 21.

Glaukos has an Earnings ESP of +1.19% and a Zacks Rank #3.

Glaukos Corporation Price and EPS Surprise

Glaukos Corporation price-eps-surprise | Glaukos Corporation Quote

PROCEPT BioRobotics is expected to have gained from acceleration in monthly utilization and strong U.S. system demand. The company is expected to have gained from favorable real-world clinical outcomes of Aquablation Therapy and strong surgeon interest, leading to rapid adoption within urology practices.

PROCEPT BioRobotics is scheduled to release fourth-quarter 2023 results on Feb 27.

PROCEPT BioRobotics has an Earnings ESP of +0.38% and a Zacks Rank #3.

PROCEPT BioRobotics Corporation Price and EPS Surprise

PROCEPT BioRobotics Corporation price-eps-surprise | PROCEPT BioRobotics Corporation Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

Globus Medical, Inc. (GMED) : Free Stock Analysis Report

Glaukos Corporation (GKOS) : Free Stock Analysis Report

PROCEPT BioRobotics Corporation (PRCT) : Free Stock Analysis Report