3 Micro-Cap Stocks Well Worth a Calculated Gamble

Within equities as an asset class, blue-chip stocks representing companies with an investment grade rating are the safest bet. Fundamentally strong growth stocks would be next in line in terms of risk exposure. Penny stocks carry high-risk and micro-cap stocks can be rated as equally risky.

I would however not shy away from the high-beta bets. With few positive catalysts, micro-cap stocks can deliver multibagger returns. Of course, it’s important to limit exposure to micro-caps at 5% or 10% of the total portfolio.

I must add here that some micro-cap stocks are far from being speculative. There are early-stage businesses with tailwinds that have average fundamentals and represent micro-caps. These names are worth a calculated gamble as they can boost overall portfolio returns even with less than 10% exposure.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

This column discusses three micro-cap stocks that are worth considering at current levels. Let’s discuss the reasons to be bullish on these emerging companies.

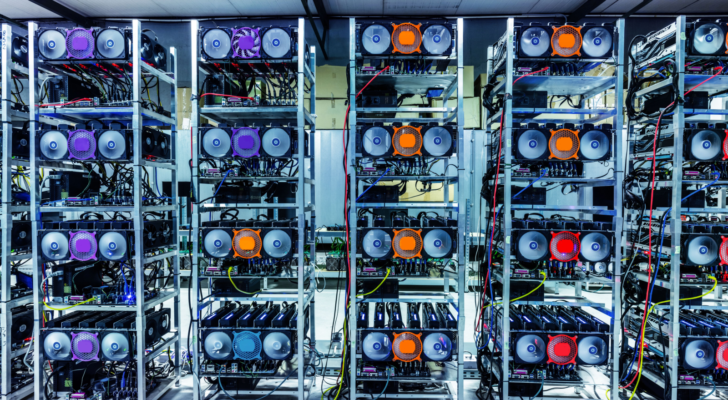

Bitfarms (BITF)

Source: PHOTOCREO Michal Bednarek / Shutterstock.com

Micro-cap stocks have a market capitalization in the range of $50 to $300 million. I would however take some liberty and talk about Bitfarms (NASDAQ:BITF), which trades at a valuation of $338 million. The reason is the potential for 5x or 10x returns in BITF stock in the next 12 to 24 months.

Being a Bitcoin (BTC-USD) miner, the basic assumption is that the digital assets trends higher. The outlook for Bitcoin is positive with halving due next year. Further, the likelihood of a spot Bitcoin ETF is another big catalyst. With the possibility of rate cuts next year, cryptocurrencies can rally on a weak dollar.

Specific to Bitfarms, I like the fact that the company has a robust liquidity buffer of $65.8 million as of Q3 2023. Further, Bitfarms expects to be debt free by February 2024. With high financial flexibility, the company is positioned to pursue aggressive mining capacity expansion. Assuming that Bitcoin re-tests previous highs, BITF stock can easily be a five-bagger considering its low-cost mining operations.

Yatra Online (YTRA)

Source: icemanphotos / Shutterstock.com

Yatra Online (NASDAQ:YTRA) is another interesting name among micro-cap stocks that can skyrocket. Yatra is an online tourism company with operational focus in India. In a post-pandemic world, the tourism industry gaining traction in one of the fastest growing economies in the world. Yarta is well positioned to benefit from this trend.

An important point to note is that Yatra is focused on the corporate and consumer travel market. The corporate travel market is worth $32 billion with online penetration only at 5% to 10%. Therefore, there is a big scope for penetration and robust growth. Even in the consumer travel market, a swelling middle-class in India is a big tailwind.

For Q1 2024, Yatra reported revenue of $13.4 million, which was higher by 23% on a year-over-year basis. For the same period, the company’s adjusted EBITDA margin was 10.4%. I expect healthy revenue growth to sustain coupled with margin expansion. Given the big addressable market, YTRA stock can be a potential multibagger.

Blade Air Mobility (BLDE)

Source: Wirestock Creators / Shutterstock.com

Blade Air Mobility (NASDAQ:BLDE) is another interesting name among micro-cap stocks—one that has skyrocketed by 60% in the last month. I would wait for some correction to consider exposure to this promising business.

As an overview, Blade Air is a provider of air transport in congested ground routes in the United States. The recent rally in BLDE stock has been backed by strong financials and an optimistic growth outlook.

To put things into perspective, Blade Air reported revenue of $71.4 million for Q3 2023, which was higher by 56% YoY. Besides the stellar revenue growth, the company also reported positive adjusted EBITDA as compared to an EBITDA loss in the prior year period. If this growth trajectory sustains with gradual margin expansion, BLDE stock will be positioned for multibagger returns.

Besides providing short distance travel and jet charter, Blade has also initiated MediMobility Organ Transport. As a matter of fact, the last segment is the key revenue driver. MediMobility is the largest dedicated air transporter of human organs for transplant in the United States. With multiple revenue streams, BLDE stock is a potential value creator.

On the date of publication, Faisal Humayun did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Faisal Humayun is a senior research analyst with 12 years of industry experience in the field of credit research, equity research and financial modeling. Faisal has authored over 1,500 stock specific articles with focus on the technology, energy and commodities sector.

More From InvestorPlace

ChatGPT IPO Could Shock the World, Make This Move Before the Announcement

Musk’s “Project Omega” May Be Set to Mint New Millionaires. Here’s How to Get In.

The Rich Use This Income Secret (NOT Dividends) Far More Than Regular Investors

The post 3 Micro-Cap Stocks Well Worth a Calculated Gamble appeared first on InvestorPlace.