3 Mortgage & Related Services Stocks to Watch Amid Industry Woes

The Zacks Mortgage & Related Services industry has seen major upheavals with the cooling market, fears of a looming recession and rising mortgage rates. Purchase market tightening and declining refinancing volumes have cast a shadow over a speedy recovery of the industry. Housing price appreciation and affordability issues are other near-term headwinds.

Amid ongoing economic headwinds, mortgage service providers will need to be more agile. To navigate the deterioration in the mortgage market and improve operational efficiencies, companies have resorted to headcount reduction and technology adoption. Also, diversified business operations and encouraging scenarios for the servicing segment will help industry players like Federal Agricultural Mortgage AGM, Velocity Financial VEL and LendingTree, Inc. TREE tide over choppy waters.

Industry Description

The Zacks Mortgage & Related Services industry comprises providers of mortgage-related loans, refinancing and other loan-servicing facilities. Numerous banks have been retreating from the mortgage business due to higher compliance and capital requirements. This allowed non-banks to increase their capacity to gain market share in the mortgage loans business, which accounts for the largest class of U.S. consumer debt. Players in the industry are dependent on the interest rates determined by the Federal Reserve, as prevailing rates influence customers' decisions to apply for mortgages. The companies also generate investment income from several financial assets, such as residential or commercial mortgage-backed securities and asset-backed securities. Further, the firms make equity investments in mortgage-related entities, among others.

3 Mortgage & Related Services Industry Trends to Watch

High Mortgage Rates Keep Homebuyers on the Sidelines: The mortgage market dynamics have been challenged by the hawkish monetary policy, with the central bank having raised interest rates 11 times since March 2022, bringing it to a 22-year high of 5.25-5.50%. The high interest rate regime was designed to combat inflation. In its September 2023 meeting, the Federal Reserve held the interest rates steady, while indicating one more hike before this year's end. Consequently, the mortgage rate on the benchmark 30-year home loan has climbed to 7.31% from 6.70% a year ago. High rates and low home inventory have resulted in affordability issues and priced out many potential home buyers. This is affecting mortgage demand, both purchase and refinance. The downward trend will negatively impact top-line growth for industry players.

Industry Players to Resort to Capacity Reductions: The mortgage industry continues to be labor-intensive, while servicing operations have been a significant cost driver. Assuming mortgage rates continue their climb, homeowners will be less keen on home purchases and refinancings. This will likely compel companies to reduce excess headcount capacity as they recalibrate to a slower market. Moreover, the industry has lagged other sectors in adopting automation technology. Amid a tight labor market, technology adoption can be a competitive moat by offering notable efficiency improvements and cost savings.

Servicing Segment to be the Saving Grace: With significant declines in gain-on-sale margins and lower loan origination volume, industry players are likely to increase their reliance on the service segment for profitability. In a high-rate environment, the servicing segment offers a natural operational hedge to the origination business. We expect slow prepayment speed to offer mortgage service rights (MSR) tailwinds. Hence, MSR investments are poised to deliver significant value appreciation and offer attractive unleveraged yields. Such MSR appreciation can drive the book value. With the U.S. single-family mortgage debt outstanding to reach $13.7 trillion by 2023 end, there is a massive growth opportunity in the servicing portfolios.

Zacks Industry Rank Reflects Bleak Prospects

The Zacks Mortgage & Related Services industry, housed within the broader Zacks Finance sector, currently carries a Zacks Industry Rank #164, which places it in the bottom 34% of more than 246 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates drab near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are losing confidence in this group’s earnings growth potential. The industry’s bottom-line estimate has declined 34.1% from September 2022.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

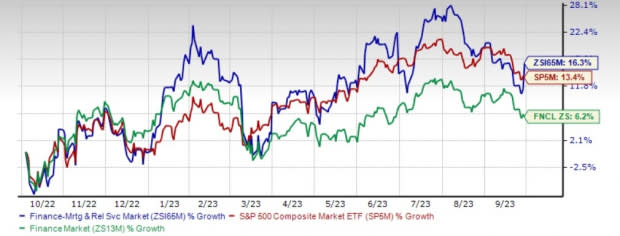

Industry Outperforms Sector and S&P 500

The Zacks Mortgage & Related Services industry has outperformed the broader Zacks Finance sector and the S&P 500 composite over the past year.

The industry has rallied 16.3% in this period compared with the broader sector's growth of 6.2% and the S&P 500 composite’s rise of 13.4% in the past year.

One-Year Price Performance

Image Source: Zacks Investment Research

Industry's Current Valuation

On the basis of the price-to-book ratio (P/B), which is commonly used for valuing mortgage and related services companies, the industry currently trades at 1.82X compared with the S&P 500's 5.56X.

Over the last five years, the industry has traded as high as 2.53X, as low as 0.78X and at the median of 1.69X, as the chart below shows.

Price-to-Book Ratio (TTM)

Image Source: Zacks Investment Research

As finance stocks typically have a lower P/B ratio, comparing mortgage and related services companies with the S&P 500 may not make sense to many investors. However, comparing the group's P/B ratio with that of its broader sector ensures that the group is trading at a decent discount. The Zacks Finance sector's trailing 12-month P/B of 3.10X for the same period is above the Zacks Mortgage & Related Services industry's ratio, as the chart shows below.

Price-to-Book Ratio (TTM)

Image Source: Zacks Investment Research

3 Mortgage & Related Services Stocks to Watch

Federal Agricultural Mortgage: The company, also known as Farmer Mac, is a federally chartered corporation that combines private capital and public sponsorship to create a secondary market for various loans made to rural borrowers.

The company’s business lines include agriculture finance (consisting of farm and ranch, and corporate AgFinance), rural infrastructure finance (consisting of rural utilities and renewable energy) and treasury (funding and investment).

The company is expected to enjoy strong pipelines and volumes in the upcoming years, given the expected rise in agricultural productivity to meet global demand, a growing U.S. agriculture mortgage market and a significant scope of growth in renewable electricity capacity. Moreover, the expanding corporate AgFinance and renewable energy business lines carry higher margins than other operations.

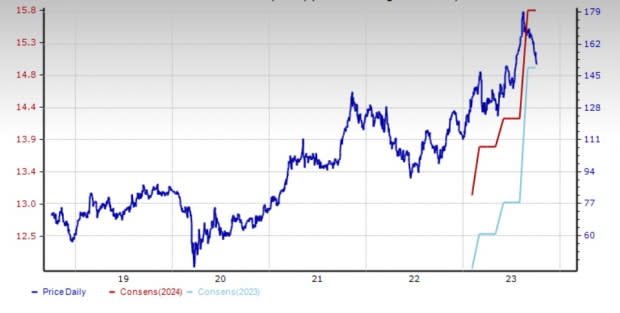

The Zacks Consensus Estimate for AGM’s 2023 and 2024 earnings has been unchanged over the past month. The Zacks #1 (Strong Buy) ranked company’s earnings for the ongoing year and 2024 are expected to rise 30.7% and 5.5% year over year, respectively. Revenues for 2023 and 2024 are expected to rise 9.4% and 8.4%, respectively.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Price and Consensus: AGM

Image Source: Zacks Investment Research

Velocity Financial: Based in Westlake Village, CA, the company is a vertically integrated real estate finance firm, which offers and manages investor loans for 1-4 unit residential rental and small commercial properties. VEL originates loans across the United States through its extensive network of independent mortgage brokers.

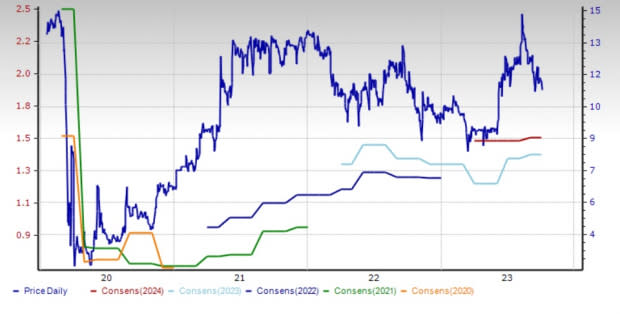

In second-quarter 2023, core diluted earnings per share of 38 cents surpassed the Zacks Consensus Estimate of 34 cents on strong net interest income and other income. Moreover, book value per share of $12.57 as of the second-quarter 2023 end increased 3.2% on a sequential basis. Also, the total loan portfolio increased 20.4% year over year to $3.7 billion as of Jun 30, 2023.

Robust portfolio performance and recent origination volume levels are expected to continue in the near term. This, along with a favorable outlook for book value growth and embedded gains in the investment portfolio, is a positive.

The Zacks Consensus Estimate for VEL's 2023 earnings has been unrevised over the past month. Also, for the ongoing and the next year, its revenues are expected to increase 27.2% and 17.2%, respectively. The company carries a Zacks Rank of 2 (Buy) at present.

Price and Consensus: VEL

Image Source: Zacks Investment Research

LendingTree: This parent company of LendingTree, LLC, is headquartered in Charlotte, NC, and has been operating solely in the United States since July 1998.Its online marketplace provides clients with access to product offerings from more than 600 partners.

Over the past few years, the company has enhanced its credit services and credit card product offerings, along with strengthening its online lending platform through acquisitions. In first-quarter 2022, it acquired an equity interest in EarnUp, a consumer-facing payments platform, for $15 million.Such buyouts have enabled the company to enjoy a market-leading position and a flexible business model to navigate through the fluctuating macroeconomic situations and high interest-rate environment.

TREE is committed to boosting revenues by diversifying its non-mortgage product offerings, particularly in the consumer segment. With the launch of the LendingTree WinCard in partnership with Upgrade in February 2023, the company provided its first-branded consumer credit offering. Over the past years, the company has increased its services, such as credit cards and widened loan offerings to personal, auto, small business and student loans. Such efforts will drive the consumer segment’s revenues.

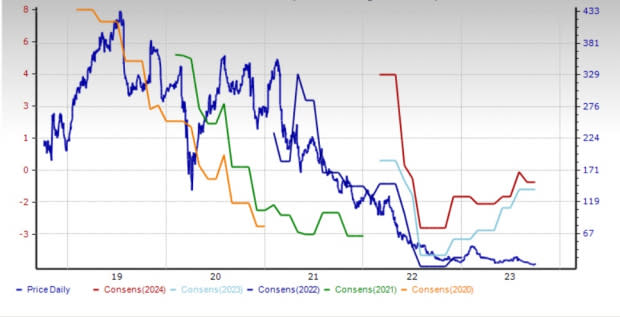

The Zacks Consensus Estimate for TREE’s 2023 earnings has been revised marginally upward over the past month, while the same for 2024 has been revised marginally downward. For the ongoing year, earnings are expected to rise 73.8% year over year. For 2024, earnings are projected to grow 23.5% on 8.3% revenue growth. The company carries a Zacks Rank of 3 (Hold) at present.

Price and Consensus: TREE

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Federal Agricultural Mortgage Corporation (AGM) : Free Stock Analysis Report

LendingTree, Inc. (TREE) : Free Stock Analysis Report

Velocity Financial, Inc. (VEL) : Free Stock Analysis Report