3 Mortgage & Related Services Stocks to Watch Amid Macro Woes

The Zacks Mortgage & Related Services industry continues to bear the brunt of a deteriorating mortgage environment. High mortgage rates, purchase market tightening and declining refinancing volumes cast a shadow over a speedy recovery of the industry. Additionally, housing price appreciation and increasing competition are near-term headwinds.

Nonetheless, diversified business operations and encouraging scenarios for the servicing segment will help industry players tide over choppy waters. Slow prepayment speed and technological enhancements are anticipated to drivePennyMac Financial Services, Inc. PFSI, Federal Agricultural Mortgage Corporation AGM and Velocity Financial, Inc. VEL.

Industry Description

The Zacks Mortgage & Related Services industry comprises providers of mortgage-related loans, refinancing and other loan-servicing facilities. Numerous banks have been retreating from the mortgage business due to higher compliance and capital requirements. This provided an opportunity for non-banks to increase their capacity to gain market share in the mortgage loans business, which accounts for the largest class of U.S. consumer debt. Players in the industry are dependent on the interest rates determined by the Federal Reserve, as prevailing rates influence customers' decisions to apply for mortgages. The companies also generate investment income from several financial assets, such as residential or commercial mortgage-backed securities, and asset-backed securities. Further, the firms make equity investments in mortgage-related entities, among others.

3 Mortgage & Related Services Industry Trends to Watch

Origination Volume Deterioration to Persist: After raising its benchmark rate 10 times, starting March 2022, the Fed opted to forgo another hike last month. Still, the central bank hinted at two more interest rate hikes this year to tackle inflation. Thus, heightened uncertainty regarding the Fed’s next moves can lead to more volatility in mortgage rates. High rates and home prices are likely to subdue affordability. These are expected to hinder origination volumes and revenue growth for the industry participants with mortgage businesses.

Competition Picking Up: Per a MBA forecast, U.S. single-family mortgage debt outstanding is expected to see an increasing trend in the upcoming years. This is anticipated to be primarily driven by house price appreciation. However, customer acquisition in the mortgage services industry is becoming more competitive due to housing shortages and a tougher-than-expected purchase market. Hence, the competitive landscape in the mortgage industry is likely to heat up and participants are expected to resort to price cutting. This may result in a significant reduction in sales margins across the space. With tighter margins, many originators may struggle to be profitable in the upcoming period, especially if rates continue to be high.

Servicing Segment Performance to Improve: With significant declines in gain-on-sale margins and lower loan origination volume, industry players are likely to increase their reliance on the service segment for profitability. In a high-rate environment, the servicing segment offers a natural operational hedge to the origination business. We expect slow prepayment speed to offer mortgage service rights (MSR) tailwinds. Hence, MSR investments are poised to deliver significant value appreciation and offer attractive unleveraged yields. Such MSR appreciation can drive the book value.

Zacks Industry Rank Reflects Bleak Prospects

The Zacks Mortgage & Related Services industry, housed within the broader Zacks Finance sector, currently carries a Zacks Industry Rank #197, which places it in the bottom 22% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates drab near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are losing confidence in this group’s earnings growth potential. The industry’s bottom-line estimate has declined 42.5% from July 2022.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

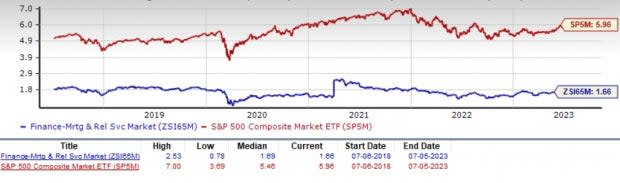

Industry Underperforms Sector and S&P 500

The Zacks Mortgage & Related Services industry has underperformed the broader Zacks Finance sector and the S&P 500 composite over the past year.

The industry has rallied 3.5% in this period compared with the broader sector's growth of 6.7% and the S&P 500 composite’s rise of 13.8% in the past year.

One-Year Price Performance

Image Source: Zacks Investment Research

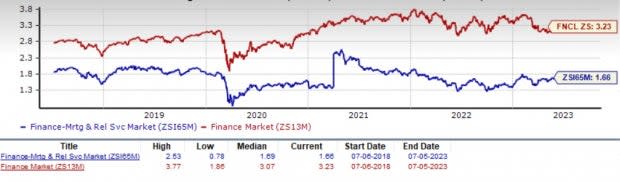

Industry's Current Valuation

On the basis of the price-to-book ratio (P/B), which is commonly used for valuing mortgage loan providers, the industry currently trades at 1.66X compared with the S&P 500's 5.96X.

Over the last five years, the industry has traded as high as 2.53X, as low as 0.78X, and at the median of 1.69X, as the chart below shows.

Price-to-Book Ratio (TTM)

Image Source: Zacks Investment Research

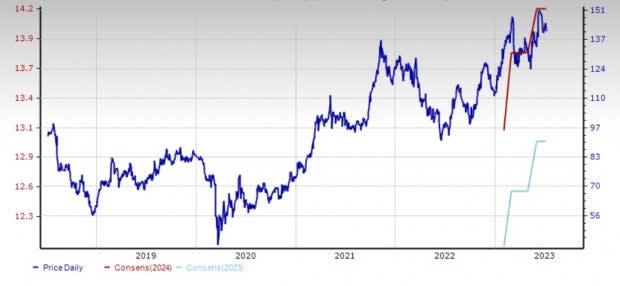

As finance stocks typically have a lower P/B ratio, comparing mortgage loan providers with the S&P 500 may not make sense to many investors. But a comparison of the group's P/B ratio with that of its broader sector ensures that the group is trading at a decent discount. The Zacks Finance sector's trailing 12-month P/B of 3.23X for the same period is above the Zacks Mortgage & Related Services industry's ratio, as the chart shows below.

Price-to-Book Ratio (TTM)

Image Source: Zacks Investment Research

3 Mortgage & Related Services Stocks to Watch

Federal Agricultural Mortgage: The company, also known as Farmer Mac, is a federally-chartered corporation that combines private capital and public sponsorship to create a secondary market for various loans made to rural borrowers.

The company’s business lines include agriculture finance (consisting of farm and ranch, and corporate AgFinance), rural infrastructure finance (consisting of rural utilities and renewable energy) and treasury (funding and investment).

The company is expected to enjoy strong pipelines and volumes in the upcoming years, given the expected rise in agricultural productivity to meet global demand, a growing U.S. agriculture mortgage market and a significant scope of growth in renewable electricity capacity. Moreover, the expanding corporate AgFinance and renewable energy business lines carry higher margins relative to other operations.

Supported by strong fundamentals, the company announced a 15.8% sequential hike in quarterly dividends in February 2023, the 12th consecutive annual increase. The increased dividend underlines the company’s confidence in core earnings power despite an unfavorable industry backdrop.

The Zacks Consensus Estimate for its 2023 and 2024 earnings has been unchanged over the past month. The Zacks #2 (Buy) Ranked company’s earnings for the ongoing year and 2024 are expected to rise 13.8% and 9.2%, respectively. Revenues for 2023 and 2024 are expected to rise 2.7% and 9.4%, respectively.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

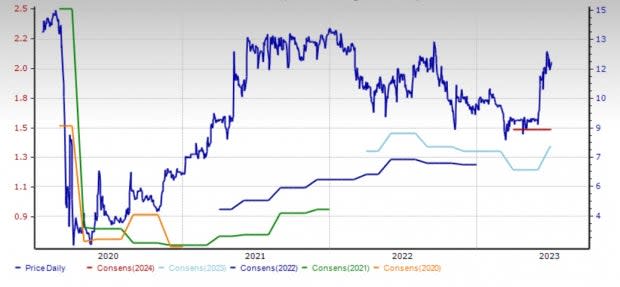

Price and Consensus: AGM

Image Source: Zacks Investment Research

Velocity Financial: Based in Westlake Village, CA, the company is a vertically integrated real estate finance firm, which offers and manages investor loans for 1-4 unit residential rental and small commercial properties. VEL originates loans across the United States through its extensive network of independent mortgage brokers.

The company enjoys decent support from the capital markets, as underlined by the April issuance of its VCC 2023-1R securitization. The transaction indicates modest market improvement and offers a new source of non-mark-to-market liquidity to enhance its ability to capitalize on new growth opportunities.

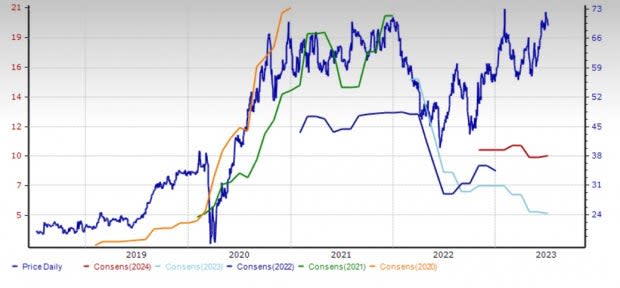

The Zacks Consensus Estimate for VEL's 2023 has been revised 14.7 % upward over the past month. Also, for the ongoing and the next year, its revenues are expected to increase 23.5% and 11.6%, respectively. The company carries a Zacks Rank of 2 at present.

Price and Consensus: VEL

Image Source: Zacks Investment Research

PennyMac Financial: This Zacks Rank #3 stock is a specialty financial services firm with a comprehensive mortgage platform and integrated business focused on the origination and servicing of mortgage loans, along with the management of investments related to the U.S. mortgage market.

PFSI’s production technology seems to be working well. While the company’s mortgage production business will likely be affected by industry headwinds, its growing servicing portfolio is likely to provide support. Lower prepayment speed will reduce amortization expenses and inflate pretax income for PFSI. Its efficient and low-cost operating platform, along with strong capital levels, will help it sail through the current choppy waters.

The Zacks Consensus Estimate for PFSI’s 2023 earnings has been revised 1.4% downward over the past month, while the same for 2024 has been revised 1.1% upward. For the ongoing year, earnings are expected to fall 38.3% year over year on a 23.5% decline in revenues. Nonetheless, in 2024, earnings are projected to grow 81% on 26.6% revenue growth. The company carries a Zacks Rank of 3 (Hold) at present.

Price and Consensus: PFSI

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PennyMac Financial Services, Inc. (PFSI) : Free Stock Analysis Report

Federal Agricultural Mortgage Corporation (AGM) : Free Stock Analysis Report

Velocity Financial, Inc. (VEL) : Free Stock Analysis Report