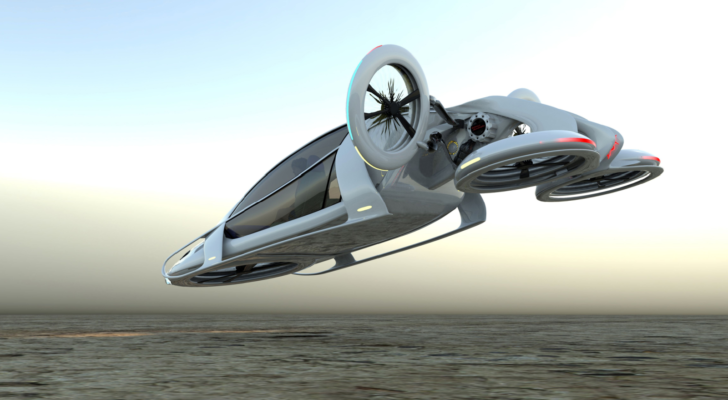

The 3 Most Undervalued Flying Cars Stocks to Buy Now: November 2023

Years ago, hearing “cars will fly someday” sounded crazy. Today, it is more than a reality. Of course, we still don’t have cities full of flying cars, nor do they look like the cartoons we saw on TV when we were kids, but there is a lot of progress resulting from companies like these. These flying car stocks constantly invest in this young sector with excellent growth potential.

So here are three flying car stocks to buy. Let’s take a quick look.

Lilium (LILM)

Source: jsCreater / Shutterstock.com

Lilium N.V. (NASDAQ:LILM) is creating a stir in the flying car world and has attracted attention as an undervalued stock worth considering for your portfolio. It recently raised an impressive $192 million in funding from major German tech investors, allowing it to move forward with developing its Lilium Jet.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

In addition, it has obtained crucial certifications from the European Union Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA), making it the only eVTOL manufacturer with this dual certification for a powered eVTOL aircraft.

China has also welcomed Lilium through a partnership with the Bao’an District of Shenzhen Municipality and a preliminary agreement for 100 Lilium Jets. They are making great strides in the development of the aircraft, reaching milestones such as successful wind tunnel testing and the completion of vital components. Their financial intelligence is shining through, with second-quarter expenses coming in on budget, demonstrating their efficiency and focus on key program objectives.

On the market side, Lilium has partnered with ArcosJet DMCC, purchasing 10 Lilium Jets and exclusive distributor authorization for the Middle East. This means that eVTOL travel is on the horizon for customers in that region, and the Lilium Pioneer Edition Jet promises eco-friendly, spacious, and scenic travel starting in 2026. This makes it one of those flying car stocks to buy.

Finally, expanding its partnership with InoBat to produce high-performance battery cells ensures a stable supply chain for Lilium’s innovative jet, underscoring its commitment to sustainable air travel.

Blade Air (BLDE)

Source: kolesinibimitresku / Shutterstock.com

Blade Air Mobility (NASDAQ:BLDE) is no ordinary company; it is a rising star in the flying car sector, making waves as an undervalued stock with huge potential. In the recent financial spotlight, the third quarter of 2023 illuminated Blade’s success story.

They achieved the following: net $2.0 million from operating activities, basking in the glow of positive free cash flow amounting to $1.3 million in Q3 2023. It’s not just about numbers; it’s a testament to their financial prowess, showing an $8.4 million increase in net cash and a $7.8 million increase in free cash flow compared to last year.

Revenues soared to $71.4 million in the third quarter of 2023, up 56% year-over-year. Behind these figures lie strategic triumphs, such as security screening on the runway at Nice International Airport, the grand opening of a dedicated heliport in Atlantic City, and an innovative organ placement service for the medical sector.

A shining example of Blade’s impact is its partnership with NYU Langone Health, which reduces travel times and costs for organ transplants. Imagine a world where every hour counts in saving lives, and Blade is there, making it happen. Beyond organs, Blade is also revolutionizing urban air transportation, ferrying people to and from urban centers with unparalleled efficiency.

Blade is preparing for the electric future with its Electric Vertical Aircraft. They didn’t just talk the talk; Blade, hand in hand with BETA Technologies, made history with a monumental Electric Vertical Aircraft flight in New York. This is more than just actions; it is a journey of financial success, strategic brilliance, and commitment to a future where aviation is not only accessible but also environmentally friendly.

Embraer (ERJ)

Source: Shutterstock

Embraer S.A. (NYSE:ERJ) is a Brazilian company specializing in commercial and business aircraft that has attracted the attention of investors because it is considered an undervalued stock option. During the third quarter, the company delivered 43 aircraft, showing a 30% increase over the previous year, and its revenues reached US$ 1,284 million, with an impressive 68% growth in commercial aviation. In addition, adjusted EBIT increased to 7.8%, signaling a solid financial performance.

The solid financial position is reflected in the order backlog that reached US$ 17.8 billion, the highest level in a year. Completing liability management extended average loan maturity to 4.8 years, and adjusted free cash flow in the third quarter was US$ 44.0 million, indicating strong cash generation.

Embraer’s latest strategic move has been to collaborate with Eve Air Mobility and NATS Services to develop air traffic management services for urban air mobility. This reflects the company’s commitment to faster and more sustainable urban air transportation. In addition, the partnership with Kookiejar to implement its urban air traffic management system in Dubai highlights Embraer’s global growth in this sector.

As of this writing, Gabriel Osorio-Mazzilli did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Gabriel Osorio is a former Goldman Sachs and Citigroup employee. He possesses discipline in bottom-up value investing and volatility-based long/short equities trading.

More From InvestorPlace

Musk’s “Project Omega” May Be Set to Mint New Millionaires. Here’s How to Get In.

The #1 AI Investment Might Be This Company You’ve Never Heard Of

The Rich Use This Income Secret (NOT Dividends) Far More Than Regular Investors

The post The 3 Most Undervalued Flying Cars Stocks to Buy Now: November 2023 appeared first on InvestorPlace.