3 mREIT Stocks in Focus Despite Lackluster Origination Scenario

The Zacks REIT and Equity Trust has been bearing the brunt of interest rate volatility and uncertainty in the macro-economic conditions due to regional banks’ collapse in the United States, high rates, below-average market liquidity and limited fixed-income demand. This has resulted in a rise in mortgage rates, significantly reducing originations. The mREIT industry should see book value erosion in the near term, as wider spreads in the Agency market affect asset prices.

While rising rates have hindered origination volumes, it continues to be a tailwind to servicing businesses, as the two segments are operational hedges for each other. Low prepayment spreads offer respite by supporting asset yields and margins, whereas business diversification will help keep companies afloat. Companies with primarily floating-rate loan books should see a rise in net interest income (NII). Hence, industry players like Annaly Capital Management, Inc. NLY, ARMOUR Residential REIT, Inc. ARR and Invesco Mortgage Capital Inc. IVR are well-poised to navigate the market blues.

About the Industry

The Zacks REIT and Equity Trust industry comprises mortgage REITs, also known as mREITs. Industry participants invest in and originate mortgages and mortgage-backed securities (MBS), and provide mortgage credit for homeowners and businesses. Typically, these companies focus on either residential or commercial mortgage markets. Some invest in both markets through the respective asset-backed securities. Agency securities are backed by the federal government, making it a safer bet and limiting credit risk. Also, such REITs raise funds in the debt and equity markets through common and preferred equity, repurchase agreements, structured financing, convertible and long-term debt, and other credit facilities. The net interest margin (NIM), the spread between interest income on mortgage assets and securities held, as well as funding costs, is a key revenue metric for mREITs.

What's Shaping the Future of the mREIT Industry?

Purchase Volume Deterioration to Continue: The incremental volatility in mortgage rates has served as another hurdle for any potential recovery in purchase originations, with buyers and sellers remaining on the sidelines. Housing inventory has fallen and affordability challenges have increased due to high mortgage rates, affecting seasonal buying trends.

Amid this lackluster housing market, mortgage originations are likely to continue to be suppressed. This has caused operational and financial challenges for originators, and may reduce the gain on sale margin and new investment activity.

Conservative Approach to Impede Returns: The Federal Reserve’s aggressive rate hikes to slow persistent inflation has made financial markets extremely volatile, restricting financial conditions and resulting in negative fixed-income fund flows. Given these macro worries, as strain grows on credit-risky assets, we expect mREITs to be selective in their investments, resulting in lower portfolio growth. Also, numerous companies have resorted to a higher hedge ratio to reduce interest rate risks. While such moves may seem prudent in the ongoing uncertain times, those will impede mREITs’ growth expectations. As companies prioritize risk and liquidity management over incremental returns, at least in the short term, we expect robust returns to remain elusive.

Industry Resorts to Dividend Cuts as Book Values Erode: High volatility in the fixed-income markets, high interest rates, and the widening of the spread between the 30-year Agency MBS and 10-year treasury rate are affecting valuations of Agency mortgage-backed securities. Hence, mREITs will continue to see book value pressure in the upcoming period. Also, liability-sensitive mREITs will see funding costs repricing faster than asset yields. Hence, we anticipate the cost of funds to be a headwind, and reduce net interest spreads and profitability.

This scenario has reduced dividend coverage and companies like Invesco Mortgage, Two Harbors Investment Corp. and Annaly have resorted to dividend cuts to preserve book value. This may discourage mREIT investors and result in capital outflows from the industry, potentially resulting in even greater book value declines for companies in the upcoming period.

Zacks Industry Rank Indicates Dismal Prospects

The Zacks REIT and Equity Trust industry is housed within the broader Zacks Finance sector. It carries a Zacks Industry Rank #225, which places it in the bottom 10% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates underperformance in the near term. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is an outcome of the disappointing earnings outlook for the constituent companies. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group's earnings growth potential. The industry’s current-year earnings estimates have moved 14.5% down since June 2022.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

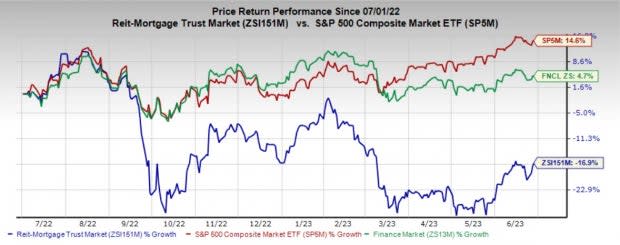

Industry Lags Sector and S&P 500

The Zacks REIT and Equity Trust industry has lagged the broader Zacks Finance sector and the S&P 500 composite in the past year.

The industry has slumped 16.9% in the above-mentioned period against the broader sector’s rise of 4.7%. The S&P Index has gained 14.6% over the past year.

One-Year Price Performance

Image Source: Zacks Investment Research

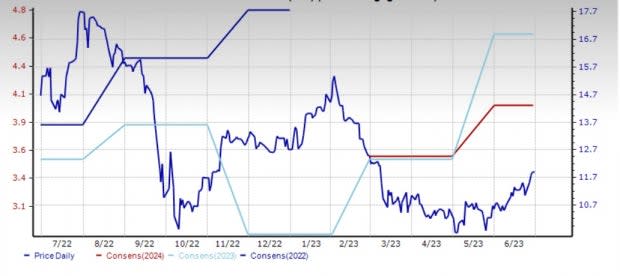

Industry's Current Valuation

Based on the trailing 12-month price-to-book (P/BV), which is a commonly used multiple for valuing mREITs, the industry is currently trading at 0.83X compared with the S&P 500’s 5.86X. It is also below the sector’s trailing-12-month P/BV of 2.99X. Over the past five years, the industry has traded as high as 1.11X, as low as 0.38X and at the median of 0.94X.

Price-to-Book TTM

Image Source: Zacks Investment Research

3 mREIT Stocks Worth Betting On

Invesco Mortgage: The company primarily focuses on investing in, financing, and managing MBSs and other mortgage-related assets. Amid headwinds for Agency MBSs, the company has been actively managing its portfolio. It has reduced exposure to such securities, as the current macro situation continues to weigh on Agency RMBS valuations. IVR is shifting its Agency RMBS portfolio to higher coupon investments by selling lower coupon ones.

As of Mar 31, substantially all of the company’s $5.4-billion investment portfolio consisted of Agency RMBS. It had unrestricted cash and unencumbered investments aggregating $463.9 million. IVR estimates a debt-to-equity ratio of 5.8X and a book value per common share of $12.61.

The Zacks Consensus Estimate for IVR’s 2023 earnings has been revised 30.8% upward over the past two months to $4.63. Also, the company has an impressive earnings surprise history, having surpassed the Zacks Consensus Estimate in all four trailing quarters. IVR has a market cap of $496.8 million.

The company sports a Zacks Rank of 1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Price and Consensus: IVR

Image Source: Zacks Investment Research

Annaly: The mREIT primarily owns, manages and finances a portfolio of real-estate-related investment securities. Its investment portfolio includes mortgage pass-through certificates, collateralized mortgage obligations and credit risk transfer. NLY’s investment may also comprise other securities indicating interests in or obligations backed by pools of mortgage loans, residential mortgage loans, MSR and corporate debt.

Annaly's investment strategy is driven by the prudent selection of assets and effective allocation of capital to achieve stable returns. The company's investment strategy involves traditional Agency MBSs, which provide downside protection and investments in more non-Agency and credit-focused asset classes that aid in enhancing returns.

Moreover, Annaly is focusing on the diversification of its investment portfolio. In 2022, the company sold its Middle Market Lending portfolio and completely exited its commercial real estate business. Through these exits, Annaly aims to enhance capabilities across its core housing finance strategy. In line with this, it is allocating capital to residential credit businesses and the MSR platform, along with Agency MBS. Focus on residential credit will enhance the stability of returns across various rate and macro scenarios. Past acquisitions of MTGE Investment and Hatteras Financial Corp helped diversify investment and financing options for the company.

The company currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for NLY’s 2023 earnings has been revised marginally upward to $2.86 in the past two months. While earnings are expected to decline 32% in 2023, the same is likely to increase1.7% in 2024. NLY has a market cap of $9.88 billion.

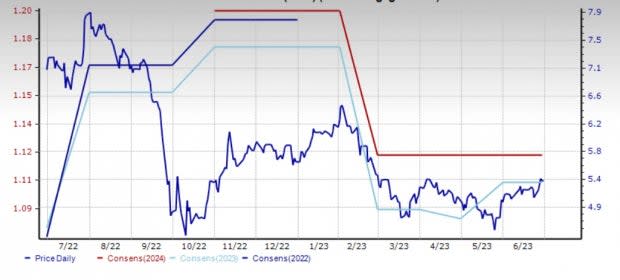

Price and Consensus: NLY

Image Source: Zacks Investment Research

ARMOUR Residential: This REIT invests primarily in fixed-rate residential, adjustable rate and hybrid adjustable-rate RMBS issued or guaranteed by U.S. Government-sponsored enterprises or guaranteed by the Government National Mortgage Association.

ARMOUR Residential's portfolio comprised totally of agency MBS as of the first-quarter end. It had a debt-to-equity ratio of 8.7 to 1 (based on repurchase agreements divided by total stockholders’ equity). Liquidity, including cash and unencumbered agency and U.S. government securities, aggregated $550.2 million as of the first-quarter 2023 end. Supported by high liquidity, the company repurchased 842,927 shares of common stock at an average cost of $5.11 per share.

The company currently carries a Zacks Rank #2. It has a decent earnings surprise history, having surpassed the Zacks Consensus Estimate in three of the four trailing quarters. The Zacks Consensus Estimate for ARMOUR Residential’s 2023 earnings has been revised marginally upward in the past two months. While earnings are expected to decline 4.3% in 2023, the same is likely to rebound 1.4% in 2024. ARR has a market cap of $1.04 billion.

Price and Consensus: ARR

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Annaly Capital Management Inc (NLY) : Free Stock Analysis Report

ARMOUR Residential REIT, Inc. (ARR) : Free Stock Analysis Report

INVESCO MORTGAGE CAPITAL INC (IVR) : Free Stock Analysis Report