3 No-Brainer Healthcare Stocks to Buy Right Now for Less Than $1,000

If you're aiming to add diversification, safety, and growth to your portfolio, look no further; a selection of quality healthcare players could do the trick. I mention diversification because, in the field of healthcare, you'll find a variety of different options, including biotech, pharma, medical device players, and more. Each of these types of companies offers you a different profile. Some come with a track record of steady earnings and dividend payments, while others promise future growth.

If you spread your investment across these businesses, you'll find yourself with a well-balanced portfolio that may deliver great rewards over time. Where to start? With the following three no-brainer healthcare buys, today you can pick up a handful of shares of each with less than $1,000 and set yourself up for a potential win as time goes by.

1. Pfizer

After a spectacular couple of years bringing in billions of dollars in coronavirus product sales, Pfizer (NYSE: PFE) has entered a period of transition. The big pharma player's shares have slipped, along with demand for coronavirus vaccines and treatments. And some of Pfizer's blockbusters outside of the coronavirus program face loss of exclusivity. So, Pfizer's revenue these days has fallen from its 2022 peak.

But here's why the stock makes a terrific buy now. This pharma company is completing its biggest streak of product launches -- 19 over 18 months. And this, along with Pfizer's string of acquisitions, including the purchase of oncology specialist Seagen, should drive a new era of revenue growth.

The Seagen deal, in particular, is a brilliant move because it offers Pfizer four commercialized products with growing revenue and a solid pipeline of potential oncology treatments. This is key since the oncology drugs market is expanding at a rapid pace -- it's expected to more than double to $484 billion by 2030, according to Fortune Business Insights.

Today, you can get in on Pfizer shares for about 12 times forward earnings estimates, a steal considering the company's long-term potential.

2. CRISPR Therapeutics

CRISPR Therapeutics (NASDAQ: CRSP) recently reached a major milestone. The biotech won the world's first regulatory authorization for a product based on CRISPR gene editing. The technology involves cutting DNA at a particular location to allow for a repair process to take place. This procedure fixes faulty genes involved in disease, so it offers the potential for functional cures.

The company's recently approved product, Casgevy, treats blood disorders sickle cell disease and beta-thalassemia. Considering that today's treatment options for these conditions are limited and the idea that Casgevy offers a one-time curative opportunity, this new product could attract both doctors and patients.

CRISPR Therapeutic's big biotech partner, Vertex Pharmaceuticals, leads this program, which is a plus now at the commercialization stage -- Vertex, as a company with several marketed products, has the expertise and infrastructure to establish Casgevy's position in the market.

However, CRISPR Therapeutics isn't likely to be a one-hit wonder. The company has a solid pipeline of gene-editing candidates in the areas of immuno-oncology, autoimmune disease, and cardiovascular disease and predicts a "catalyst-rich" 12 to 18 months ahead. So, to take advantage of this potential growth, now is a great time to get in on this biotech stock on the rise.

3. Medtronic

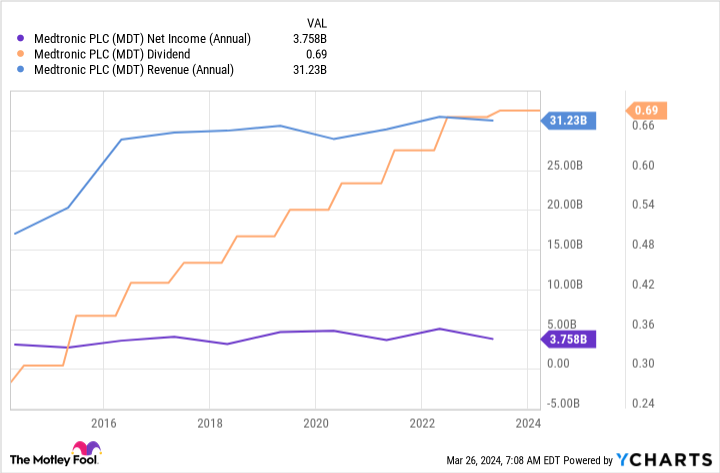

Medtronic (NYSE: MDT) is a medical device giant, developing products in the areas of diabetes, cardiovascular, medical surgical, and neuroscience. Over time, the company has delivered earnings growth as well as dividend payments, making it a top long-term choice for any healthcare portfolio.

But, like the stocks I mentioned above, this tried-and-true player also could be heading for a new era of growth. Medtronic, over the past few years, streamlined its operations to focus on its highest-growth opportunities, and this medical device giant continues to launch new products at a dynamic pace. The company won about 130 product approvals in its key geographies over the past 12 months.

All of this helped Medtronic report revenue growth in the most recent quarter and prompted the company to raise its full-year revenue and earnings-per-share guidance.

On top of this, Medtronic also is putting a big focus on the high-growth area of artificial intelligence (AI) and now has five approved AI products. These are designed to help make the job of surgeons easier and improve patient outcomes -- a win-win situation that could lead to significant revenue gains for Medtronic over time.

And that's why, trading for 16 times forward earnings estimates, this medical device powerhouse looks like a no-brainer buy right now.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Adria Cimino has positions in Vertex Pharmaceuticals. The Motley Fool has positions in and recommends CRISPR Therapeutics, Pfizer, and Vertex Pharmaceuticals. The Motley Fool recommends Medtronic. The Motley Fool has a disclosure policy.

3 No-Brainer Healthcare Stocks to Buy Right Now for Less Than $1,000 was originally published by The Motley Fool