3 ‘Perfect 10’ Stocks That Could Win Big

US-China trade talks resumed on Thursday, and on Friday President Trump announced a preliminary agreement outlining Phase I of a potential trade deal. The outline includes ramped-up Chinese purchase of US agricultural products and US cancellation of new tariffs planned for October 15. The news made an immediate impact on the markets, with the Dow Jones jumping 320 points on by Friday’s close, and the S&P 500 adding a 1.1% gain of 32 points.

So, markets are looking up after two volatile weeks, and investors want to know the best places to put their money. TipRanks has the guide you need to find the right stocks to buy, in the Smart Score tool. The Smart Score uses a multi-factor analysis to rate every stock in the market, taking data from insider opinions, hedge fund activity, news sentiment, and technical and fundamental analyses. The result is distilled to a single number on a rising scale of 1 to 10, making it simple and intuitive to use.

Using the Smart Score filters, we’ve picked out three stocks with perfect 10 scores and Buy ratings that are ready to rise with today’s markets.

PagSeguro Digital (PAGS)

For investors in the US markets, Brazil’s banking industry may not be the first sector that comes to mind when considering profits. PagSeguro, however, is not a typical component of the banking industry. It’s an online e-commerce payment service, catering to commercial clients primarily among Brazil’s banks, but also internationally. It’s a successful niche; PagSeguro’s stock is up an eye-catching 143% year-to-date.

Taking a close look at the Smart Score, we see that the technical factors are positive. PAGS’s return on equity is a healthy 17.67%. Hedge fund activity on this stock is rising, with the major funds increasing their holdings by more than 330,000 shares in the last quarter. Finally, the financial bloggers are bullish on PAGS, with the positive sentiment at 80%, well above the sector average of 65%.

The stock’s market performance and future potential have gained the notice of Wall Street’s analysts. Writing from JPMorgan, Domingos Falavina notes the company’s drive to expand services beyond the core niche of Brazilian banks to international commercial clients, saying, “PagSeguro disclosed its banking initiative already has 1.4mn clients. Some of those clients are micro merchants and existed preceding the retail initiative launched mid-May; others however are new net adds from May launch. We estimate consumer retail clients will reach ~3mn by YE 2020 and we attribute an economic value to them of~$1k/client.”

He sums up his stance on PAGS by saying, “PagSeguro will leverage on strong brand value to now successfully deliver a banking solution to the long tail of retail customers.” In line with his upbeat outlook on the stock, Falavina raised his price target by 50%, from $40 to $60. His new price target suggests an upside potential of about 30% to PAGS stock. (To watch Falavina'a track record, click here)

Moving on to Deutsche Bank’s Bryan Keane who met the company’s CEO Ricardo Dutra da Silva at an industry conference in Las Vegas. After speaking with the CEO, Keane wrote, “Since going public and despite the increase in competitors, Mr. Dutra’s belief that micro-merchants are not price sensitive to merchant discount rates (MDRs) has been confirmed… Highlighting the health of the business, we believe net merchant adds are running ahead of plan and that guidance for ~1m in FY19 will ultimately prove conservative.” He sees a bullish future for PAGS, and sets a $57 price target, describing the company’s strategy as "winning."

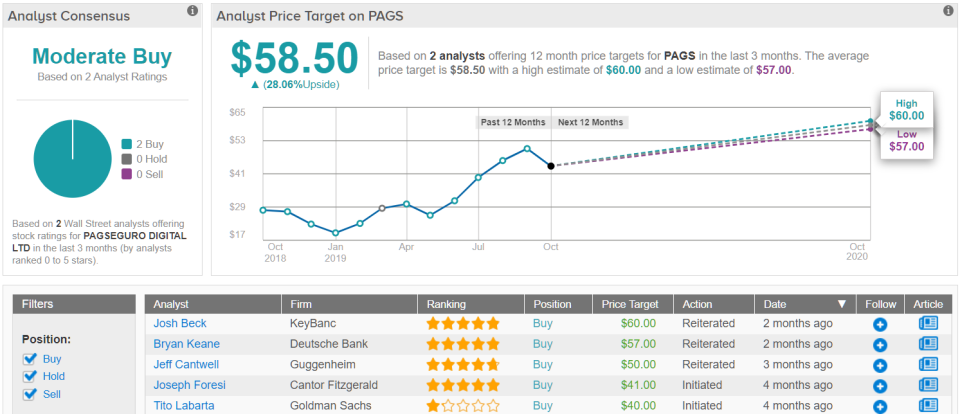

Overall, the two most recent analyst reviews on PAGS are Buy ratings, making the stock an overall Moderate Buy on TipRanks. Shares are trading for $45.68, and have an average price target of $58.50, making the upside potential a healthy 28%. (See PagSeguro stock analysis on TipRanks)

Arista Networks (ANET)

Arista is a mid-cap networking company out of Silicon Valley. Arista produces multilayer network switches and software-defined networking in the cloud computing and datacenter sectors. The company’s products are found in the high-performance computing and high-frequency trading environments, and run on a company-designed Linux-based operating system.

The high-end networking niche brought Arista $328 million in profit last year, on more than $2.15 billion in revenues. Better yet, Arista has beaten quarterly earnings expectations in every report for the last two years. In the most recent report, for Q2 released, the company’s $2.20 EPS beat the forecast by 11%.

The Smart Score reflects this underlying strength. Return on equity is up 34.33%, and the asset growth is up 21.51%. More importantly, the sentiment on this stock is bullish News sentiment, which measures the stock’s standing in journalistic coverage, is 100% bullish, while the bloggers sentiment comes in at 91%.

A profitable niche in the computer networking industry, and a history of beating the earnings forecasts, have earned ANET accolades from some of the Street’s top analysts. 5-star Cowen analyst Paul Silverstein gave this stock a $295 price target after attending investor meetings with the company CFO. In support of his high price target, Silverstein wrote, “Arista should continue to benefit from an ongoing data center upgrade. Arista’s high-performance EOS has proved to be a significant competitive differentiator, delivering ease, speed and agility of application and service provisioning. Arista also enjoys a management team that has a demonstrated ability to open doors and close deals.”

James Fish, a 4-star analyst with Piper Jaffray, reiterated his Buy rating on ANET last week. In his previous comments on the stock, he pointed out, “Arista is furthest along in the contribution of software to its business relative to peers, and the updates likely create further adoption… Arista has only penetrated ~10% of its installed base with CloudVision, leaving a large opportunity ahead… We believe Arista remains best-in-class for datacenter switching.” Fish’s $272 target indicates a potential for 15% upside to ANET.

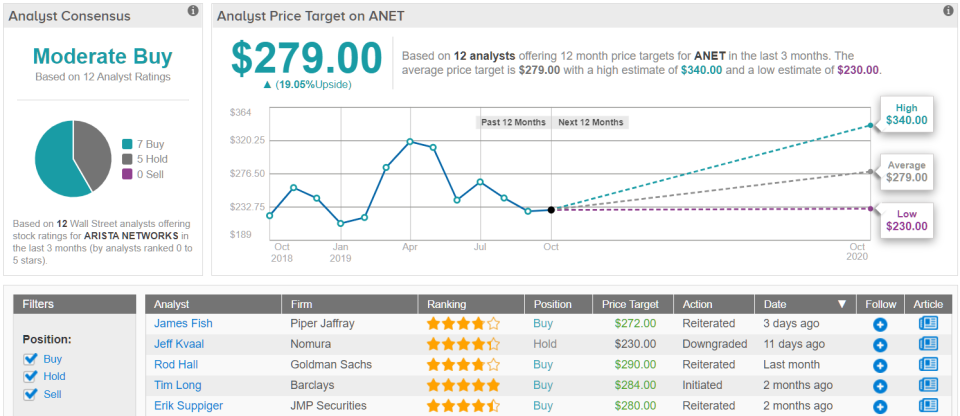

Overall, this stock has a Moderate Buy from the analyst consensus. This is based on 12 ratings given in the last three months, including 7 "buys" and 5 "holds." Shares are selling for $236, and the average price target of $279 implies room for an 19% upside. (See Arista stock analysis on TipRanks)

ConocoPhillips (COP)

With our third ‘perfect 10’ stock, we enter the energy market. ConocoPhillips is an old name in the oil industry, and stands as the largest exploration and production company in the petroleum sector. COP showed 2018 revenue of $38.727 billion, and generated net profits of $6.257 billion. The company beat earnings expectations in 3 of the last 4 quarters. Impressively, COP has managed this despite crude oil prices dropping over the past six months.

Turning to the Smart Score, COP shows some impressive stats. Blogger opinion is 88% bullish, and news sentiment is 100% bullish. In the fundamentals, the 12-month return on equity is 22.28%, and the asset growth is 3.37%. The most impressive mark, however, comes from the hedge fund activity; the major funds purchased over 4 million shares of COP in the second quarter of 2019.

For income-minded investors, COP offers a newly increased dividend and a commitment to boosting share value. The company this month announced a 38% increase to the dividend, making the quarterly payment 42 cents per share and bumping the annual yield to 3.1%. For comparison, the average dividend yield on the S$P 500 is 2%. Despite the drop in oil prices, COP has $12 billion in liquid assets to back up the announced $3 billion in share buybacks for 2020.

UBS analyst Lloyd Byrne is impressed with COP’s performance. He reiterated his Buy rating, saying, “We think COP is taking the right steps to attract the generalist: a stable business model with visibility that focuses on returns on capital, and returning excess cash flow to the shareholder… COP holds their investor day on Nov 19th and is expected to detail a 10-year outlook including a more detailed capital plan… We expect a plan that provides details into asset specific trajectories including Eagle Ford, Bakken, Delaware, international (Montney?) and Alaska assets.” In line with this optimistic outlook, Byrne put a $75 price target on the stock, suggesting an upside potential of 33%.

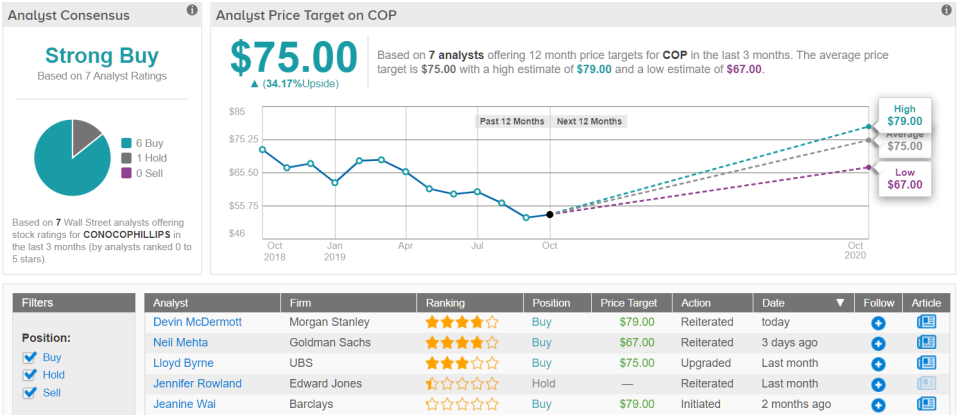

Overall, COP holds a Strong Buy from the analyst consensus, with 5 "buys" and 1 "hold" ratings given in the past three months. Shares sell for $56.43 and have an average price target of $74, giving the stock room for about 30% upside. (See ConocoPhillips stock analysis on TipRanks)