3 Reasons to Add HealthEquity (HQY) Stock to Your Portfolio

HealthEquity, Inc. HQY has been gaining from its unique investment platform. The optimism led by a solid third-quarter fiscal 2024 performance and strength in Health Savings Accounts (HSA) are expected to contribute further. However, data security issues and the possibility that integration of acquisitions may be unsuccessful are major downsides.

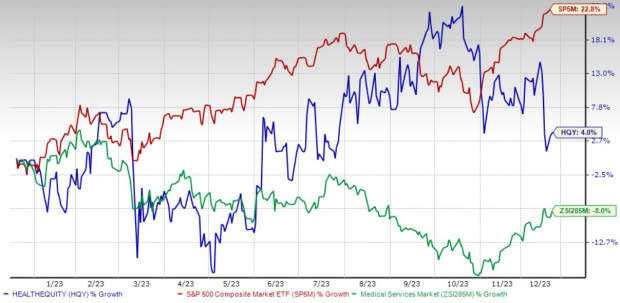

Over the past year, the Zacks Rank #2 (Buy) stock has gained 3.9% against the 7.9% decline of the industry. The S&P 500 has witnessed 22.8% growth in the said time frame.

The renowned provider of technology-enabled services platforms for healthcare savings and spending decisions has a market capitalization of $5.51 billion. The company projects 27.5% growth for the next five years and expects to witness continued improvements in its business. HealthEquity’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average earnings surprise being 16.5%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Unique Investment Platform: We are optimistic about HealthEquity’s multiple cloud-based platforms, which are accessed by its members online via a desktop or mobile device. Individuals can make health-saving and spending decisions and pay healthcare bills, among other activities, via these platforms. These platforms provide users access to services HealthEquity provides as well as services provided by third parties selected by HealthEquity or its Network Partners. Among other features, HealthEquity’s HSA platform has the capability to provide users with medical bills upon adjudication by a health plan, including details such as the amount paid by insurance.

Strength in HSA: HealthEquity’s total number of HSAs, as of Oct 31, 2023, rose 8.4% year over year. HealthEquity reported 592,000 HSAs with investments as of Oct 31, 2023, up 11.9% year over year. Total Accounts, as of Oct 31, 2023, were up 5.4% year over year. This uptick included total HSAs and 6.9 million other consumer-directed benefits. Total HSA assets at the end of Oct 31, 2023, were up 11.7% year over year. This included HSA cash and HSA investments.

Strong Q3 Results: HealthEquity saw solid top-line and bottom-line performances in third-quarter fiscal 2024. The top line benefited from robust contributions from the majority of its revenue sources. The expansion of both margins was also seen.

Downsides

Integration of Acquisitions Maybe Unsuccessful: The success of HealthEquity’s recent acquisitions depends partly on its ability to realize the anticipated business opportunities by combining the operations of the acquired businesses with its business in an efficient and effective manner. The integration of HealthEquity’s acquisitions could take longer and be more costly than anticipated, and it could result in the disruption of its ongoing business and the acquired business, among others, and could harm its financial performance.

Data Security Issues: HealthEquity deals with a high level of sensitive personal data and information. Any security breaches might result in the loss of sensitive information, theft or loss of actual funds, litigation or indemnity obligations to the customers. The company’s ability to ensure the security of its technology platforms and, thus, sensitive customer and partner information is critical to its operations.

Estimate Trend

HealthEquity has been witnessing a positive estimate revision trend for fiscal 2024. Over the past 90 days, the Zacks Consensus Estimate for its earnings per share has moved 4.9% north to $2.11.

The Zacks Consensus Estimate for fourth-quarter fiscal 2024 revenues is pegged at $256 million, suggesting a 9.5% rise from the year-ago reported number.

Other Key Picks

A few other top-ranked stocks in the broader medical space are DaVita Inc. DVA, DexCom, Inc. DXCM and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 17.3%. DVA’s earnings surpassed estimates in all the trailing four quarters, with an average surprise of 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 45.4% compared with the industry’s 8.6% rise in the past year.

DexCom, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 33.6%. DXCM’s earnings surpassed estimates in all the trailing four quarters, with an average of 36.4%.

DexCom has gained 7.4% compared with the industry’s 3.7% rise over the past year.

Integer Holdings, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 11.9%.

Integer Holdings’ shares have rallied 45.6% compared with the industry’s 3.7% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report